Question: A machine that will be worthless after five years costs $3.2 million. This machine can be leased for $760,000 pa for five years. Assume the

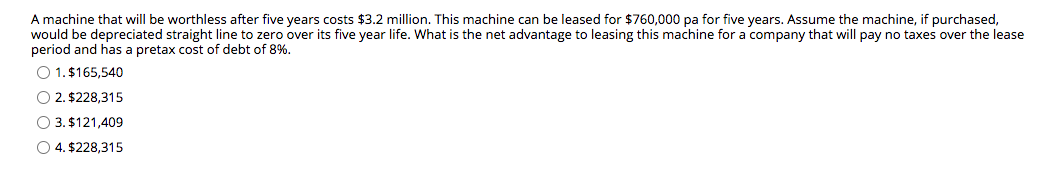

A machine that will be worthless after five years costs $3.2 million. This machine can be leased for $760,000 pa for five years. Assume the machine, if purchased, would be depreciated straight line to zero over its five year life. What is the net advantage to leasing this machine for a company that will pay no taxes over the lease period and has a pretax cost of debt of 8%. O 1. $165,540 O2. $228,315 O 3. $121,409 O 4. $228,315

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock