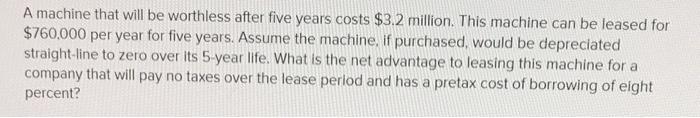

Question: A machine that will be worthless after five years costs $3.2 million. This machine can be leased for $760,000 per year for five years. Assume

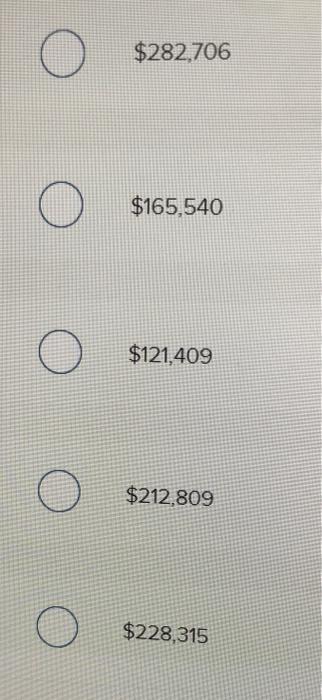

A machine that will be worthless after five years costs $3.2 million. This machine can be leased for $760,000 per year for five years. Assume the machine, if purchased, would be depreciated straight-line to zero over its 5-year life. What is the net advantage to leasing this machine for a company that will pay no taxes over the lease period and has a pretax cost of borrowing of eight percent? $282,706 $165,540 $121,409 $212,809 $228,315

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock