Question: ... A Moving to another question will save this response. K Question 2 of 9 >>> Question 2 3 points Save Answer Patrick Corporation acquired

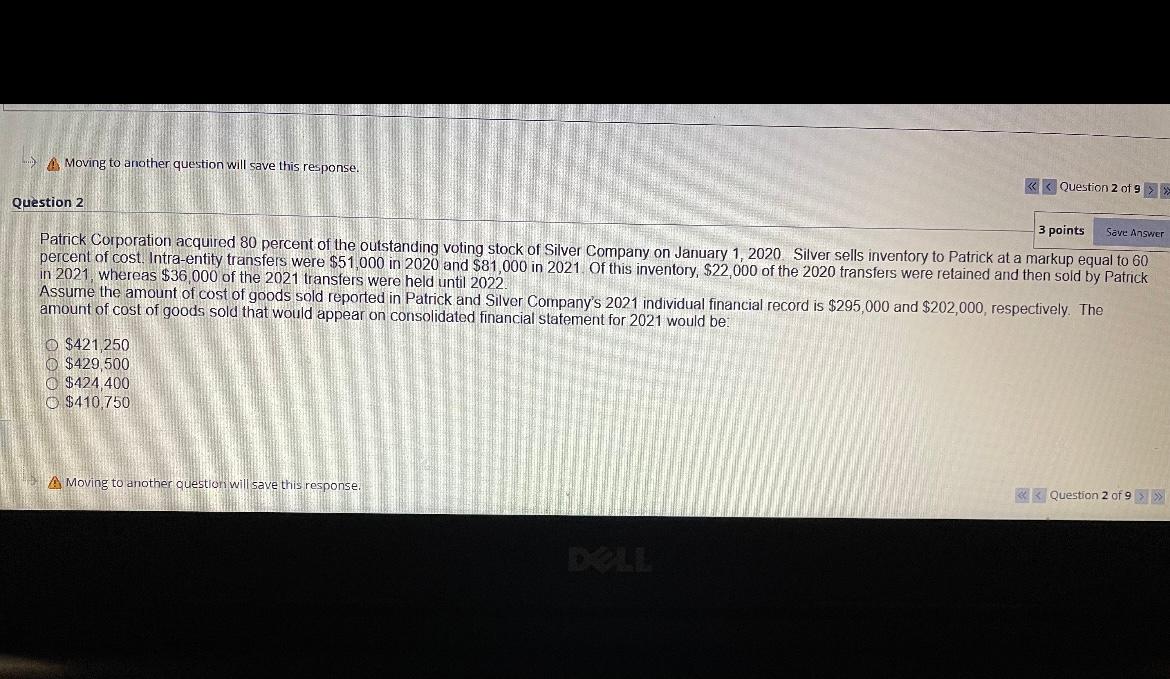

... A Moving to another question will save this response. K Question 2 of 9 >>> Question 2 3 points Save Answer Patrick Corporation acquired 80 percent of the outstanding voting stock of Silver Company on January 1, 2020 Silver sells inventory to Patrick at a markup equal to 60 percent of cost. Intra-entity transfers were $51,000 in 2020 and $81,000 in 2021. Of this inventory, $22,000 of the 2020 transfers were retained and then sold by Patrick in 2021, whereas $36,000 of the 2021 transfers were held until 2022 Assume the amount of cost of goods sold reported in Patrick and Silver Company's 2021 individual financial record is $295,000 and $202,000, respectively. The amount of cost of goods sold that would appear on consolidated financial statement for 2021 would be 0 $421,250 O $429,500 O $424,400 O $410,750 A Moving to another ques e this response >>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts