Question: A Moving to another question will save this response Question 12 Olexly is a 66 year old widow. His wife died about 3 years ago.

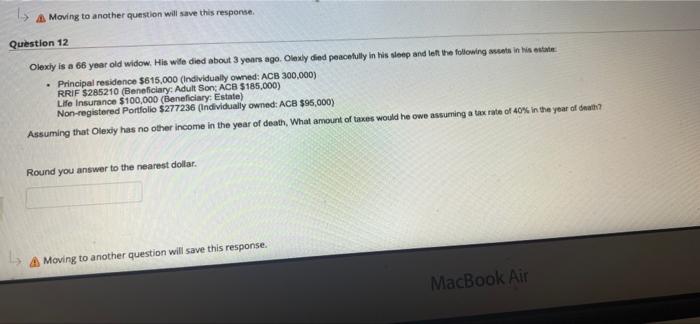

A Moving to another question will save this response Question 12 Olexly is a 66 year old widow. His wife died about 3 years ago. Olexly died peacefully in his sleep and tell the following assets in his state Principal residence $615,000 (Individually owned: ACB 300,000) RRIF $285210 (Beneficiary: Adult Son; ACB $185,000) Life Insurance $100,000 (Beneficiary: Estate) Non-registered Portfolio $277236 (Individually owned: ACB $95.000) Assuming that Olexey has no other income in the year of death. What amount of taxes would he owe assuming a tax rate of % in the year of mate? Round you answer to the nearest dollar. Moving to another question will save this response. MacBook Air A Moving to another question will save this response Question 12 Olexly is a 66 year old widow. His wife died about 3 years ago. Olexly died peacefully in his sleep and tell the following assets in his state Principal residence $615,000 (Individually owned: ACB 300,000) RRIF $285210 (Beneficiary: Adult Son; ACB $185,000) Life Insurance $100,000 (Beneficiary: Estate) Non-registered Portfolio $277236 (Individually owned: ACB $95.000) Assuming that Olexey has no other income in the year of death. What amount of taxes would he owe assuming a tax rate of % in the year of mate? Round you answer to the nearest dollar. Moving to another question will save this response. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts