Question: A Moving to and que ponse. 2 points Question 12 Save Answer Consider an all-equity firm with 600,000 shares outstanding trading at a price of

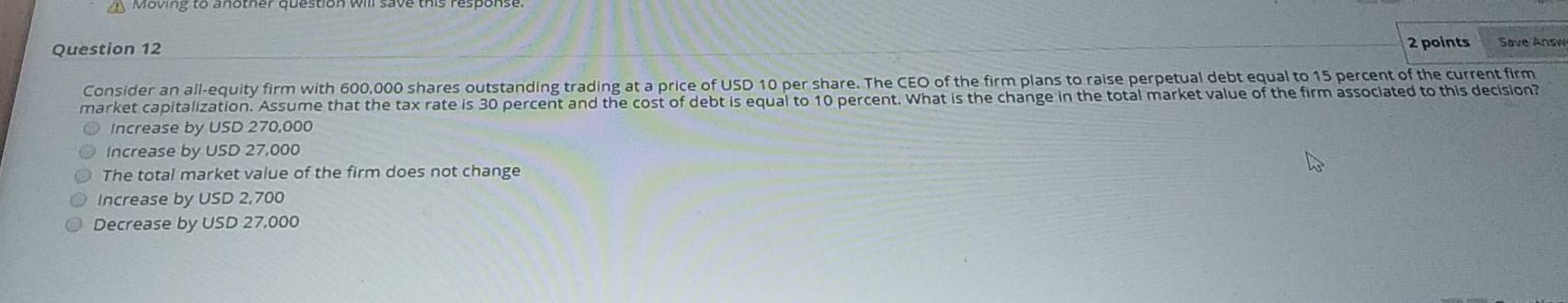

A Moving to and que ponse. 2 points Question 12 Save Answer Consider an all-equity firm with 600,000 shares outstanding trading at a price of USD 10 per share. The CEO of the firm plans to raise perpetual debt equal to 15 percent of the current firm market capitalization. Assume that the tax rate is 30 percent and the cost of debt is equal to 10 percent. What is the change in the total market value of the firm associated to this decision? Increase by USD 270,000 Increase by USD 27.000 The total market value of the firm does not change Increase by USD 2.700 Decrease by USD 27.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts