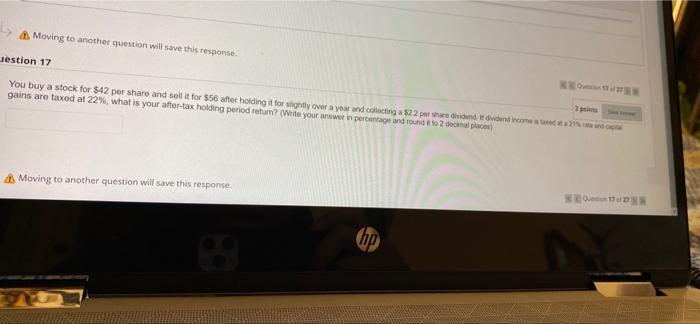

Question: & Moving to another question will save this response. 1727EN estion 17 2 points COME You buy a stock for $42 per share and sell

& Moving to another question will save this response. 1727EN estion 17 2 points COME You buy a stock for $42 per share and sell it for $56 after holding it for slightly over a year and collecting a $2.2 per share dividend. It dividend income is taxed at a 21% rate and capital gains are taxed at 22%, what is your after-tax holding period retum? (Write your answer in percentage and round it to 2 decimal places) Q1727EN Moving to another question will save this response. hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts