Question: A Moving to another question will save this response. Question 11 12 Question 11 3 points Stock A experiences non-constant growth for the first 3

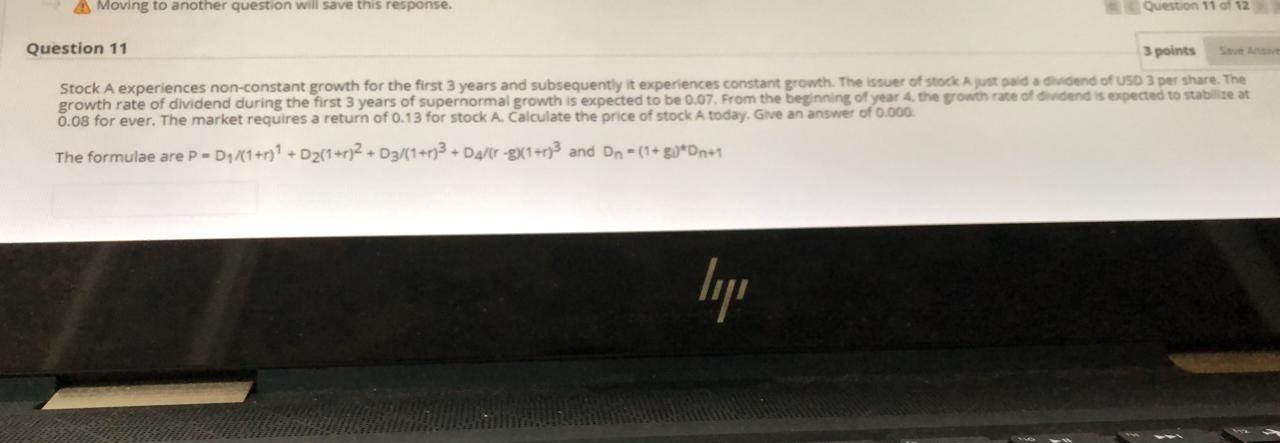

A Moving to another question will save this response. Question 11 12 Question 11 3 points Stock A experiences non-constant growth for the first 3 years and subsequently it experiences constant growth. The issuer of stock justada end of USD 3 per share. The growth rate of dividend during the first 3 years of supernormal growth is expected to be 0.07. From the beginning of year 4. the growth rate of dend is expected to stabilisat 0.08 for ever. The market requires a return of 0.13 for stock A. Calculate the price of stock A today. Give an answer of 0.000 The formulae are P-D1/(1+r)? + O2(1+r)2 + D3/(1+r)3 +Da/r -8X1+33 and Dn = (1+3)*Dne? log

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts