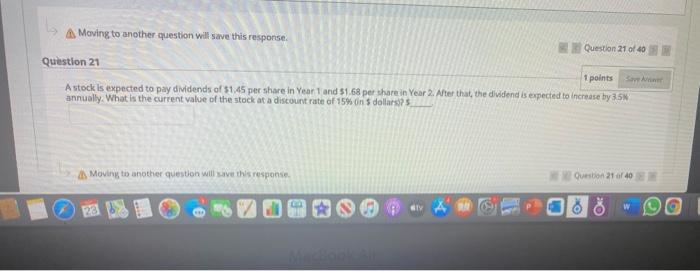

Question: A Moving to another question will save this response Question 21 of 40 Question 21 1 points Astock is expected to pay dividends of 51.45

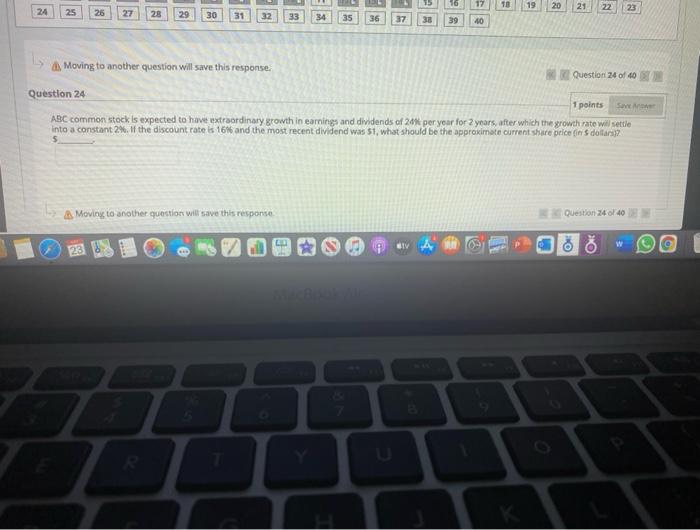

A Moving to another question will save this response Question 21 of 40 Question 21 1 points Astock is expected to pay dividends of 51.45 per share in Year 1 and 51.68 per share in Year 2. After that, the dividend is expected to increase by 3.5 annually. What is the current value of the stock at a discount rate of 15% ons dollars? Moving to another question will save this response Question 2140 w 16 TE 19 20 24 21 26 25 22 23 27 28 29 30 31 32 35 36 37 38 39 40 Moving to another question will save this response Question 24 of 40 Question 24 1 points ABC common stock is expected to have extraordinary growth in earnings and dividends of 20% per year for 2 years, after which the growth rate wil settle into a constant 2%. If the discount rate is 16% and the most recent dividend was 51, what should be the approximate current share price in dollars) 5 Moving to another question will save this response Question 24 of 40 BIV w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts