Question: A manager is trying to decide whether to build a small, medium, or large facility Demand can be low average, or high, with the estimated

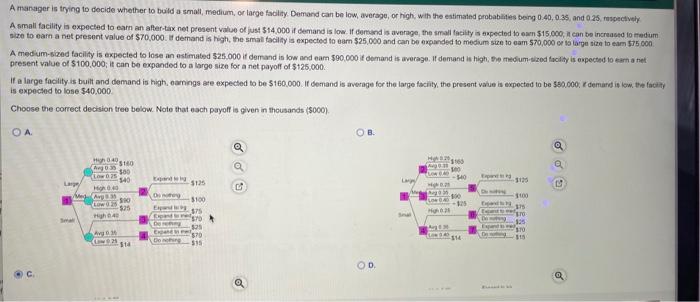

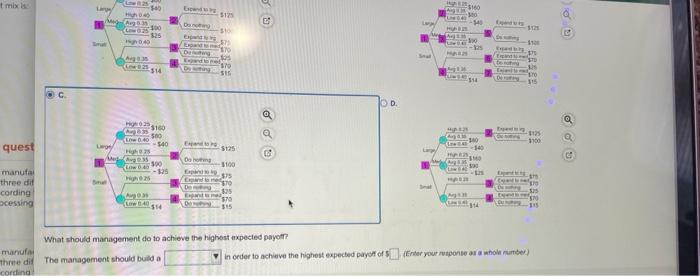

A manager is trying to decide whether to build a small, medium, or large facility Demand can be low average, or high, with the estimated probabilities being 0.40, 0.35, and 0 25.mespedively A small facility is expected to earn an alter-tax net present value of just $14.000 i demand is low. If demand is average, the small facility is expected to an $15,000, can be increased to medium se to earn a not present value of $70,000. demand is high, the smal facility is expected to cam $25.000 and can be expanded to medium size to cam 570,000 or to large size tocam $75.000 A medium-sized facility is expected to lose an estimated $25.000 i demand in low and gar $00.000 i demand is everage. If demand is high, so medium-sized facility is expected to an athet present value of $100.000, it can be expanded to a large size for a net payoff of $125,000 If a large facility is built and demand is high, camings are expected to be $160,000. I demand is average for the large facility, the present value is expected to be 500.000 demand is low, the facity is expected to lose $40,000 Choose the correct decision treo below. Note that each payoff is given in thousands (5000) 160 -10 La 040 S160 LODS 300 540 H040 A -525 5125 So -100 -125 5100 $75 570 100 175 HOR 135 10 115 AVO E DO $70 515 514 OD t mix 5160 5 540 A33 100 325 40 AU 300 140 A 100 B570 110 D 57 ho D 2160 1700 865 quest 5125 140 0:40 500 -$40 HD 35 040 500 - 25 25 03 Do 300 - cs manufal three dit cording ocessing 325 314 11 What should management de to achieve the highest expected payo? manufa three dit The management should build a in order to achieve the highest expected payoff of 5) Enter your response as a whole number) cording A manager is trying to decide whether to build a small, medium, or large facility Demand can be low average, or high, with the estimated probabilities being 0.40, 0.35, and 0 25.mespedively A small facility is expected to earn an alter-tax net present value of just $14.000 i demand is low. If demand is average, the small facility is expected to an $15,000, can be increased to medium se to earn a not present value of $70,000. demand is high, the smal facility is expected to cam $25.000 and can be expanded to medium size to cam 570,000 or to large size tocam $75.000 A medium-sized facility is expected to lose an estimated $25.000 i demand in low and gar $00.000 i demand is everage. If demand is high, so medium-sized facility is expected to an athet present value of $100.000, it can be expanded to a large size for a net payoff of $125,000 If a large facility is built and demand is high, camings are expected to be $160,000. I demand is average for the large facility, the present value is expected to be 500.000 demand is low, the facity is expected to lose $40,000 Choose the correct decision treo below. Note that each payoff is given in thousands (5000) 160 -10 La 040 S160 LODS 300 540 H040 A -525 5125 So -100 -125 5100 $75 570 100 175 HOR 135 10 115 AVO E DO $70 515 514 OD t mix 5160 5 540 A33 100 325 40 AU 300 140 A 100 B570 110 D 57 ho D 2160 1700 865 quest 5125 140 0:40 500 -$40 HD 35 040 500 - 25 25 03 Do 300 - cs manufal three dit cording ocessing 325 314 11 What should management de to achieve the highest expected payo? manufa three dit The management should build a in order to achieve the highest expected payoff of 5) Enter your response as a whole number) cording