Question: Moving to the next question prevents changes to this answer. Question 24 of 25 on 24 4 points Save Anne PC Inc. has a stamping

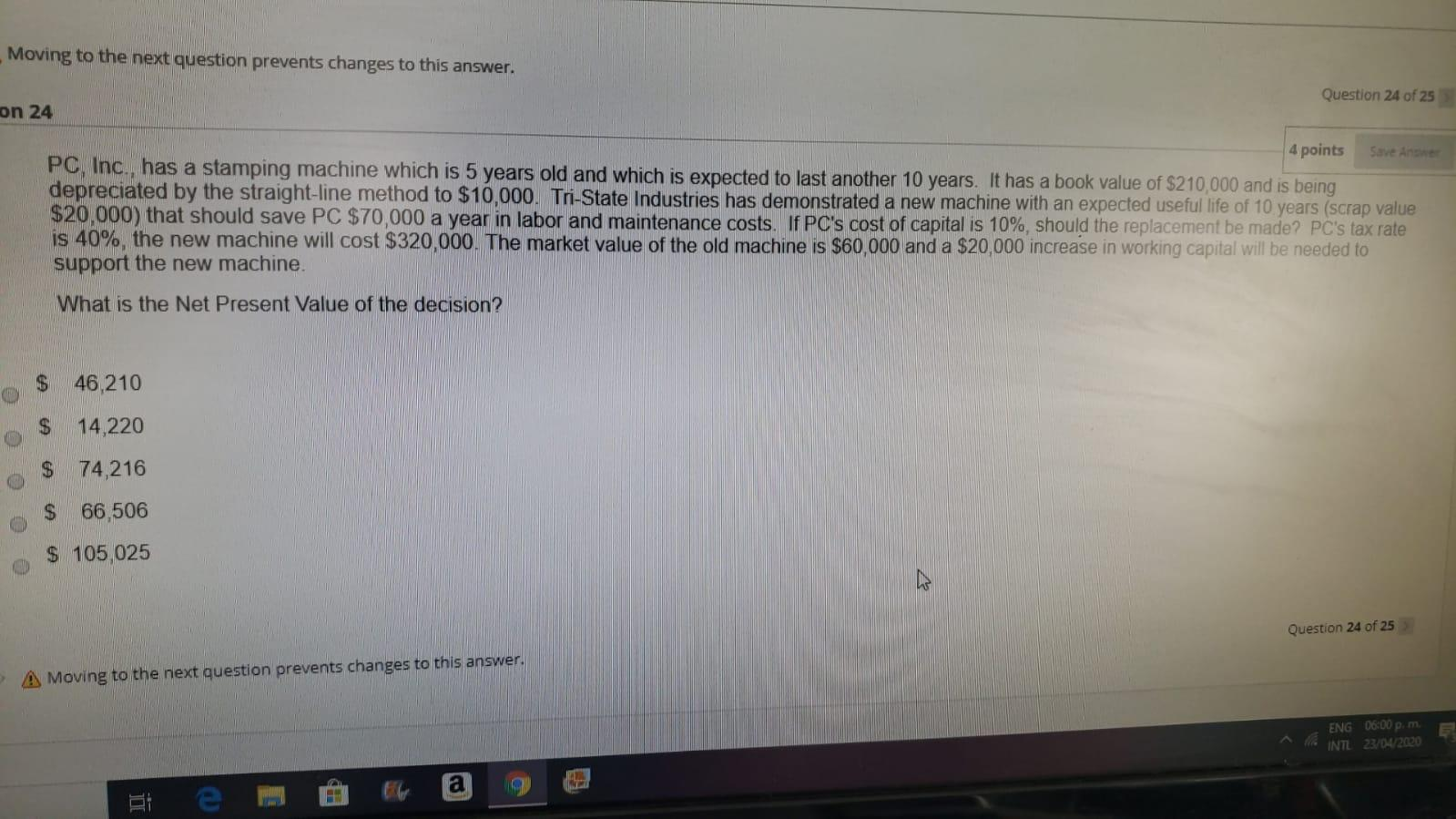

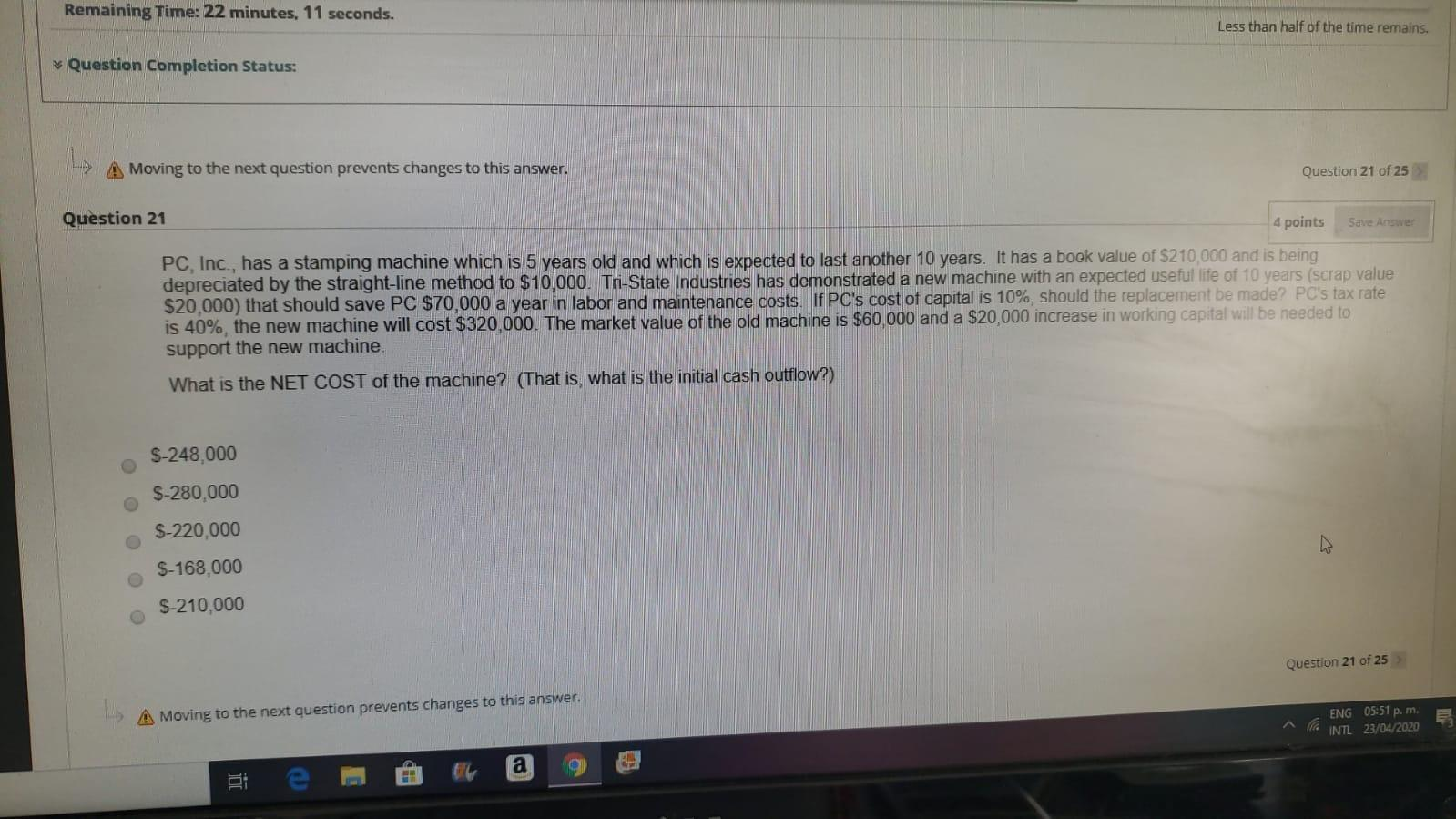

Moving to the next question prevents changes to this answer. Question 24 of 25 on 24 4 points Save Anne PC Inc. has a stamping machine which is 5 years old and which is expected to last another 10 years. It has a book value of $210,000 and is being depreciated by the straight-line method to $10,000. Tri-State Industries has demonstrated a new machine with an expected useful life of 10 years (scrap value! $20,000) that should save PC $70,000 a year in labor and maintenance costs. If PC's cost of capital is 10%, should the replacement be made? PC's tax rate is 40% the new machine will cost $320,000. The market value of the old machine is $60,000 and a $20,000 increase in working capital will be needed to support the new machine. What is the Net Present Value of the decision? A A $ 46,210 $ 14,220 $ 74,216 66,506 $ 105,025 in Question 24 of 25 A Moving to the next question prevents changes to this answer. E ENG 06:00p.m INTL 23/04/2020 i e l a g Remaining Time: 22 minutes, 11 seconds. Less than half of the time remains. Question Completion Status: A Moving to the next question prevents changes to this answer, Question 21 of 25 Question 21 4 points PC, Inc., has a stamping machine which is 5 years old and which is expected to last another 10 years. It has a book value of $210,000 and is being depreciated by the straight-line method to $10,000. Tri-State Industries has demonstrated a new machine with an expected useful life of 10 years (scrap value $20,000) that should save PC $70,000 a year in labor and maintenance costs. If PC's cost of capital is 10%, should the replacement be made? PC's tax rate is 40%, the new machine will cost $320,000. The market value of the old machine is $60.000 and a $20,000 increase in working capital will be needed to support the new machine. What is the NET COST of the machine? (That is what is the initial cash outflow?) S-248,000 $-280,000 S-220,000 S-168,000 S-210,000 Question 21 of 25 A Moving to the next question prevents changes to this answer. ENG 05:51 p. m. B ^ INTL 23/04/2020 Hi e a t l 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts