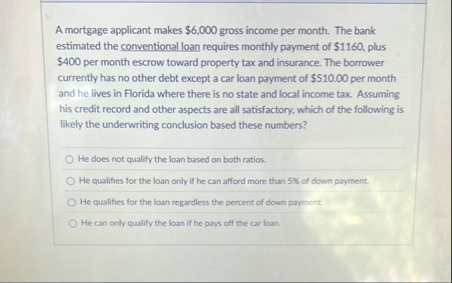

Question: A mortgage applicant makes $ 6 , 0 0 0 gross income per month. The bank estimated the conventional loan requires monthly payment of $

A mortgage applicant makes $ gross income per month. The bank estimated the conventional loan requires monthly payment of $ plus $ per month escrow toward property tax and insurance. The borrower currently has no other debt except a car loan payment of $ per month and he lives in Florida where there is no state and local income tax. Assuming his credit record and other aspects are all satisfactory, which of the following is likely the underwriting conclusion based these numbers?

He does not qualify the loan based on both ratios.

He qualifies for the foan only if he can afford more than of down payment.

He qualifies for the loan regardless the percent of down payment.

He can only qualify the foan if he prys off the car loan.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock