Question: A) Make a journal entry to record worldwide's expense for Welch's total earnings for the year, his payroll deductions, and cash for net pay. B)

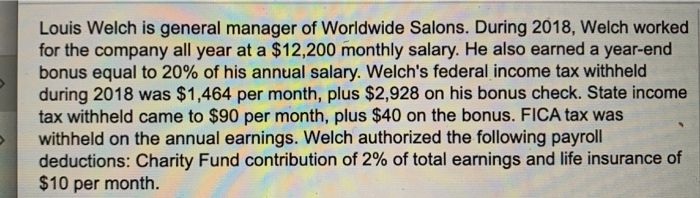

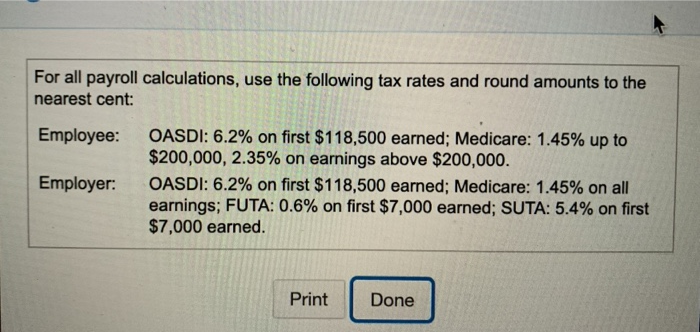

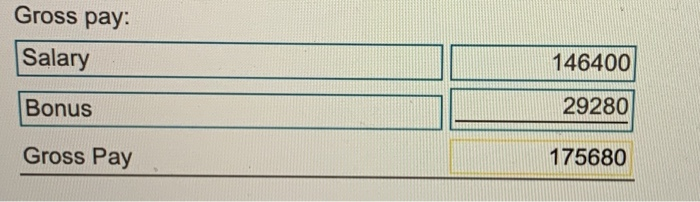

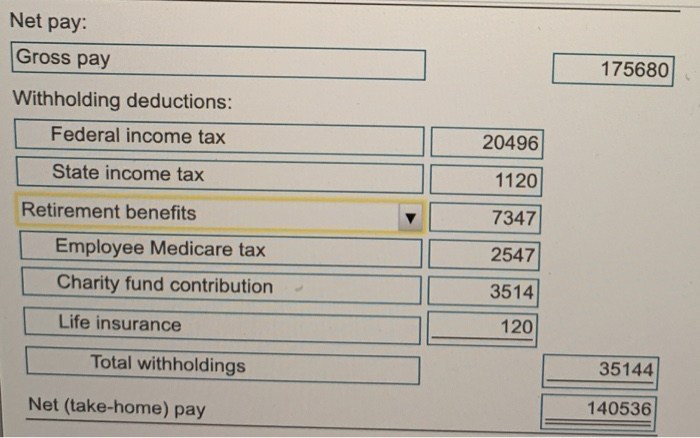

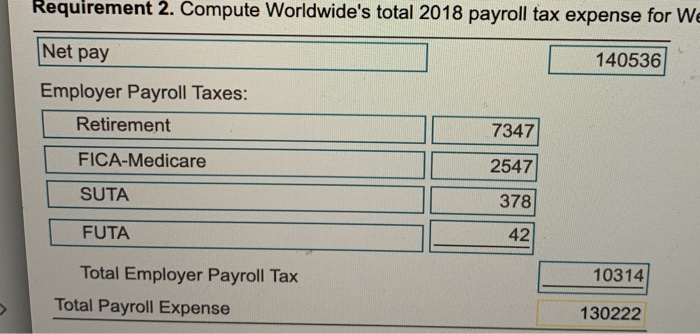

Louis Welch is general manager of Worldwide Salons. During 2018, Welch worked for the company all year at a $12,200 monthly salary. He also earned a year-end bonus equal to 20% of his annual salary. Welch's federal income tax withheld during 2018 was $1,464 per month, plus $2,928 on his bonus check. State income tax withheld came to $90 per month, plus $40 on the bonus. FICA tax was withheld on the annual earnings. Welch authorized the following payroll deductions: Charity Fund contribution of 2% of total earnings and life insurance of $10 per month. For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Print Done Done Gross pay: Salary 146400 Bonus 29280 Gross Pay 175680 Net pay: Gross pay 175680 Withholding deductions: Federal income tax 20496 State income tax 1120 Retirement benefits 7347 Employee Medicare tax 2547 Charity fund contribution 3514 Life insurance 120 Total withholdings 35144 Net (take-home) pay 140536 Requirement 2. Compute Worldwide's total 2018 payroll tax expense for W Net pay 140536 Employer Payroll Taxes: Retirement 7347 FICA-Medicare 2547 378 SUTA FUTA 42 10314 Total Employer Payroll Tax Total Payroll Expense 130222

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts