Question: > A Moving to the next question prevents changes to this answer. Question 19 of 25 Question 19 4 points a Arswer The WRANGLER Corporation

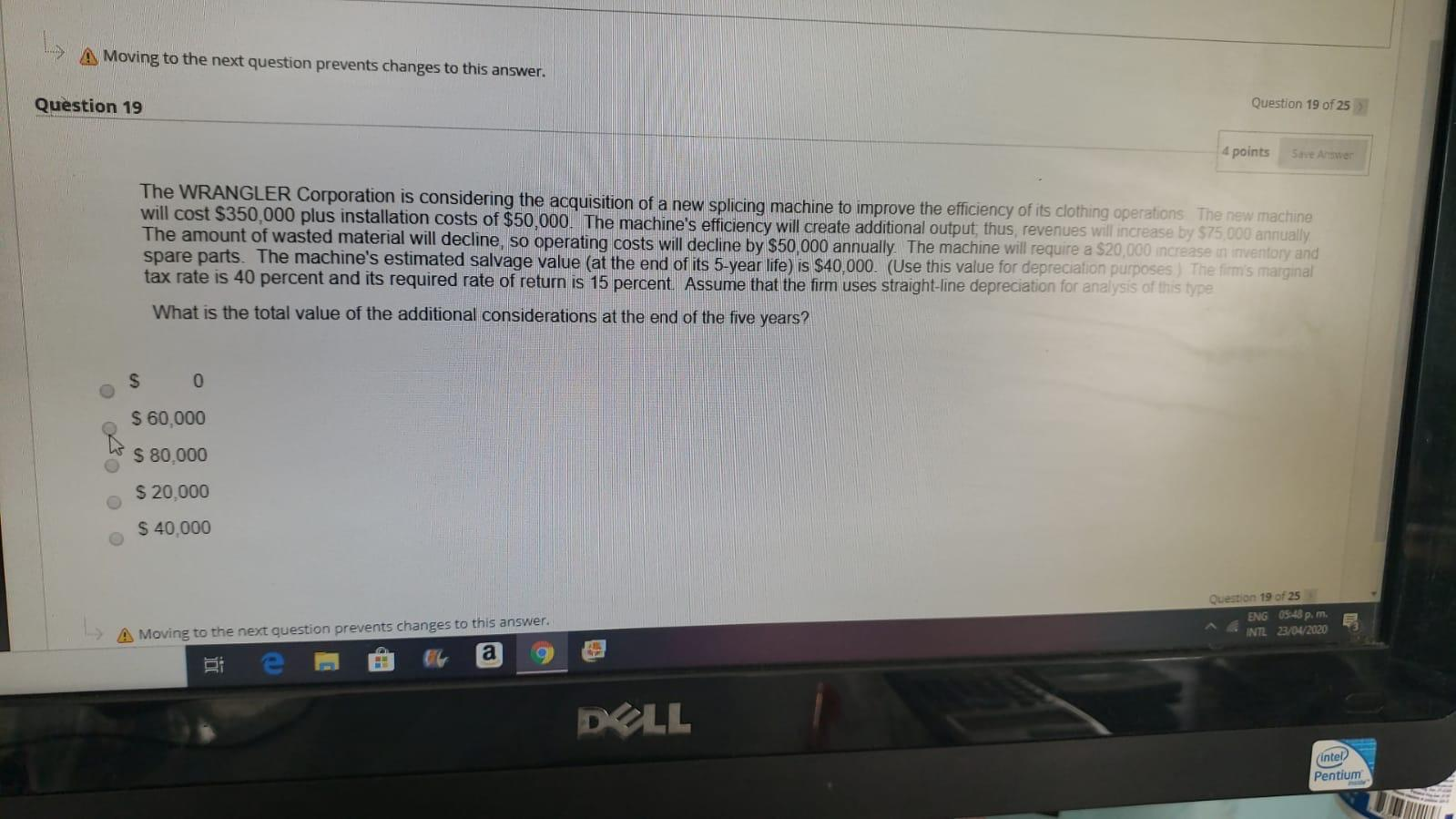

> A Moving to the next question prevents changes to this answer. Question 19 of 25 Question 19 4 points a Arswer The WRANGLER Corporation is considering the acquisition of a new splicing machine to improve the efficiency of its clothing operations. The new machine will cost $350.000 plus installation costs of $50,000. The machine's efficiency will create additional output, thus, revenues will increase by $75.000 annually! The amount of wasted material will decline, so operating costs will decline by $50,000 annually. The machine will require a $20.000 increase in inventory and spare parts. The machine's estimated salvage value (at the end of its 5-year life) is $40.000. (Use this value for depreciation purposes Themis marginal tax rate is 40 percent and its required rate of return is 15 percent. Assume that the firm uses straight-line depreciation for analysis of this type What is the total value of the additional considerations at the end of the five years? os 0 $ 60,000 hot S 80.000 $ 20,000 $ 40,000 Question 19 of 25 ENG 05:43p.m. INTL 23/04/2020 A Moving to the next question prevents changes to this answer. DOLL Intel Pentium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts