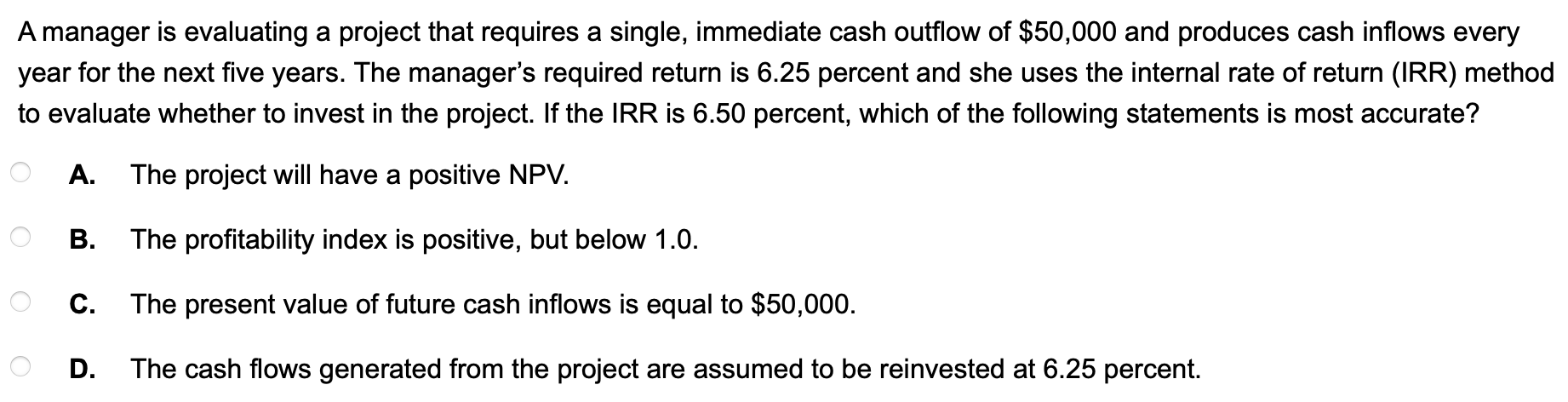

Question: A manager is evaluating a project that requires a single, immediate cash outflow of ( $ 5 0 , 0 0 0

A manager is evaluating a project that requires a single, immediate cash outflow of $ and produces cash inflows every year for the next five years. The manager's required return is percent and she uses the internal rate of return IRR method to evaluate whether to invest in the project. If the IRR is percent, which of the following statements is most accurate?

A The project will have a positive NPV

B The profitability index is positive, but below

C The present value of future cash inflows is equal to $

D The cash flows generated from the project are assumed to be reinvested at percent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock