Question: A Moving to another question will save this response. >> fupuestion Question 2 4 points Save Answer A. On July 1, 2020 ABC Co. purchased

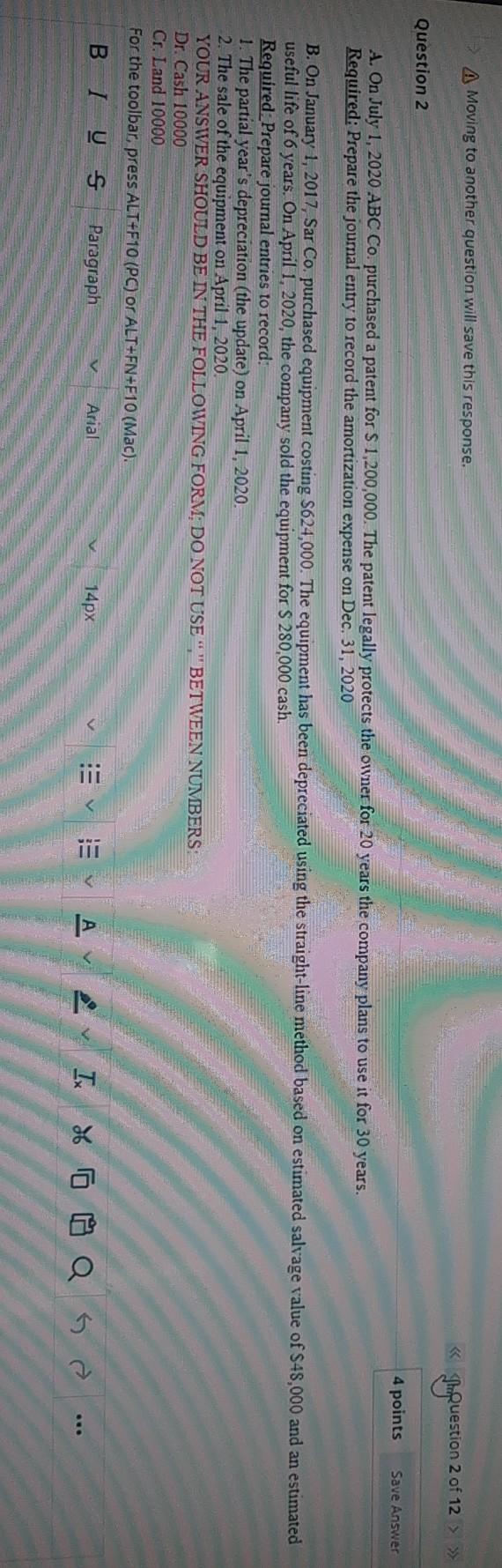

A Moving to another question will save this response. >> fupuestion Question 2 4 points Save Answer A. On July 1, 2020 ABC Co. purchased a patent for $ 1,200,000. The patent legally protects the owner for 20 years the company plans to use it for 30 years. Required: Prepare the journal entry to record the amortization expense on Dec. 31, 2020 B. On January 1, 2017, Sar Co. purchased equipment costing S624,000. The equipment has been depreciated using the straight-line method based on estimated salvage value of $48,000 and an estimated useful life of 6 years. On April 1, 2020, the company sold the equipment for S 280,000 cash. Required Prepare journal entries to record: 1. The partial year's depreciation (the update) on April 1, 2020. 2. The sale of the equipment on April 1, 2020. YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM, DO NOT USE" "BETWEEN NUMBERS: Dr. Cash 10000 Cr. Land 10000 For the toolbar press ALT+F10 (PC) or ALT+FN+F10 (Mac). I US Paragraph Arial 14px A v Ix 26 o oa se

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts