Question: A Moving to another question will save this response. uestion 6 Suppose we want to create a pay off diagram for a long strangle. Let's

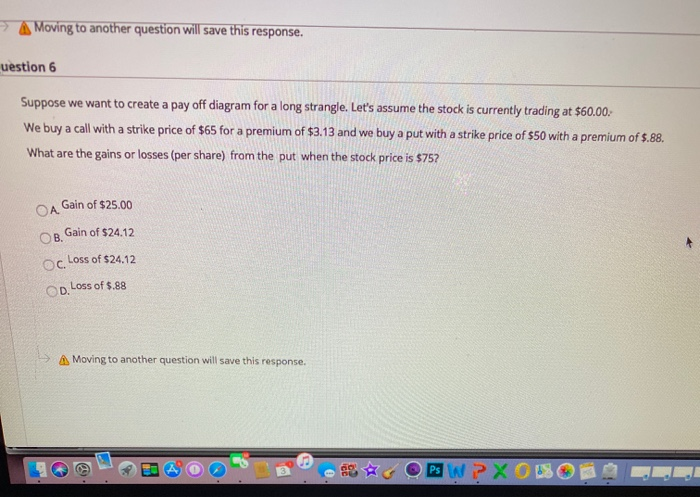

A Moving to another question will save this response. uestion 6 Suppose we want to create a pay off diagram for a long strangle. Let's assume the stock is currently trading at $60.00 We buy a call with a strike price of $65 for a premium of $3.13 and we buy a put with a strike price of $50 with a premium of $.88. What are the gains or losses (per share) from the put when the stock price is $75? O A Gain of $25.00 OB. Gain of $24.12 c. Loss of $24.12 D.Loss of 5.88 Moving to another question will save this response. 003& 25 GOEWPXOLSO DE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts