Question: Question Completion Status: 1 2 8 9 10 11 12 14 16 17 18 19 20 22 23 24 25 26 Moving to another question

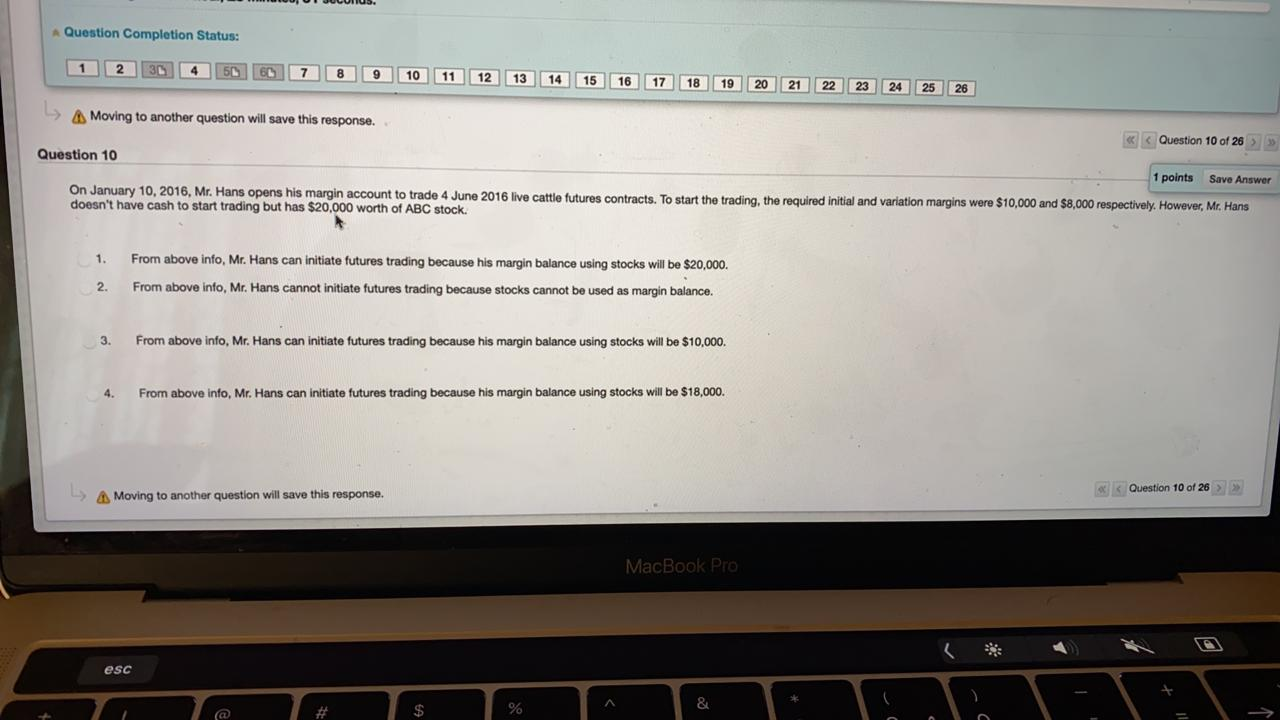

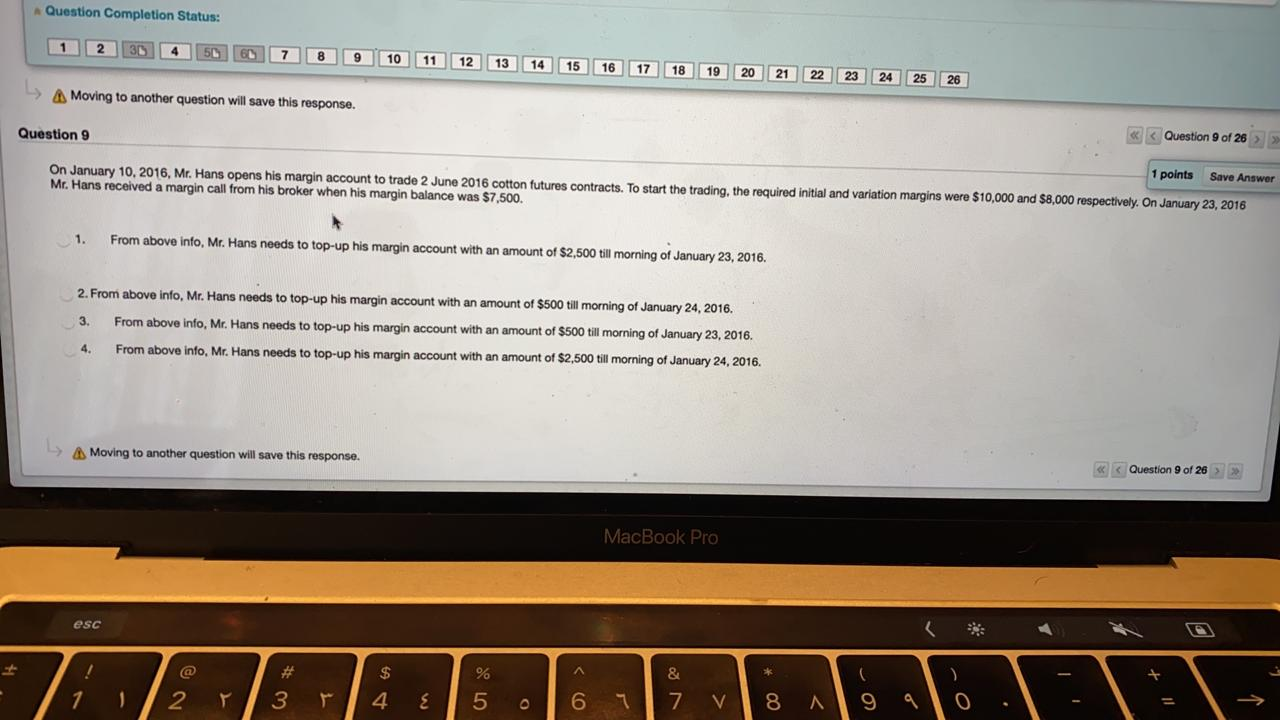

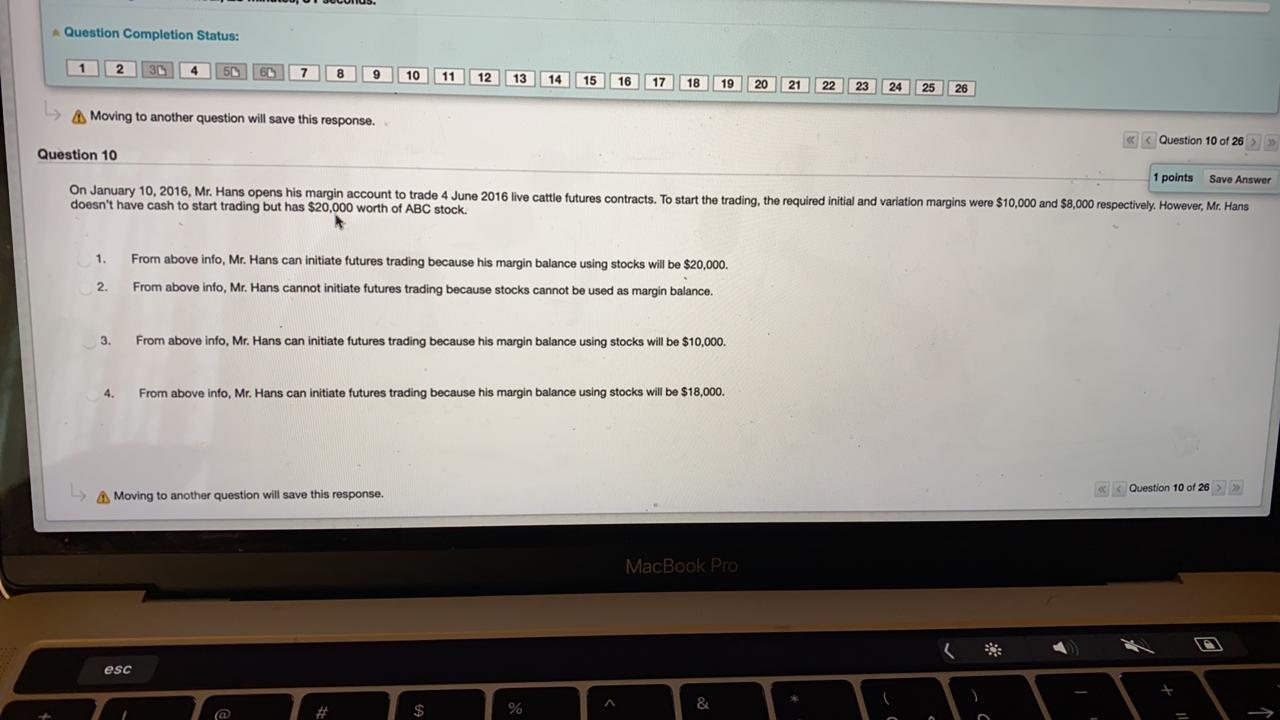

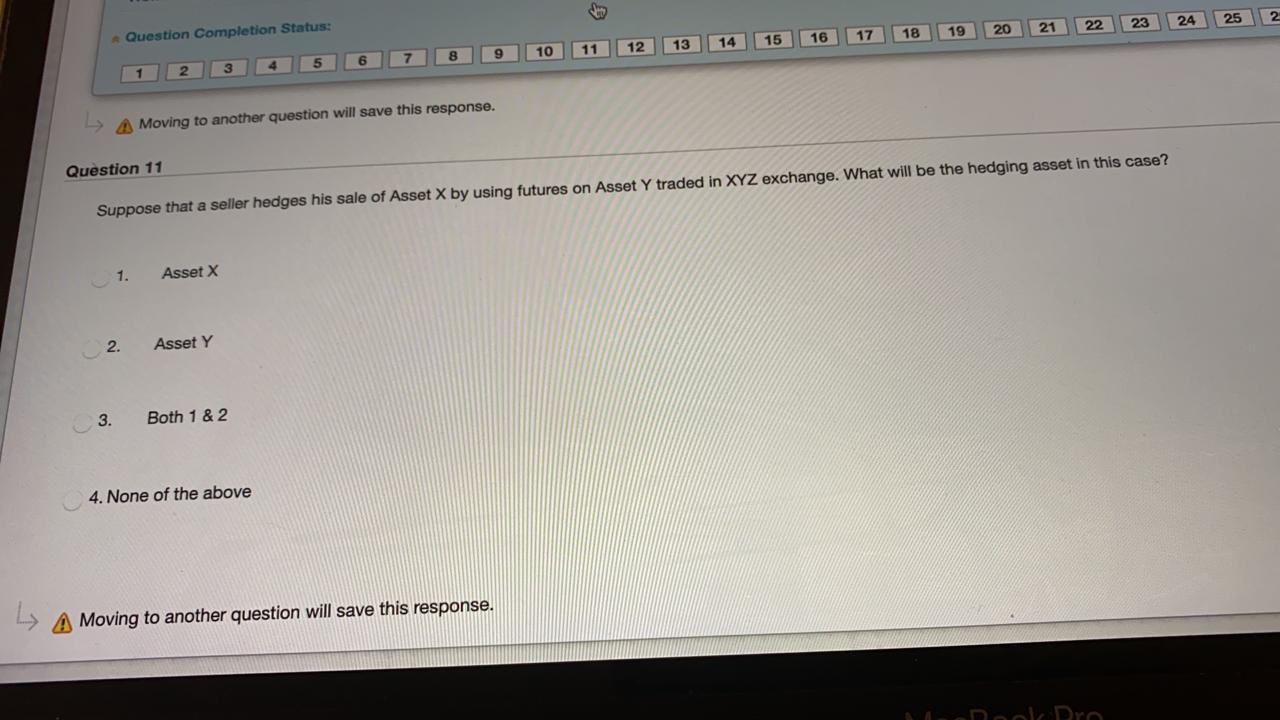

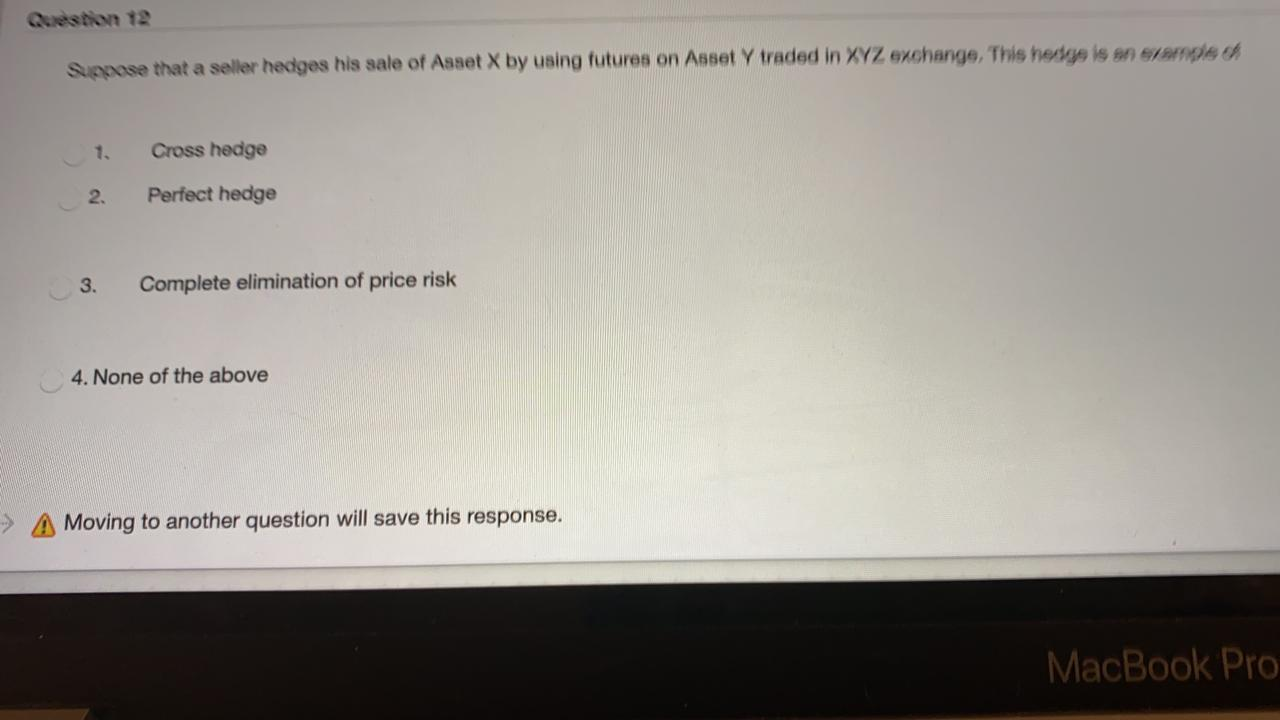

Question Completion Status: 1 2 8 9 10 11 12 14 16 17 18 19 20 22 23 24 25 26 Moving to another question will save this response. >> Question 10 1 points Save Answer On January 10, 2016. Mr. Hans opens his margin account to trade 4 June 2016 live cattle futures contracts. To start the trading, the required initial and variation margins were $10,000 and $8,000 respectively. However, Mr. Hans doesn't have cash to start trading but has $20,000 worth of ABC stock. 1. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $20,000. From above info, Mr. Hans cannot initiate futures trading because stocks cannot be used as margin balance. 2. 3. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $10,000. 4. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $18,000. Moving to another question will save this response. Question 10 of 26 > >> MacBook Pro esc % & $ Question Completion Status: 2 31 4 5L 9 10 11 12 13 14 16 17 18 19 21 22 23 25 26 Moving to another question will save this response. Question 9 Question 9 of 26 On January 10, 2016, Mr. Hans opens his margin account to trade 2 June 2016 cotton futures contracts. To start the trading, the required initial and variation margins were $10,000 and $8,000 respectively. On January 23, 2016 Mr. Hans received a margin call from his broker when his margin balance was $7,500. 1 points Save Answer 1. From above info, Mr. Hans needs to top-up his margin account with an amount of $2,500 till morning of January 23, 2016. 2. From above info, Mr. Hans needs to top-up his margin account with an amount of $500 till morning of January 24, 2016. 3. From above info, Mr. Hans needs to top-up his margin account with an amount of $500 till morning of January 23, 2016. 4. From above info, Mr. Hans needs to top-up his margin account with an amount of $2,500 till morning of January 24, 2016. Moving to another question will save this response. >> MacBook Pro esc A & * C 2 % 5 7 ) 0 3 4 E O 6 7 V 8 A 9 9 Question Completion Status: 1 2 8 9 10 11 12 14 16 17 18 19 20 22 23 24 25 26 Moving to another question will save this response. >> Question 10 1 points Save Answer On January 10, 2016. Mr. Hans opens his margin account to trade 4 June 2016 live cattle futures contracts. To start the trading, the required initial and variation margins were $10,000 and $8,000 respectively. However, Mr. Hans doesn't have cash to start trading but has $20,000 worth of ABC stock. 1. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $20,000. From above info, Mr. Hans cannot initiate futures trading because stocks cannot be used as margin balance. 2. 3. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $10,000. 4. From above info, Mr. Hans can initiate futures trading because his margin balance using stocks will be $18,000. Moving to another question will save this response. Question 10 of 26 > >> MacBook Pro esc % & $ 23 24 25 22 19 20 17 18 21 Question Completion Status: 16 15 13 14 12 10 11 6 8 3 Moving to another question will save this response. Question 11 Suppose that a seller hedges his sale of Asset X by using futures on Asset y traded in XYZ exchange. What will be the hedging asset in this case? 1. Asset X 2. Asset Y 3. Both 1 & 2 4. None of the above A Moving to another question will save this response. Suppose that a seller hedges his sale of Asset X by using futures on Asset y traded in XYZ exchange. This here is an example Cross hedge 2. Perfect hedge 3. Complete elimination of price risk 4. None of the above Moving to another question will save this response. MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts