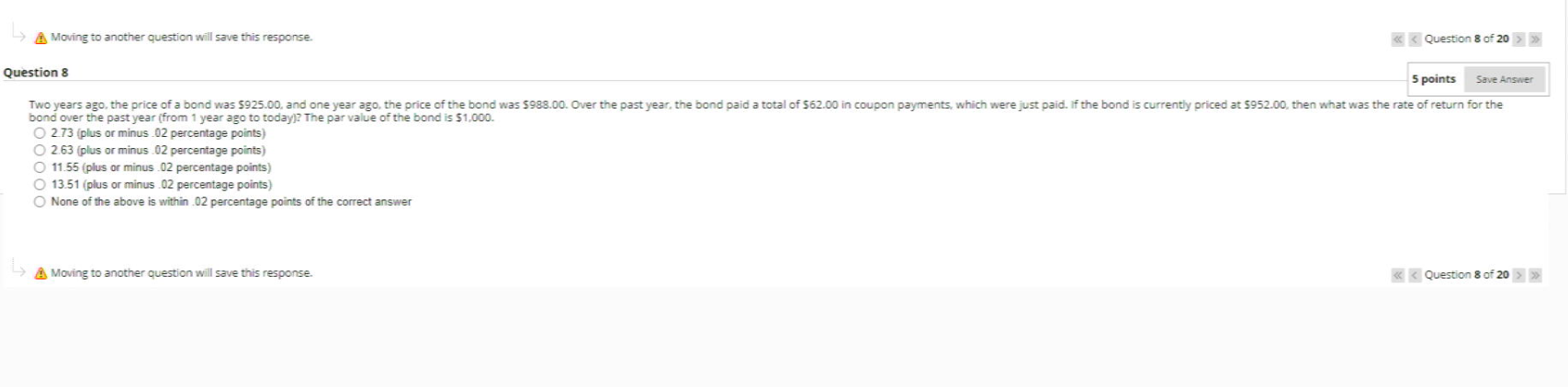

Question: >A Moving to another question will save this response. Question 8 5 points Two years ago, the price of a bond was $925.00, and one

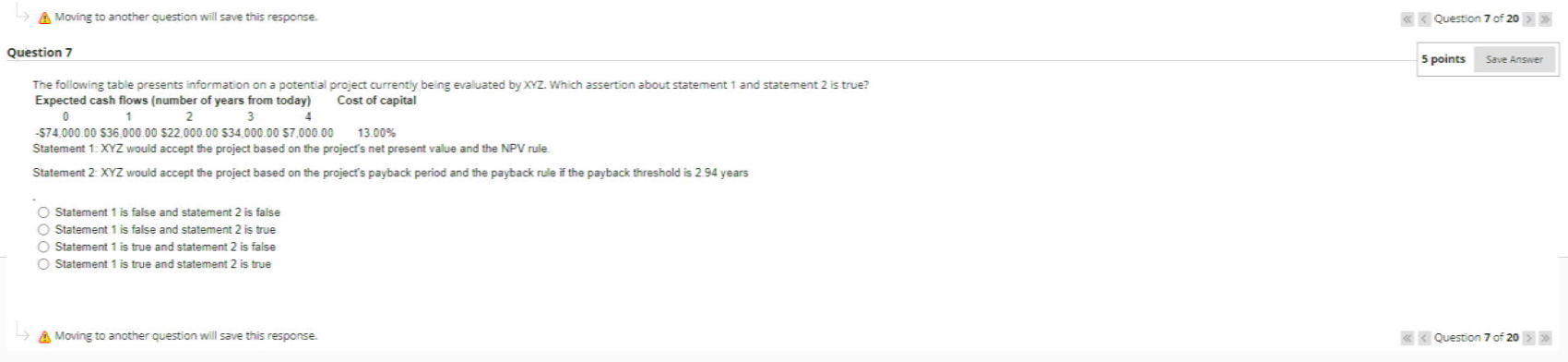

>A Moving to another question will save this response. Question 8 5 points Two years ago, the price of a bond was $925.00, and one year ago, the price of the bond was $988.00. Over the past year, the bond paid a total of $62.00 in coupon payments, which were just paid. If the bond is currently priced at $952.00, then what was the rate of return for the bond over the past year (from 1 year ago to today)? The par value of the bond is $1,000. O 2.73 (plus or minus .02 percentage points) O2.63 (plus or minus .02 percentage points) O 11.55 (plus or minus .02 percentage points) O 13.51 (plus or minus .02 percentage points) O None of the above is within .02 percentage points of the correct answer Question 8 of 20 > >> A Moving to another question will save this response. Save Answer Question 8 of 20 > >> Moving to another question will save this response. Question 7 The following table presents information on a potential project currently being evaluated by XYZ. Which assertion about statement 1 and statement 2 is true? Expected cash flows (number of years from today) Cost of capital 1 2 3 4 0 -$74,000.00 $36,000.00 $22,000.00 $34,000.00 $7,000.00 13.00% Statement 1: XYZ would accept the project based on the project's net present value and the NPV rule Statement 2: XYZ would accept the project based on the project's payback period and the payback rule if the payback threshold is 2.94 years O Statement 1 is false and statement 2 is false O Statement 1 is false and statement 2 is true O Statement 1 is true and statement 2 is false O Statement 1 is true and statement 2 is true A Moving to another question will save this response. Question 7 of 20 5 points Save Answer >>>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts