Question: Question 9 (2 points) A linear regression was done to estimate the relation between Sprint's stock returns and the market's return. The intercept of the

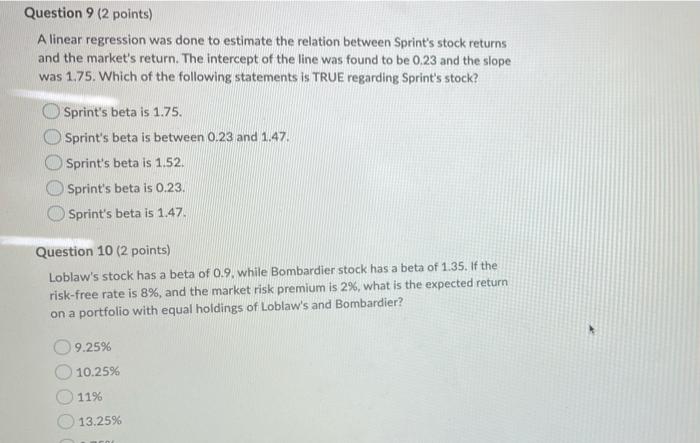

Question 9 (2 points) A linear regression was done to estimate the relation between Sprint's stock returns and the market's return. The intercept of the line was found to be 0.23 and the slope was 1.75. Which of the following statements is TRUE regarding Sprint's stock? Sprint's beta is 1.75. Sprint's beta is between 0.23 and 1.47 Sprint's beta is 1.52. Sprint's beta is 0.23. Sprint's beta is 1.47. Question 10 (2 points) Loblaw's stock has a beta of 0.9, while Bombardier stock has a beta of 1.35. If the risk-free rate is 8%, and the market risk premium is 2%, what is the expected return on a portfolio with equal holdings of Loblaw's and Bombardier? 9.25% 10.25% 11% 13.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts