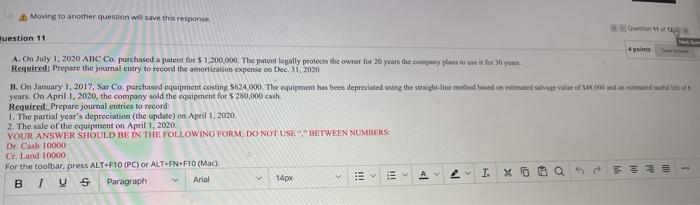

Question: Moving to another question will save this response uestion 11 A in A. On July 1, 2020 ABC Co, purchased a patent for $ 1.200.000

Moving to another question will save this response uestion 11 A in A. On July 1, 2020 ABC Co, purchased a patent for $ 1.200.000 The patent legally protects the owner for 20 years the plans to use it for 30 years Required: Prepare the journal entry to record the amortization expense on Dec 1, 2020 B. On January 1, 2017, Sar Co purchased equipment asting 3624.000 The equipment has been depreciated using the street line method based on estimated gevahe of Sex.com years. On April 1, 2020, the company sold the equipment for $280,000 cash Required: Prepare journal entries to record: 1. The partial year's depreciation (the update) on April 1.2020 2. The sale of the equipment on April 1, 2020 YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM: DO NOT USE BETWEEN NUMBERS: Dr. Cash 10000 Cr. Lund 10000 For the toolbar, press ALT+F10 (PC) or ALT-FN-F10(Mac). BIUS Paragraph BO Arial HE A 14px I. 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts