Question: A mining company is deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $14 million would occur at the end

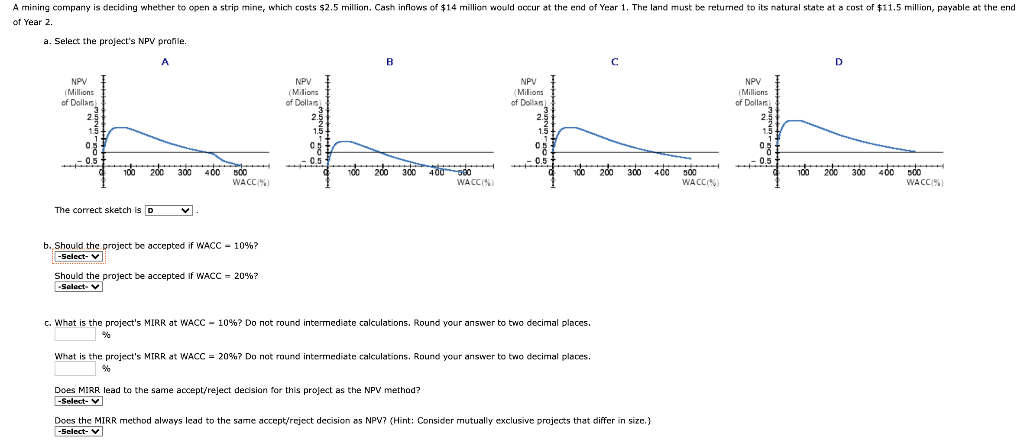

A mining company is deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $14 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $11.5 million, payable at the end of Year 2.

A mining company is deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $14 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $11.5 million, payable at the end of Year 2.

A mining company of Year 2. deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $14 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $11.5 million, payable at the end a. Select the project's NPV profile. A B D Det han har funnet NPV Millions of Dollars 2.5 1.5 0.3 -0.5 NPV (Milions of Dollas 2. 1.5 NPV Milions of Dollars 2.5 1.5 03 -0.5 NPV Millions of Dollars 2.5 1.5 OS -0.5 0.5 100 200 300 400 100 200 300 100 200 500 WACC % 400 300 100 40000 WACC%) 200 300 400 500 WACC% do WACC % ) The correct sketch is D b. Should the project be accepted if WACC - 10%? -Select- Should the project be accepted If WACC -20%? Select c. What is the project's MIRR at WACC - 10%? Do not round intermediate calculations. Round your answer to two decimal places. What is the project's MIRR at WACC = 20%? Do not round intermediate calculations. Round your answer to two decimal places. % Does MIRR lead to the same accept/reject decision for this project as the NPV method? -Select- Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts