Question: A manufacturing firm is considering a robotic system to replace its first generation robotic system. The new system costs $750,000. The firm expects to make

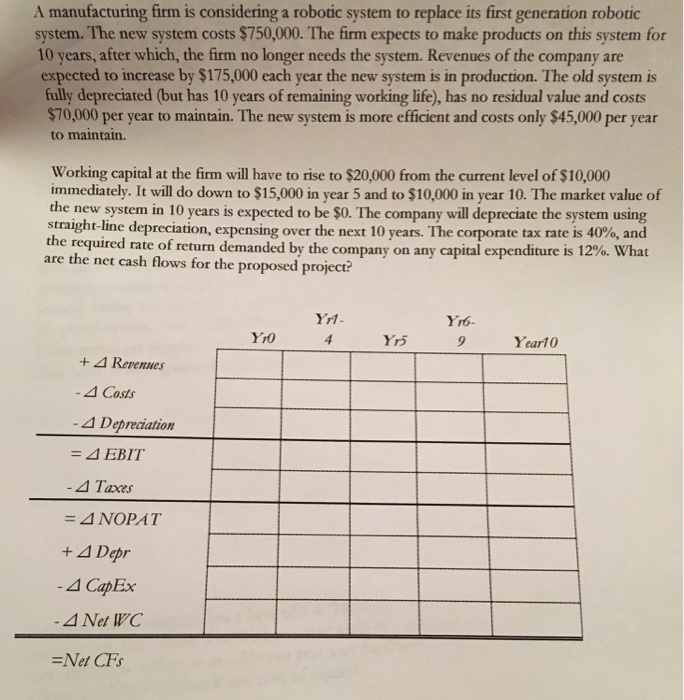

A manufacturing firm is considering a robotic system to replace its first generation robotic system. The new system costs $750,000. The firm expects to make products on this system for 10 years, after which, the firm no longer needs the system. Revenues of the company are expected to increase by $175,000 each year the new system is in production. The old system is fully depreciated (but has 10 years of remaining working life), has no residual value and costs $70,000 per year to maintain. The new system is more efficient and costs only $45,000 per year to maintain. Working capital at the firm will have to rise to $20,000 from the current level of $10,000 immediately. It will do down to $15,000 in year 5 and to $10,000 in year 10. The market value of the new system in 10 years is expected to be $0. The company will depreciate the system using straight-line depreciation, e xpensing over the next 10 years. The corporate tax rate is 40%, and the required rate of return demanded by the company on any capital expenditure is 12%. What are the net cash flows for the proposed project? Y11 Y10 Yi Year10 +4 Revenues Costs Depreciation 4 EBIT Taxes = NOPAT A CapEx Net WC Net CFs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts