Question: Moving to another question will save this response. Question 5 Suppose we want to create a pay off diagram for a long strangle. Let's assume

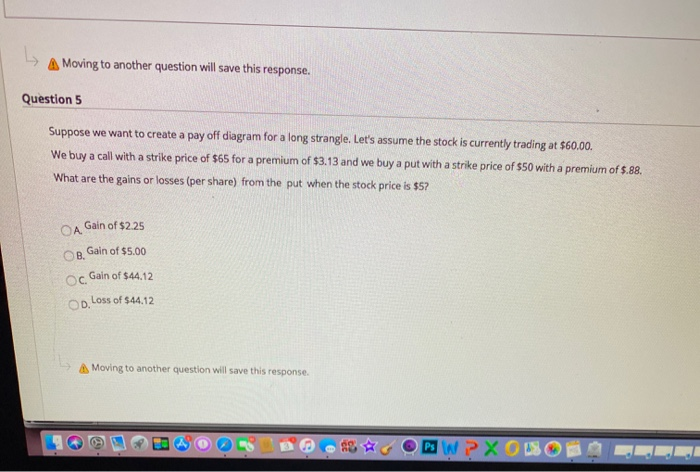

Moving to another question will save this response. Question 5 Suppose we want to create a pay off diagram for a long strangle. Let's assume the stock is currently trading at $60.00. We buy a call with a strike price of $65 for a premium of $3.13 and we buy a put with a strike price of $50 with a premium of $.88. What are the gains or losses (per share) from the put when the stock price is $5? CA Gain of $2.25 B. Gain of $5.00 Oc Gain of $44.12 D.Loss of $44.12 Moving to another question will save this response. 1001 BOOM @ 3 O P W PXOLSOS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts