Question: A loan application is approved if it passes two checks: (i) the applicant's loan risk assessment, done automatically by a system, and (ii) the appraisal

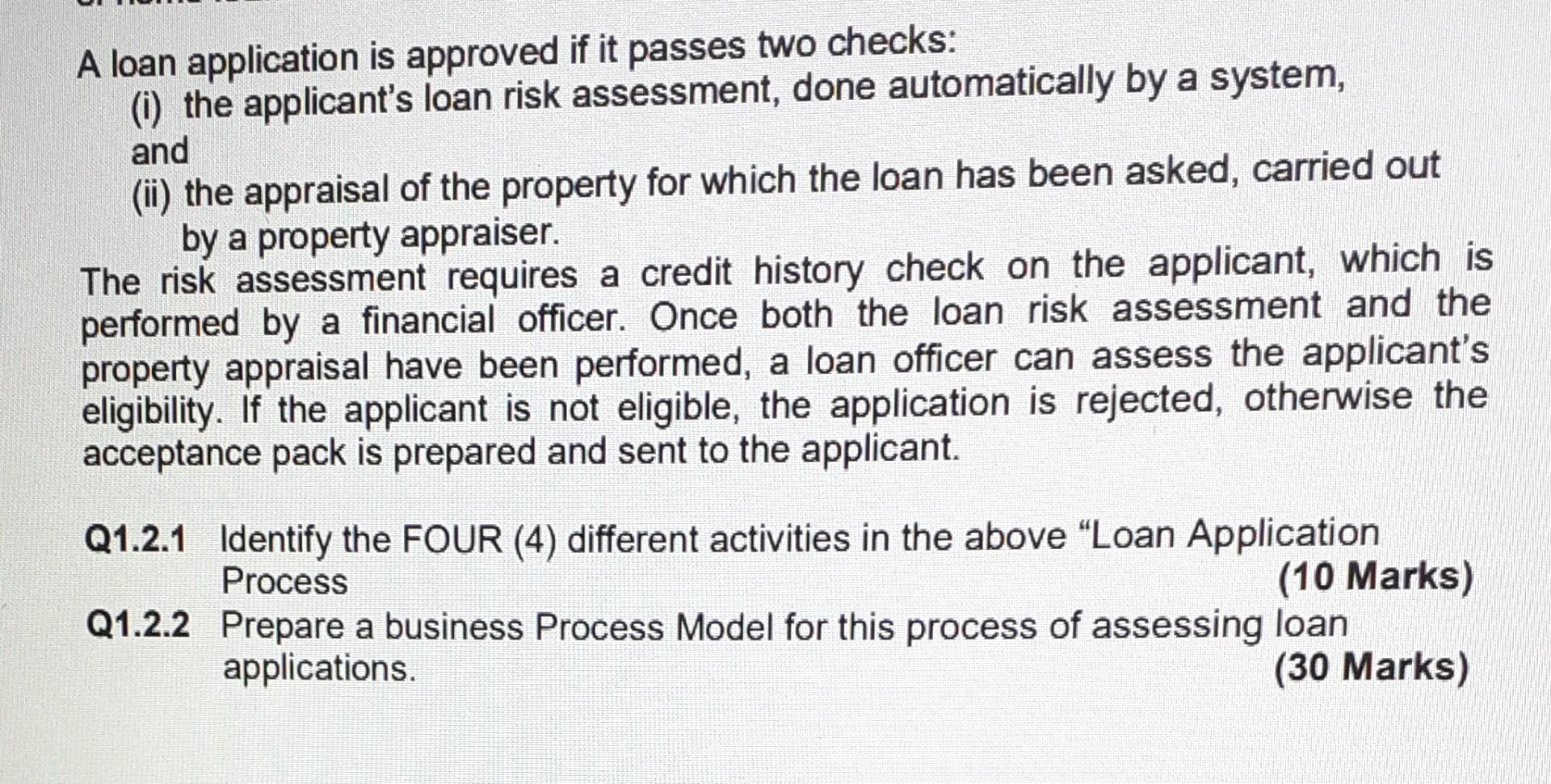

A loan application is approved if it passes two checks: (i) the applicant's loan risk assessment, done automatically by a system, and (ii) the appraisal of the property for which the loan has been asked, carried out by a property appraiser. The risk assessment requires a credit history check on the applicant, which is performed by a financial officer. Once both the loan risk assessment and the property appraisal have been performed, a loan officer can assess the applicant's eligibility. If the applicant is not eligible, the application is rejected, otherwise the acceptance pack is prepared and sent to the applicant. Q1.2.1 Identify the FOUR (4) different activities in the above "Loan Application Process (10 Marks) Q1.2.2 Prepare a business Process Model for this process of assessing loan applications. (30 Marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock