Question: - A Moving to another question will save this response. Question 8 Delta uses depreciation method a double-declining balance b. straight-line O ci accelerated O

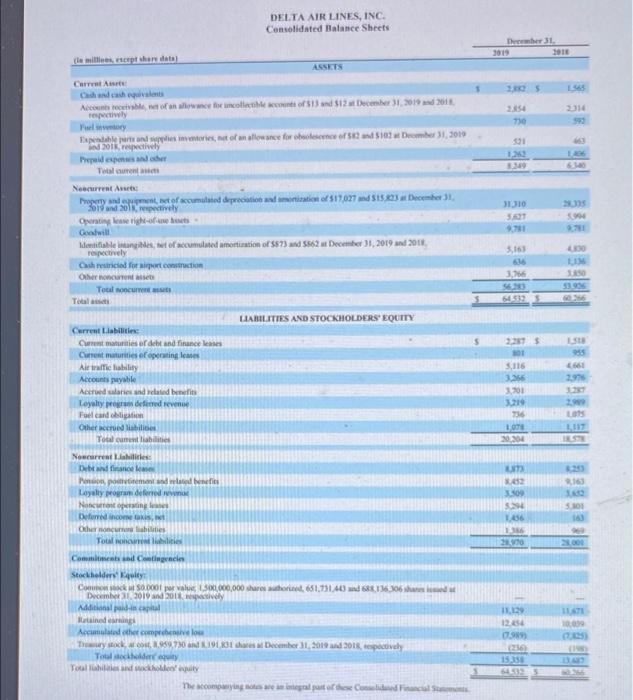

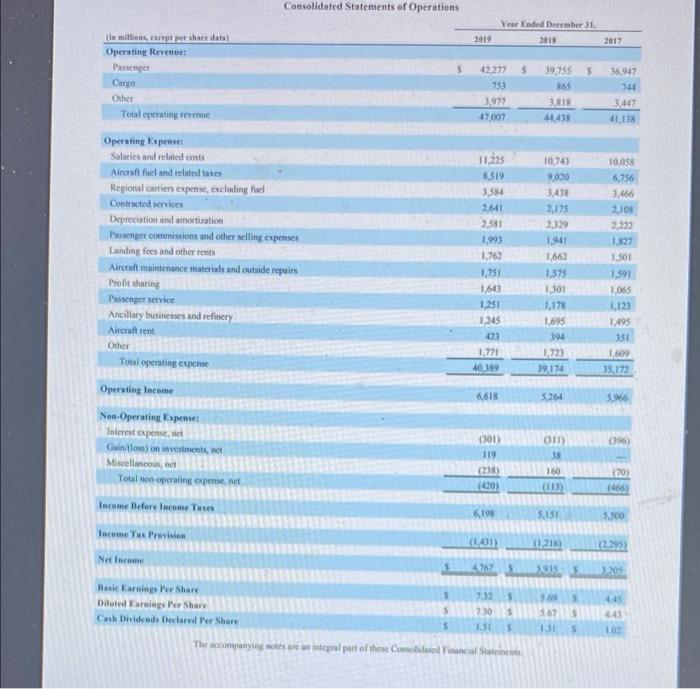

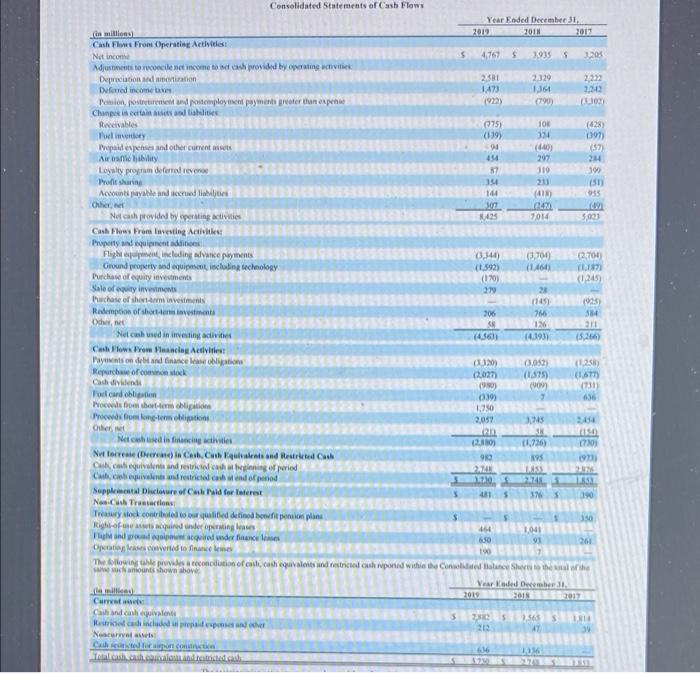

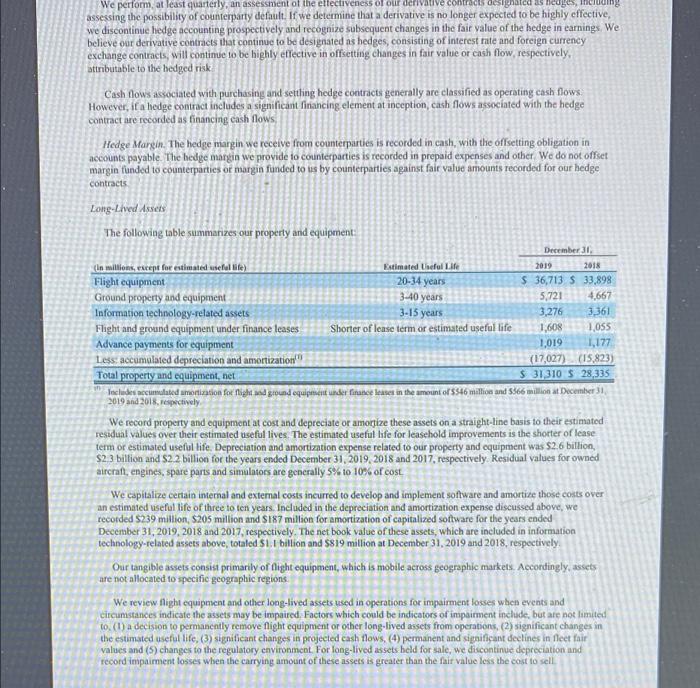

- A Moving to another question will save this response. Question 8 Delta uses depreciation method a double-declining balance b. straight-line O ci accelerated O d. units of activity DELTA AIRLINES, INC. Consolidated Balance Sheets December 31 3019 3911 leiar data ASSETS Cart A Chaves Accountable face for collected of 13 and 12 December 31, 2018 205 1565 730 93 00 1M Fly En la parte and signifies inventories, net of an allows for base of and 5103 Dember 31, 2014 in 2018 Piyalwar Twaal Norrent Art Promy and mentet maluted depreciation and mention 517,027 515.803 December 31, 2017 and Oy Openingstighet Goodwill Identifiable for accumulated amortition of 557 and 5862 December 31, 2019 2011 25 10 301 971 3,163 616 LI 56 64525 945 E 36 3.01 3219 736 2008 20.304 2. IT LT Cash restricted for it.construction Otherhoncurente Tocal Total LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Crematutes of debt and finance lees Current maturities of opening lemes Ai mbility Accounts payable Accordware and be Loyalty pre defined revenue Follando Other crow Totalci bilities Noncurrent sites Debt and finance Popoviment benefits Loyalty program deferred Non penge Dincome Our hates Toulon Commenting Stockholders Equity CSODO 300,000,000 Jr. 651,7314006 Dvoum 2010 2011 Additional Bundang Accued the compe Truy cock, wo 8859730 and 19 December 31, 2018 2018, respectively Total de You chodily The * negalite 2.16 34500 SON T.36 So 100 11,129 12:54 STI 2009 02.0 16 15.15 5455 Consolidated Statements of Operations Year Ended December 31, 2018 2019 2017 $ $ (in militarept per share data) Operating Revenue Passenger Cargo Other Total operating revenue 42277 753 3.927 47.007 19,755 5 865 3818 44.438 36,947 744 3.447 41.138 11.225 2.319 3.584 2.641 2.581 Operating Expenset Salaries and related costs Airerat fuel and related taxes Regional cariens expense, excluding fuel Cootracted services Depreciation and amortization Passenger commissions and other selling expenses Landing fees and other rents Aircraft maintenance materials and outside repairs Profit Sharing Passenger service Ancillary businesses and refinery Aircraft rent Other Total operating expense Operating Income Non-Operating Expenses Interest expense, net Gaindow) on investment, et Miscellancou, net Total non operating expose, net 1.993 1,762 1.751 1.643 1.251 1,345 423 1,771 40389 10,743 9020 3,438 2,175 2329 1.941 1662 1,575 1,301 1,178 1.695 194 1,723 19,174 10.058 6,756 3.466 2108 2.222 1.227 1.501 1.591 1.065 1.123 1,495 131 1.600 35,172 6618 3.264 3.965 (396) (301) 119 (238) (420) 011) 3 160 (113 (70) (466) Income before Income Taxes 6,198 5.151 5.500 Income Tax Prevision (1.01) (1.216) 12.295) Net Income 4,767 5 1208 5 5 3.60 5 Hasie Earnings Per Share Diluted Earnings Per Share Cash Dividends Declared Per Share 7:33 7.30 TASI 445 141 $ 5 3 13 5 The accompanyings are an integral part of these Consolidated Financial State Consolidated Statements of Cash Flows Year Ended December in millions 2012 2015 2012 Cash Flows From Operating Activities Net incon 5 4767 30155 2205 Adjusto concile neincome to cash provided operating divitiek Depreciation and mortation 2.581 2.329 2222 Deferred income taxes 1473 1364 2343 Pension, postetirement and postemployment payments greater than expenie (790 102 Champs et de Reivables 0775 100 (428) Palivery (119) 334 (397 Prepaid pesand other current 04 (410) (57) Att ability 454 207 214 Loyalty program deferral revers 17 319 390 Profit sharing 144 210 130 Accounts payable and end lobe 144 (10 933 Othere 307 4. Netcah provided by operating activities 1425 7014 3.000 Cash Flows From uvesting Activities Property and equipment addition Flightcluding are payments 03.144) 3.700 2700 Ground property and equipment, including technology 1.592) (14601 (1.187 Purchase of equity investments (170) 0.345 Sale o iniments 279 20 Marchase of short investment 1925) Redemption of shortestent 206 766 384 126 11 cashed in investing activities (45601 1493 5.266) Cash Flows From Paaslog Activities Payments on den finanse obligation 20 0.012 (1.258) Repurchase of cowock Oh didende (20271 (1375) (1.677 (900 Food cards 039 636 Proces from the traditione 1,750 from long-term obligation 2,057 3.5 2454 Other SH Nething the (2.0) (1.720 Nellore (her) C Chels and Restricted Cash 9 195 Cequivalent and restricting of period 2201 venian estrictamend of period 710 IS Supplemental Disclosure of Cold for Interest 15 37 390 Nosch Trostations Treasury stock contributo qualified defined presion plans 350 Right-of-inquired under ingles 444 104 gender and 650 26 Optiscovered to finance 190 The following the conciliation of cul, cath equivalents and restricted the posted within the Cold Shree hown above Var Kadded December 2019 2019 Curmat and calivalente 20 de padech Nacarreta ) Tincalonadech We perform at least quarterly, an assessment of the effectiveness of our derivative contract det be, Including assessing the possibility of counterparty default . If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts, will continue to be highly effective in offsetting changes in fair value or cash flow, respectively, attributable to the hedged risk Cashdows associated with purchasing and settling hedge contracts generally are classified as operating cash flows However, if a hedge contract includes a significant financing element at inception, cash flows associated with the hedge contract are recorded as financing cash flows Hedge Margin. The hedge margin we receive from counterparties is recorded in cash, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in prepaid expenses and other We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts recorded for our hedge contracts Long-Lived Assets The following table summarizes our property and equipment: December 31 In millions, except for estimated useful life) Estimated Leful Lite 2019 2018 Flight equipment 20-34 years $36,713 S 33,898 Ground property and equipment 3.40 years 5,721 4,667 Information technology-related assets 3-15 years 3,276 3361 Flight and ground equipment under finance leases Shorter of lease term or estimated useful life 1,608 1,055 Advance payments for equipment 1,019 1,177 Less accumulated depreciation and amortization" (17,027) (15.823) Total property and equipment, net $ 31310 S 28,335 Includes accumulated motion for nights ground equipment under ince lases in the amount of $546 million and $566 million at December 31 2019 and 2018 respectively We record property and equipment at cost and depreciate or amorize these assets on a straight-line basis to their estimated residual values over their estimated useful lives. The estimated useful life for leasehold improvements is the shorter of lease term or estimated useful life. Depreciation and amortization expense related to our property and equipment was $2.6 billion, $2.3 billion and S2.2 billion for the years ended December 31, 2019 2018 and 2017, respectively. Residual values for owned aircraft, engines, spare parts and simulators are generally 5% 10 10% of cost. We capitalize certain internal and external costs incurred to develop and implement software and amortize those costs over an estimated useful life of three to ten years. Included in the depreciation and amortization expense discussed above, we recorded S239 million, 5205 million and $187 million for amortization of capitalized software for the years ended December 31, 2019, 2018 and 2017, respectively. The net book value of these assets, which are included in information technology-related assets above, totaled $1.1 billion and $819 million at December 31, 2019 and 2018, respectively Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific geographic regions We review flight equipment and other long-lived assets used in operations for impairment losses when events and circumstances indicate the assets may be impaired. Factors which could be indicators of impairment include, but are not limited to (1) a decision to permanently remove flight equipment or other long-lived assets from operations, (2) significant changes in the estimated useful life,(3) significant changes in projected cash flows. 4) permanent and significant declines in fleet fair values and (5) changes to the regulatory environment For long-lived assets held for sale, we discontinue depreciation and record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts