Question: A Ltd . plans to acquire B Ltd . The following information is available: B Ltd . has property, plant, and equipment ( book value

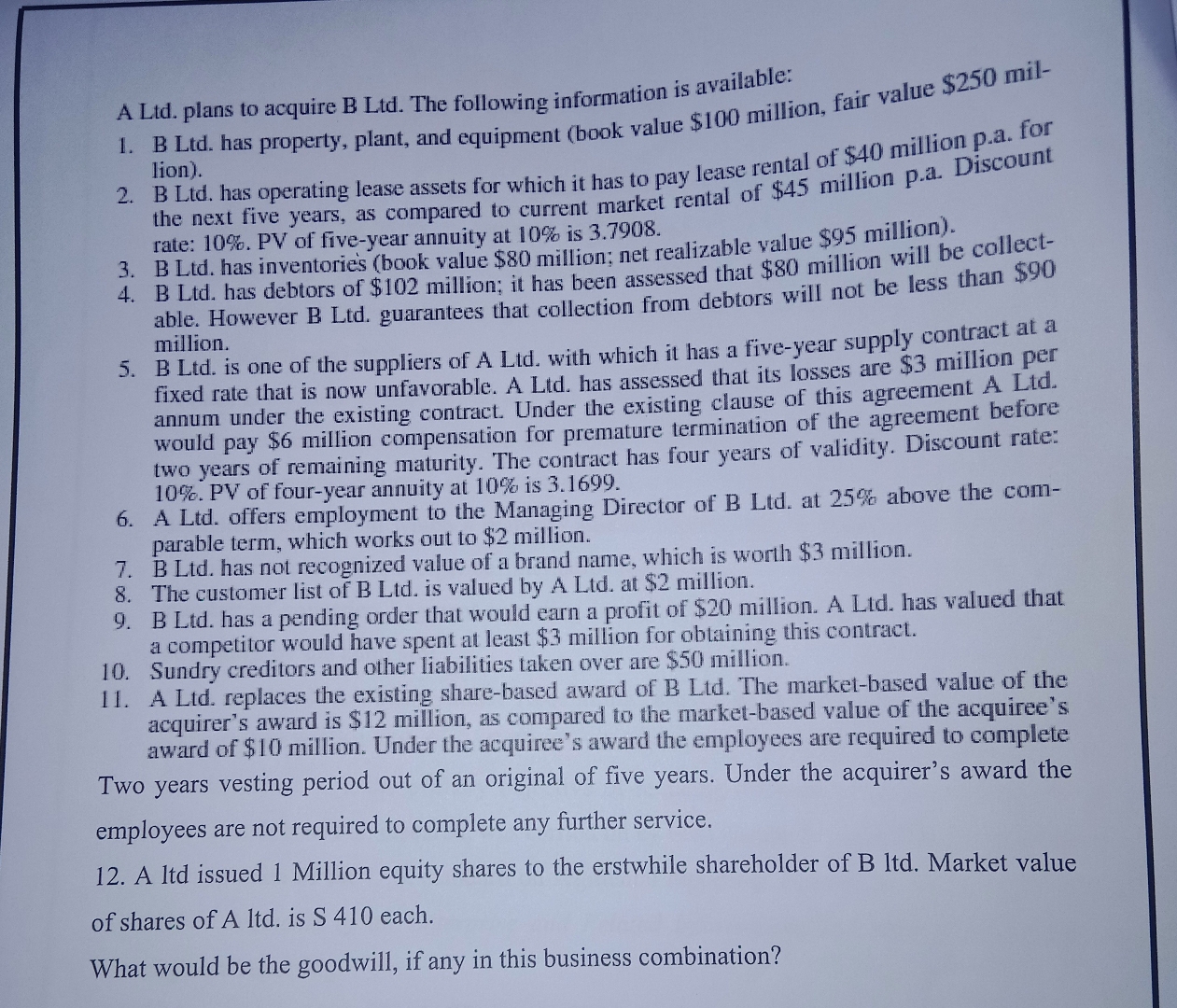

A Ltd plans to acquire B Ltd The following information is available:

B Ltd has property, plant, and equipment book value $ million, fair value $ million

B Ltd has operating lease assets for which it has to pay lease rental of $ million pa for the next five years, as compared to current market rental of $ million pa Discount rate: PV of fiveyear annuity at is

B Ltd has inventories book value $ million; net realizable value $ million

B Ltd has debtors of $ million; it has been assessed that $ million will be collectable. However B Ltd guarantees that collection from debtors will not be less than $

B Ltd is one of the suppliers of A Ltd with which it has a fiveyear supply contract at a fixed rate that is now unfavorable. A Ltd has assessed that its losses are $ million per annum under the existing contract. Under the existing clause of this agreement A Ltd would pay $ million compensation for premature termination of the agreement before two years of remaining maturity. The contract has four years of validity. Discount rate: PV of fouryear annuity at is

A Ltd offers employment to the Managing Director of B Ltd at above the comparable term, which works out to $ million.

B Ltd has not recognized value of a brand name, which is worth $ million.

The customer list of is valued by A Ltd at $ million.

B Ltd has a pending order that would earn a profit of $ million. A Ltd has valued that a competitor would have spent at least $ million for obtaining this contract.

Sundry creditors and other liabilities taken over are $ million.

A Ltd replaces the existing sharebased award of B Ltd The marketbased value of the acquirer's award is $ million, as compared to the marketbased value of the acquiree's award of $ million. Under the acquiree's award the employees are required to complete Two years vesting period out of an original of five years. Under the acquirer's award the employees are not required to complete any further service.

A ltd issued Million equity shares to the erstwhile shareholder of Market value of shares of A ltd is S each.

What would be the goodwill, if any in this business combination?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock