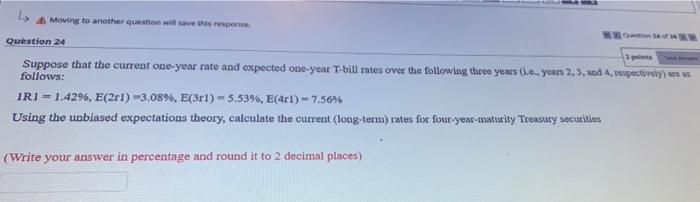

Question: Moving to another question will save this response Question 24 Suppose that the current one-year rate and expected one-year T-bill rates over the following three

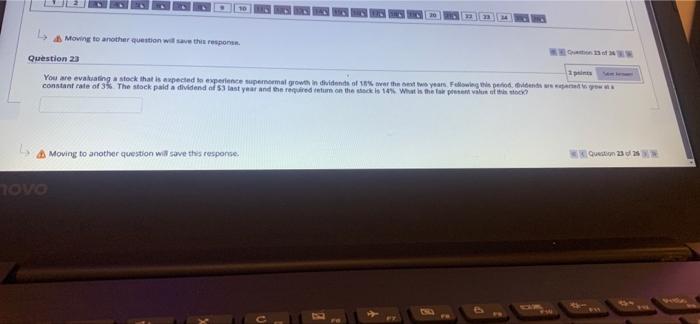

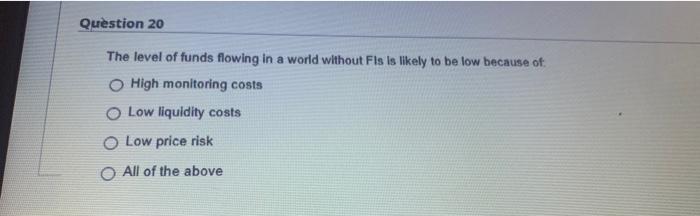

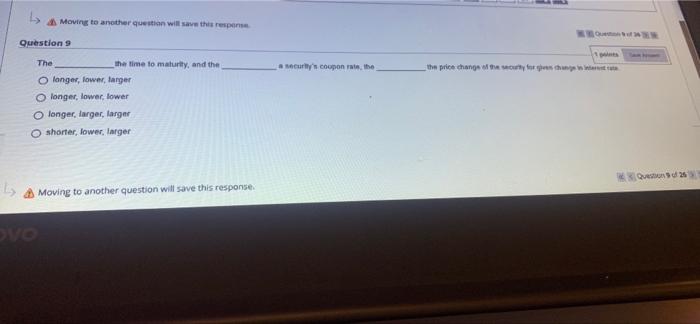

Moving to another question will save this response Question 24 Suppose that the current one-year rate and expected one-year T-bill rates over the following three years (... year 2.3, and 4 verspectively) news follows: IRI - 1.42%, E(281) -3.08%, E(3r1) - 5.53%, Ec4r1) - 7.56% Using the unbiased expectations theory, calculate the current long-term) rates for four-year-maturity Treasury securities (Write your answer in percentage and round it to 2 decimal places) Moving to another question will save this reporan. Question 23 2 You are evaluating a stock that is expected to experience super mal growth individends of war the best two years Following this periods constant rate of the stock paid a dividend oftast year and the required return on the skis 14% What is the openen value of the Moving to another question will save this response. 230 novo Question 20 The level of funds flowing in a world without Fis is likely to be low because of: High monitoring costs O Low liquidity costs O Low price risk O All of the above L Moving to another question will save this response Question 9 curly's coupon at the the price change for the The the time to maturity, and the o longer, lower larger o longer, lower, lower longer, farger, larger O shorter, lower larger Ques Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts