Question: A medium-sized local construction company provides building and construction services to a wide array of clients. The company used to charge an inclusive hourly

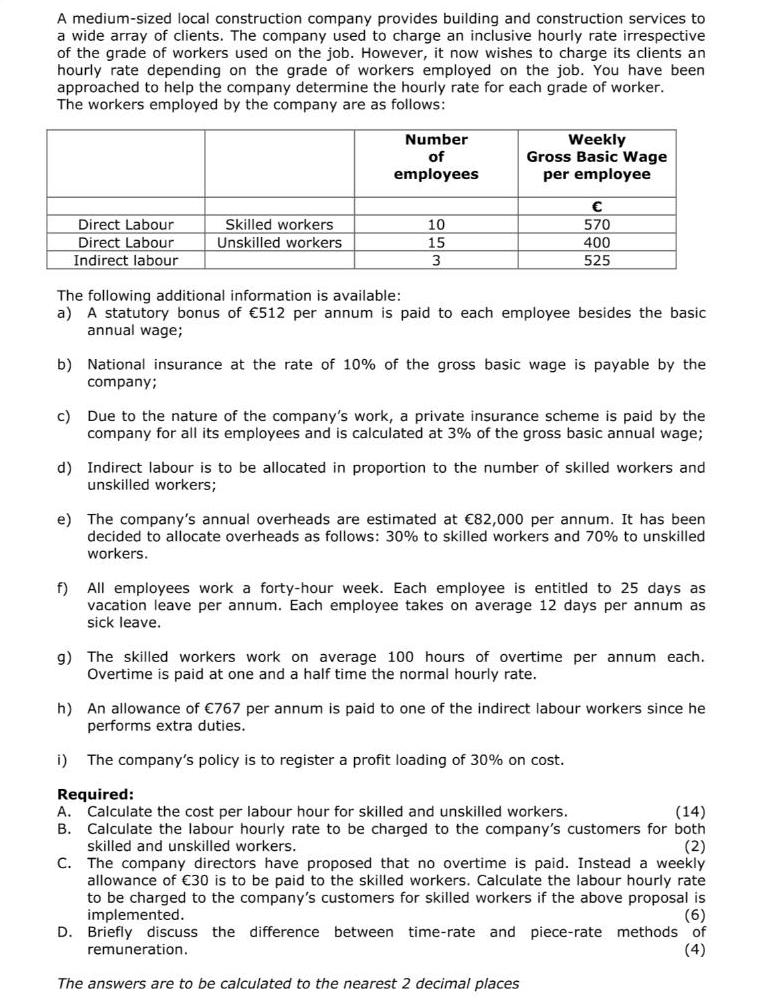

A medium-sized local construction company provides building and construction services to a wide array of clients. The company used to charge an inclusive hourly rate irrespective of the grade of workers used on the job. However, it now wishes to charge its clients an hourly rate depending on the grade of workers employed on the job. You have been approached to help the company determine the hourly rate for each grade of worker. The workers employed by the company are as follows: Direct Labour Direct Labour Indirect labour Skilled workers Unskilled workers Number of employees 10 15 3 Weekly Gross Basic Wage per employee The following additional information is available: a) A statutory bonus of 512 per annum is paid to each employee besides the basic annual wage; 570 400 525 b) National insurance at the rate of 10% of the gross basic wage is payable by the company; c) Due to the nature of the company's work, a private insurance scheme is paid by the company for all its employees and is calculated at 3% of the gross basic annual wage; i) d) Indirect labour is to be allocated in proportion to the number of skilled workers and unskilled workers; e) The company's annual overheads are estimated at 82,000 per annum. It has been decided to allocate overheads as follows: 30% to skilled workers and 70% to unskilled workers. f) All employees work a forty-hour week. Each employee is entitled to 25 days as vacation leave per annum. Each employee takes on average 12 days per annum as sick leave. g) The skilled workers work on average 100 hours of overtime per annum each. Overtime is paid at one and a half time the normal hourly rate. h) An allowance of 767 per annum is paid to one of the indirect labour workers since he performs extra duties. The company's policy is to register a profit loading of 30% on cost. Required: A. Calculate the cost per labour hour for skilled and unskilled workers. (14) B. Calculate the labour hourly rate to be charged to the company's customers for both skilled and unskilled workers. (2) C. The company directors have proposed that no overtime is paid. Instead a weekly allowance of 30 is to be paid to the skilled workers. Calculate the labour hourly rate. to be charged to the company's customers for skilled workers if the above proposal is implemented. (6) D. Briefly discuss the difference between time-rate and piece-rate methods of remuneration. (4) The answers are to be calculated to the nearest 2 decimal places

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

aThe cost per hour for skilled workers is 400 512 01400 512 1 03 76480 07 109257 per hour The cost per hour for unskilled workers is 525 01525 1 03 57... View full answer

Get step-by-step solutions from verified subject matter experts