Question: A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated

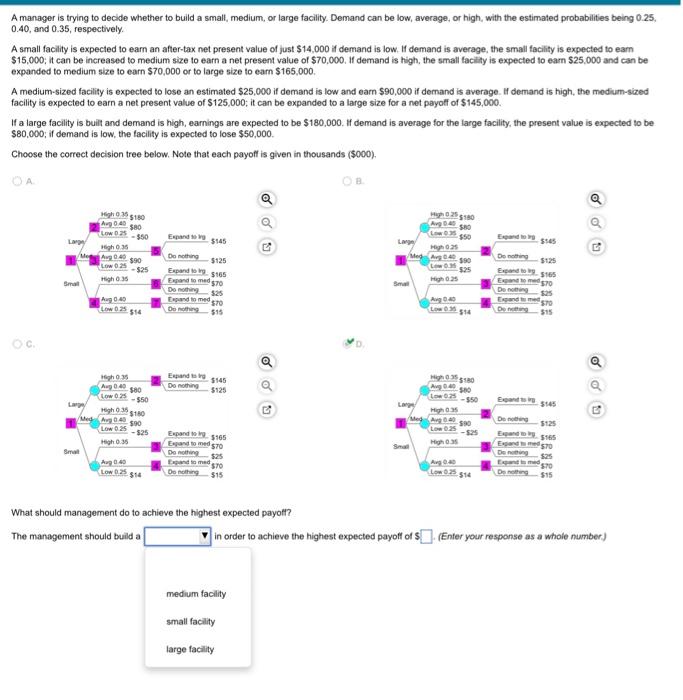

A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated probabilities being 0.25, 0.40, and 0.35, respectively A small facility is expected to earn an after-tax net present value of just $14.000 if demand is low. If demand is average, the small facility is expected to eam $15,000; it can be increased to medium size to earn a net present value of $70,000. If demand is high, the small facility is expected to earn $25,000 and can be expanded to medium size to earn $70,000 or to large size to earn $165,000 A medium-sized facility is expected to lose an estimated $25,000 if demand is low and earn $90,000 if demand is average. If demand is high, the medium-sized facility is expected to earn a net present value of $125,000; it can be expanded to a large size for a net payoff of $145,000 If a large facility is built and demand is high, earnings are expected to be $180,000. If demand is average for the large facility, the present value is expected to be $80,000; if demand is low, the facility is expected to lose $50,000 Choose the correct decision tree below. Note that each payoff is given in thousands (5000), OA 35180 202980 Aug 0.40 $80 Low 0.25 - $50 dos SHO Expand $50 La $145 Lang pos Ang 590 Aug 0.40 $90 LO 025 -525 035 LO 525 Sma De nothing $125 Expand to $165 and to med 570 Domoting 32 Come to media De 515 Dow_$12 Espen 3165 50 De Eigando D-515 Aug 0.0 Aug 0.40 514 03 Expand Do nothing oo Aug 0.40 5145 5125 50 1071-550 o o to Low 025 - $50 L 545 0:3 180 AD -590 Med 0.40 590 LOW 025 - $25 High 0.35 Small Aug 040 Sma High Expand to Expanded 570 D525 Dana 70 Derting 515 Deng 5125 16 Desa med 570 Deng$15 Aug 20 LOS $14 What should management do to achieve the highest expected payoff? The management should build a in order to achieve the highest expected payoff of $(Enter your response as a whole number) medium facility small facility large facility Techno Corporation is currently manufacturing an item at variable costs of $4 per unit. Annual fixed costs of manufacturing this item are $142,000. The current selling price of the item is $10 per unit, and the annual sales volume is 30,000 units. a. Techno can substantially improve the item's quality by installing new equipment at additional annual fixed costs of $60,000. Variable costs per unit would increase by S2, but, as more of the better-quality product could be sold, the annual volume would increase to 55,000 units. Should Techno buy the new equipment and maintain the current price of the item? Why or why not? because the profit from $ to $ Enter your responses as integers.)