Question: Please show the calculations Question Completion Status: i Moving to the next question prevents changes to this answer. Question 7 Eleanor is a 82 year

Please show the calculations

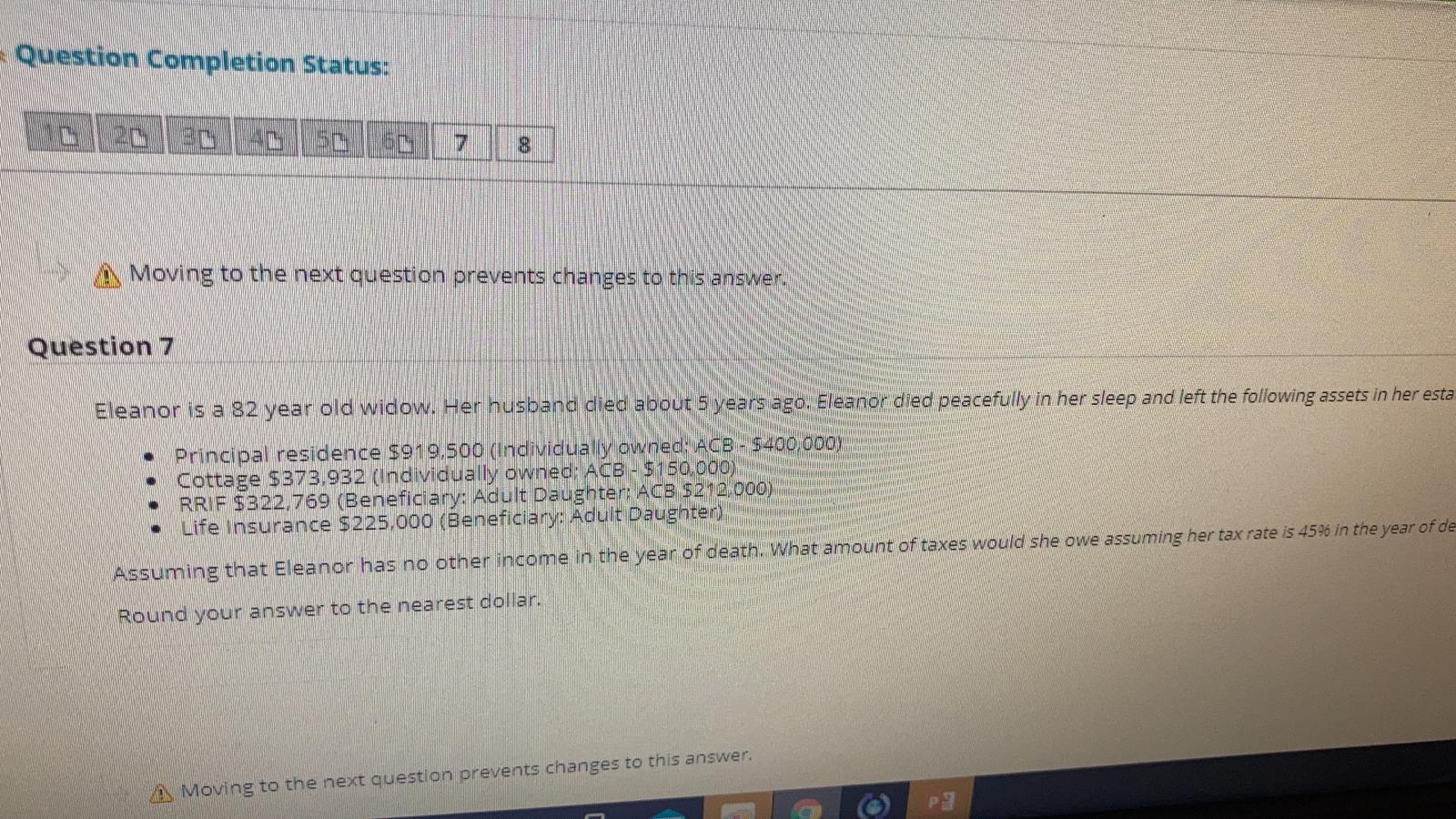

Question Completion Status: i Moving to the next question prevents changes to this answer. Question 7 Eleanor is a 82 year old widow. Her husband died about 5 years ago. Eleanor died peacefully in her sleep and left the following assets in her esta Principal residence $919,500 (Individually owned: ACB - $400,000) Cottage $373,932 (Individually owned: ACB - $150,000) RRIF $822,769 (Beneficiary: Adult Daughter: ACB $212,000) Life Insurance $225,000 (Beneficiary: Adult Daughter Assuming that Eleanor has no other income in the year of death. What amount of taxes would she owe assuming her tax rate is 4596 in the year of de Round your answer to the nearest dollar. Moving to the next question prevents changes to this answer. Question Completion Status: i Moving to the next question prevents changes to this answer. Question 7 Eleanor is a 82 year old widow. Her husband died about 5 years ago. Eleanor died peacefully in her sleep and left the following assets in her esta Principal residence $919,500 (Individually owned: ACB - $400,000) Cottage $373,932 (Individually owned: ACB - $150,000) RRIF $822,769 (Beneficiary: Adult Daughter: ACB $212,000) Life Insurance $225,000 (Beneficiary: Adult Daughter Assuming that Eleanor has no other income in the year of death. What amount of taxes would she owe assuming her tax rate is 4596 in the year of de Round your answer to the nearest dollar. Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts