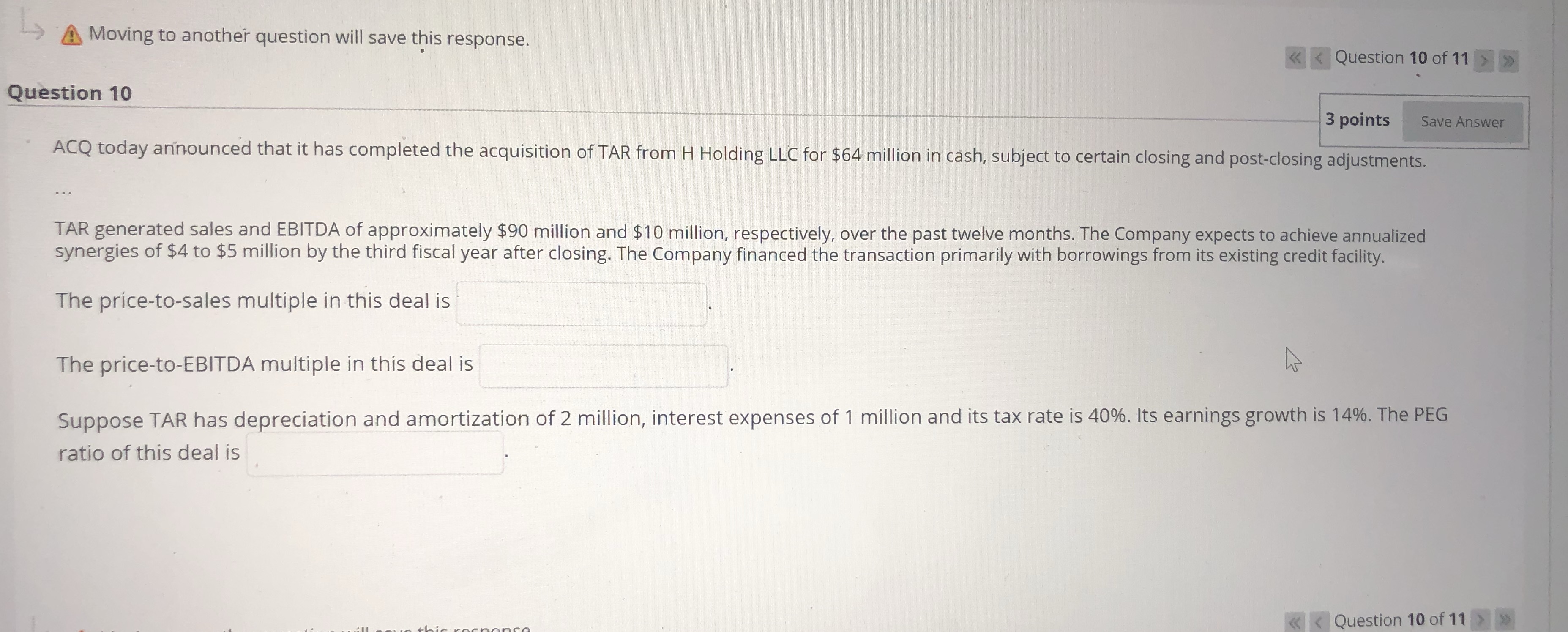

Question: A Moving to another question will save this response. > Question 10 3 points Save Answer ACQ today announced that it has completed the acquisition

A Moving to another question will save this response. > Question 10 3 points Save Answer ACQ today announced that it has completed the acquisition of TAR from H Holding LLC for $64 million in cash, subject to certain closing and post-closing adjustments. TAR generated sales and EBITDA of approximately $90 million and $10 million, respectively, over the past twelve months. The Company expects to achieve annualized synergies of $4 to $5 million by the third fiscal year after closing. The Company financed the transaction primarily with borrowings from its existing credit facility. The price-to-sales multiple in this deal is The price-to-EBITDA multiple in this deal is Suppose TAR has depreciation and amortization of 2 million, interest expenses of 1 million and its tax rate is 40%. Its earnings growth is 14%. The PEG ratio of this deal is >>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts