Question: A Moving to another question will save this response. Question 21 Newell, Inc. purchased equipment in 2011 at a cost of $800,000. Two years later

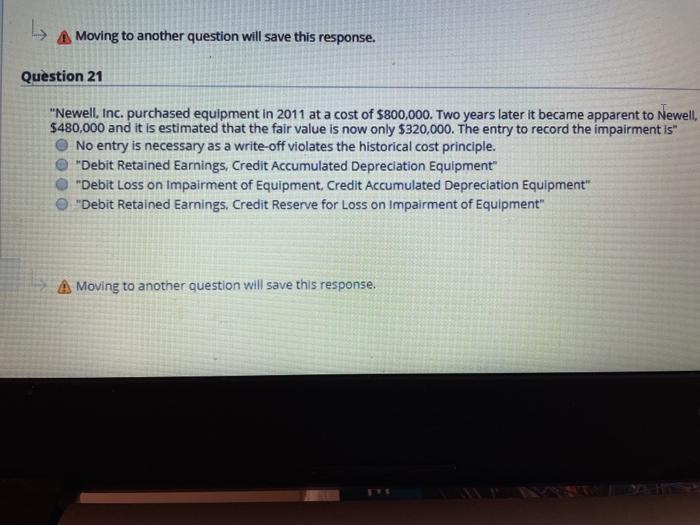

A Moving to another question will save this response. Question 21 "Newell, Inc. purchased equipment in 2011 at a cost of $800,000. Two years later it became apparent to Newell. $480,000 and it is estimated that the fair value is now only $320,000. The entry to record the impairment is" No entry is necessary as a write-off violates the historical cost principle. "Debit Retained Earnings, Credit Accumulated Depreciation Equipment" "Debit Loss on Impairment of Equipment. Credit Accumulated Depreciation Equipment" "Debit Retained Earnings, Credit Reserve for Loss on Impairment of Equipment" A Moving to another question will save this response. A Moving to another question will save this response. Question 21 "Newell, Inc. purchased equipment in 2011 at a cost of $800,000. Two years later it became apparent to Newell. $480,000 and it is estimated that the fair value is now only $320,000. The entry to record the impairment is" No entry is necessary as a write-off violates the historical cost principle. "Debit Retained Earnings, Credit Accumulated Depreciation Equipment" "Debit Loss on Impairment of Equipment. Credit Accumulated Depreciation Equipment" "Debit Retained Earnings, Credit Reserve for Loss on Impairment of Equipment" A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts