Question: A Moving to another question will save this response. Question 7 Suppose that the current one-year rate and expected one-year T-bill rates over the following

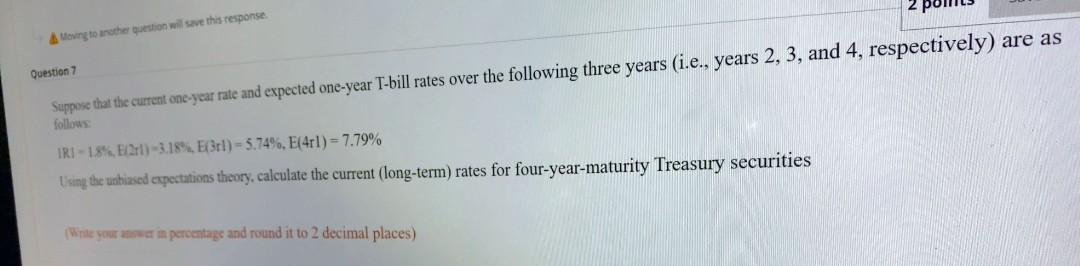

A Moving to another question will save this response. Question 7 Suppose that the current one-year rate and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows IR1 -18%. 21)-3.18%. Ef3rl) - 5.74%, E(41) = 7.79% Using the unbiased expectations theory, calculate the current (long-term) rates for four-year-maturity Treasury securities (Write your answer in percentage and round it to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts