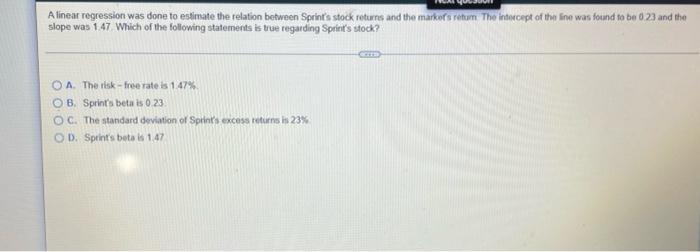

Question: A linear regression was done to estimate the relation between Sprint's stock returns and the markef's retum. The intercept of the line was found to

A linear regression was done to estimate the relation between Sprint's stock returns and the markef's retum. The intercept of the line was found to be 0.23 and the slope was 1.47. Which of the following statements is true regarding Sprint's stock? OA. The risk-free rate is 1.47% OB. Sprint's beta is 0.23. OC. The standard deviation of Sprint's excess returns is 23% OD. Sprint's beta is 1.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts