Question: A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated

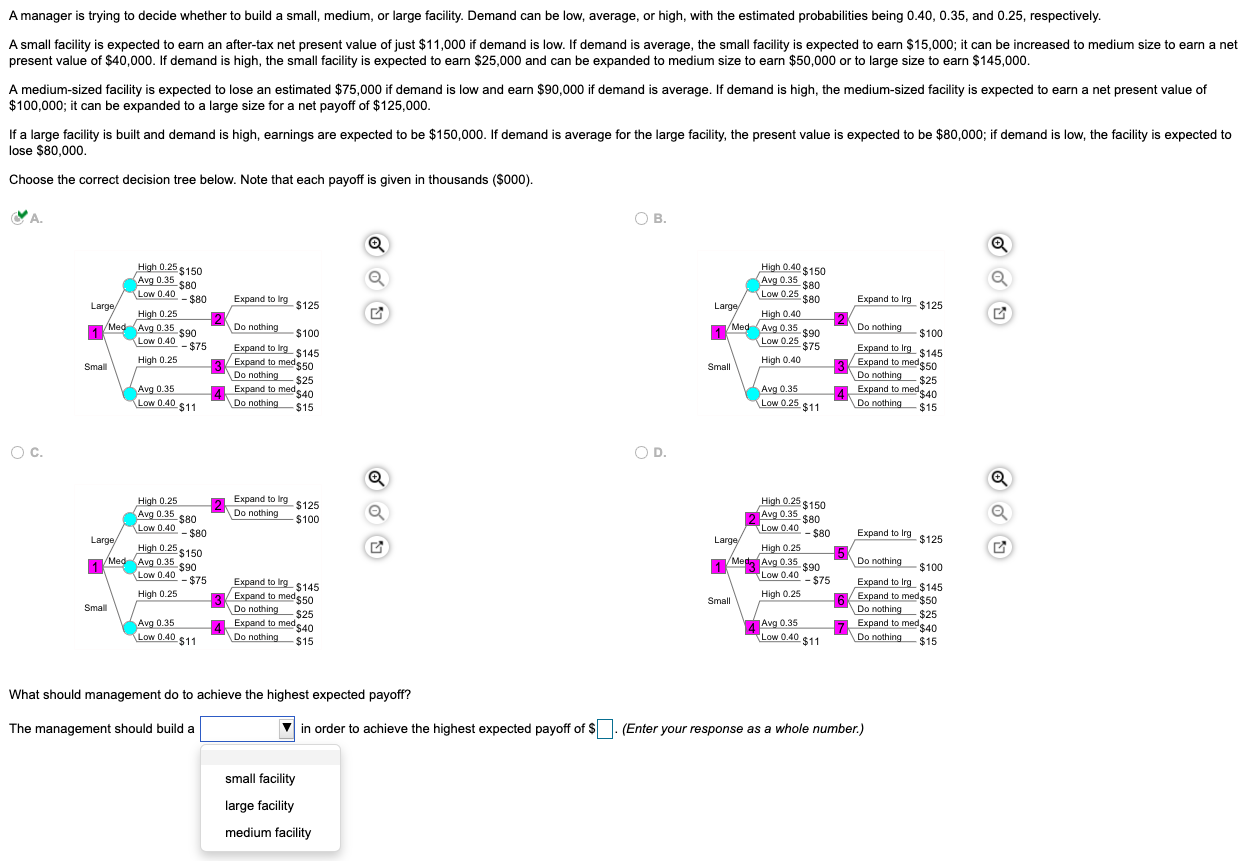

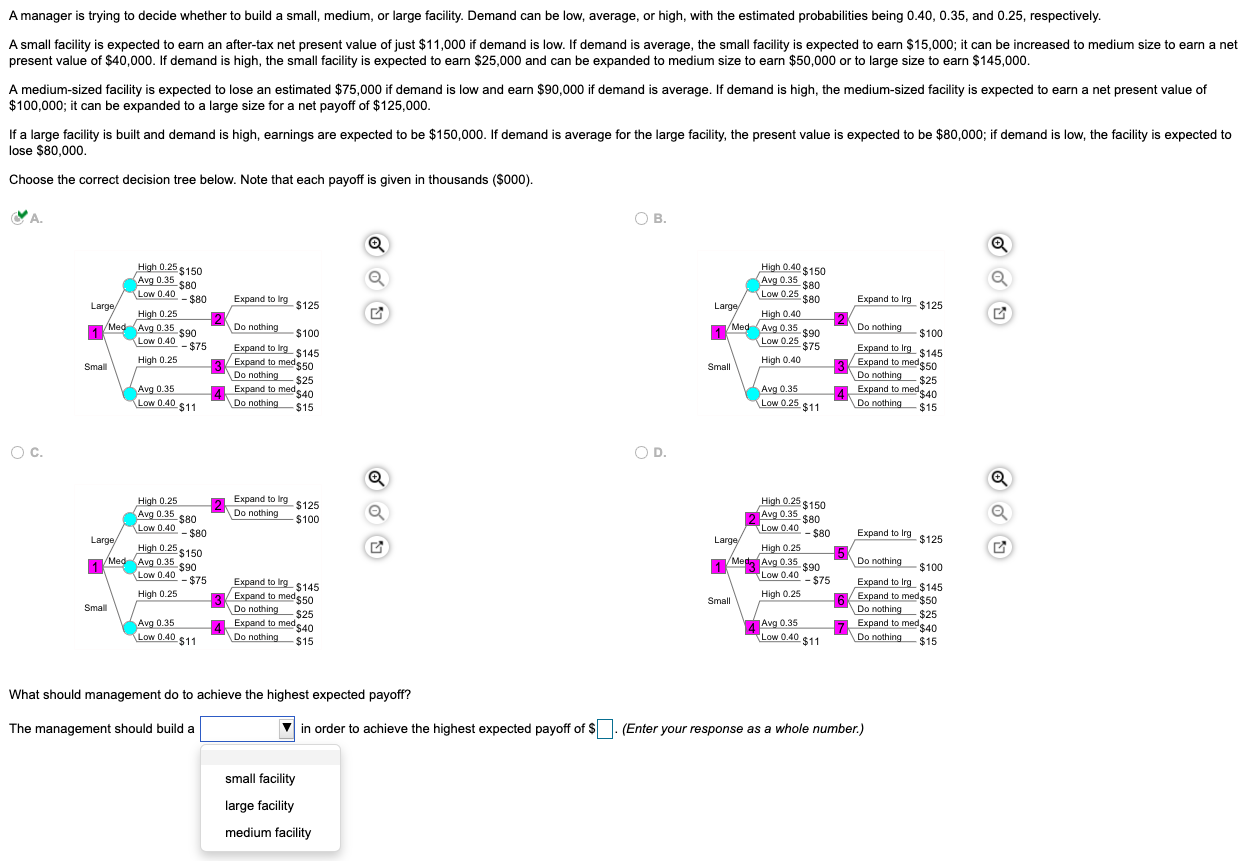

A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated probabilities being 0.40, 0.35, and 0.25, respectively. A small facility is expected to earn an after-tax net present value of just $11,000 if demand is low. If demand is average, the small facility is expected to earn $15,000; it can be increased to medium size to earn a net present value of $40,000. If demand is high, the small facility is expected to earn $25,000 and can be expanded to medium size to earn $50,000 or to large size to earn $145,000. A medium-sized facility is expected to lose an estimated $75,000 if demand is low and earn $90,000 if demand is average. If demand is high, the medium-sized facility is expected to earn a net present value of $100,000; it can be expanded to a large size for a net payoff of $125,000. If a large facility is built and demand is high, earnings are expected to be $150,000. If demand is average for the large facility, the present value is expected to be $80,000; if demand is low, the facility is expected to lose $80,000. Choose the correct decision tree below. Note that each payoff is given in thousands ($000). A. OB. High 0.25 $150 Avg 0.35 $80 High 0.40 $150 Avg 0.35 $80 Expand to lrg $125 Expand to lrg $125 Low 0.40 Large - $80 High 0.25 1 Med Avg 0.35 $90 - Low 0.25 $80 Large High 0.40 Med Avg 0.35 $90 Low 0.40 - $75 Low 0.25 $75 High 0.25 Do nothing $100 Expand to lrg. $145 Expand to med $50 Do nothing $25 Expand to meds Do nothing $15 Small Small High 0.40 Do nothing $100 Expand to lrg$145 Expand to med$50 Do nothing $25 Expand to med 540 Do nothing - $15 Avg 0.35 $40 Avg 0.35 Low 0.40 $11 Low 0.25 $11 OC OD. a High 0.25 Expand to lng $125 High 0.25 $150 Do nothing $100 Avg 0.35 980 Low 0,40 - $80 Expand to lrg $125 Large Avg 0.35 $80 Low 0.40 - $80 High 0.25 $150 Med Avg 0.35 $90 Low 0.40 - $75 1 Large High 0.25 Med, Avg 0.35 $90 - High 0.25 Small Low 0.40 - $75 High 0.25 Do nothing $100 Expand to lng $145 Expand to med$50 Do nothing $25 Expand to med $40 Do nothing $15 Expand to lrg. $145 Expand to med $50 Do nothing $25 Expand to med $40 Do nothing $15 Small Avg 0.35 Avg 0.35 Low 0.40 $11 7 Low 0.40 $11 What should management do to achieve the highest expected payoff? The management should build a v in order to achieve the highest expected payoff of $ (Enter your response as a whole number.) small facility large facility medium facility A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated probabilities being 0.40, 0.35, and 0.25, respectively. A small facility is expected to earn an after-tax net present value of just $11,000 if demand is low. If demand is average, the small facility is expected to earn $15,000; it can be increased to medium size to earn a net present value of $40,000. If demand is high, the small facility is expected to earn $25,000 and can be expanded to medium size to earn $50,000 or to large size to earn $145,000. A medium-sized facility is expected to lose an estimated $75,000 if demand is low and earn $90,000 if demand is average. If demand is high, the medium-sized facility is expected to earn a net present value of $100,000; it can be expanded to a large size for a net payoff of $125,000. If a large facility is built and demand is high, earnings are expected to be $150,000. If demand is average for the large facility, the present value is expected to be $80,000; if demand is low, the facility is expected to lose $80,000. Choose the correct decision tree below. Note that each payoff is given in thousands ($000). A. OB. High 0.25 $150 Avg 0.35 $80 High 0.40 $150 Avg 0.35 $80 Expand to lrg $125 Expand to lrg $125 Low 0.40 Large - $80 High 0.25 1 Med Avg 0.35 $90 - Low 0.25 $80 Large High 0.40 Med Avg 0.35 $90 Low 0.40 - $75 Low 0.25 $75 High 0.25 Do nothing $100 Expand to lrg. $145 Expand to med $50 Do nothing $25 Expand to meds Do nothing $15 Small Small High 0.40 Do nothing $100 Expand to lrg$145 Expand to med$50 Do nothing $25 Expand to med 540 Do nothing - $15 Avg 0.35 $40 Avg 0.35 Low 0.40 $11 Low 0.25 $11 OC OD. a High 0.25 Expand to lng $125 High 0.25 $150 Do nothing $100 Avg 0.35 980 Low 0,40 - $80 Expand to lrg $125 Large Avg 0.35 $80 Low 0.40 - $80 High 0.25 $150 Med Avg 0.35 $90 Low 0.40 - $75 1 Large High 0.25 Med, Avg 0.35 $90 - High 0.25 Small Low 0.40 - $75 High 0.25 Do nothing $100 Expand to lng $145 Expand to med$50 Do nothing $25 Expand to med $40 Do nothing $15 Expand to lrg. $145 Expand to med $50 Do nothing $25 Expand to med $40 Do nothing $15 Small Avg 0.35 Avg 0.35 Low 0.40 $11 7 Low 0.40 $11 What should management do to achieve the highest expected payoff? The management should build a v in order to achieve the highest expected payoff of $ (Enter your response as a whole number.) small facility large facility medium facility