Question: how would i solve this equation using Excel. Please show the work Question 3 O out of 0.8 point Consider a project of the Cornell

how would i solve this equation using Excel. Please show the work

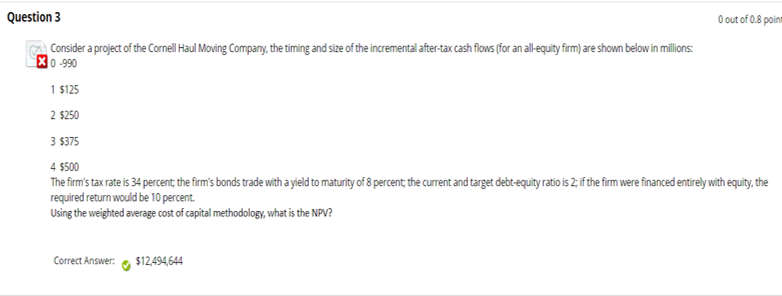

Question 3 O out of 0.8 point Consider a project of the Cornell Haul Moving Company, the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in Millions: X0-990 1 5125 2 $250 3 $375 4 $500 The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent, the current and target debt-equity ratio is 2, if the firm were financed entirely with equity, the required return would be 10 percent. Using the weighted average cost of capital methodology, what is the NPV? Correct Answer: $12.494,644

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts