Question: a . Michele received $ 1 3 0 , 0 0 0 in salary from Red Steel Corporation, where she is a construction engineer. Withholding

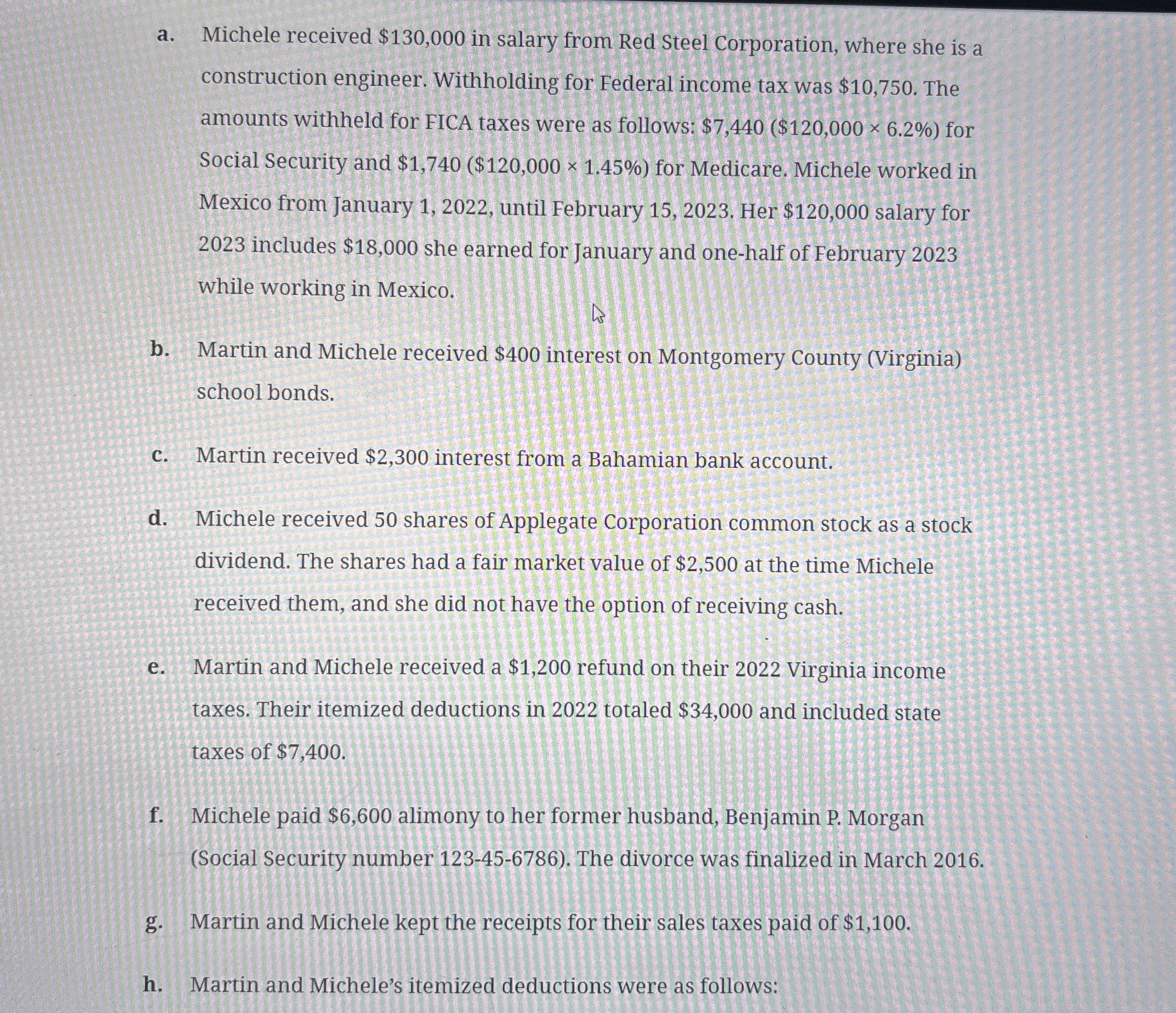

a Michele received $ in salary from Red Steel Corporation, where she is a

construction engineer. Withholding for Federal income tax was $ The

amounts withheld for FICA taxes were as follows: $$ for

Social Security and $$ for Medicare. Michele worked in

Mexico from January until February Her $ salary for

includes $ she earned for January and onehalf of February

while working in Mexico.

b Martin and Michele received $ interest on Montgomery County Virginia

school bonds.

c Martin received $ interest from a Bahamian bank account.

d Michele received shares of Applegate Corporation common stock as a stock

dividend. The shares had a fair market value of $ at the time Michele

received them, and she did not have the option of receiving cash.

e Martin and Michele received a $ refund on their Virginia income

taxes. Their itemized deductions in totaled $ and included state

taxes of $

f Michele paid $ alimony to her former husband, Benjamin P Morgan

Social Security number The divorce was finalized in March

g Martin and Michele kept the receipts for their sales taxes paid of $

h Martin and Michele's itemized deductions were as follows:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock