Question: A major hypermarket is considering the future for its warehousing and distribution facilities. It has decided that it needs to build a new facility but

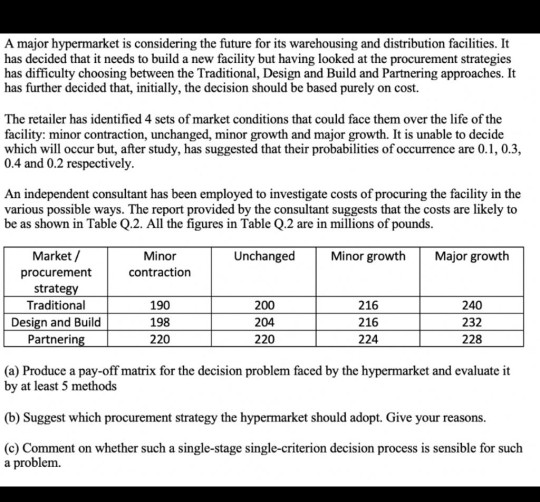

A major hypermarket is considering the future for its warehousing and distribution facilities. It has decided that it needs to build a new facility but having looked at the procurement strategies has difficulty choosing between the Traditional, Design and Build and Partnering approaches. It has further decided that, initially, the decision should be based purely on cost. The retailer has identified 4 sets of market conditions that could face them over the life of the facility: minor contraction, unchanged, minor growth and major growth. It is unable to decide which will occur but, after study, has suggested that their probabilities of occurrence are 0.1, 0.3, 0.4 and 0.2 respectively. An independent consultant has been employed to investigate costs of procuring the facility in the various possible ways. The report provided by the consultant suggests that the costs are likely to be as shown in Table Q.2. All the figures in Table Q.2 are in millions of pounds. 190 220 228 Market / Minor Unchanged Minor growth Major growth procurement contraction strategy Traditional 200 216 240 Design and Build 198 204 216 232 Partnering 220 224 (a) Produce a pay-off matrix for the decision problem faced by the hypermarket and evaluate it by at least 5 methods (b) Suggest which procurement strategy the hypermarket should adopt. Give your reasons. (c) Comment on whether such a single-stage single-criterion decision process is sensible for such a problem. A major hypermarket is considering the future for its warehousing and distribution facilities. It has decided that it needs to build a new facility but having looked at the procurement strategies has difficulty choosing between the Traditional, Design and Build and Partnering approaches. It has further decided that, initially, the decision should be based purely on cost. The retailer has identified 4 sets of market conditions that could face them over the life of the facility: minor contraction, unchanged, minor growth and major growth. It is unable to decide which will occur but, after study, has suggested that their probabilities of occurrence are 0.1, 0.3, 0.4 and 0.2 respectively. An independent consultant has been employed to investigate costs of procuring the facility in the various possible ways. The report provided by the consultant suggests that the costs are likely to be as shown in Table Q.2. All the figures in Table Q.2 are in millions of pounds. 190 220 228 Market / Minor Unchanged Minor growth Major growth procurement contraction strategy Traditional 200 216 240 Design and Build 198 204 216 232 Partnering 220 224 (a) Produce a pay-off matrix for the decision problem faced by the hypermarket and evaluate it by at least 5 methods (b) Suggest which procurement strategy the hypermarket should adopt. Give your reasons. (c) Comment on whether such a single-stage single-criterion decision process is sensible for such a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts