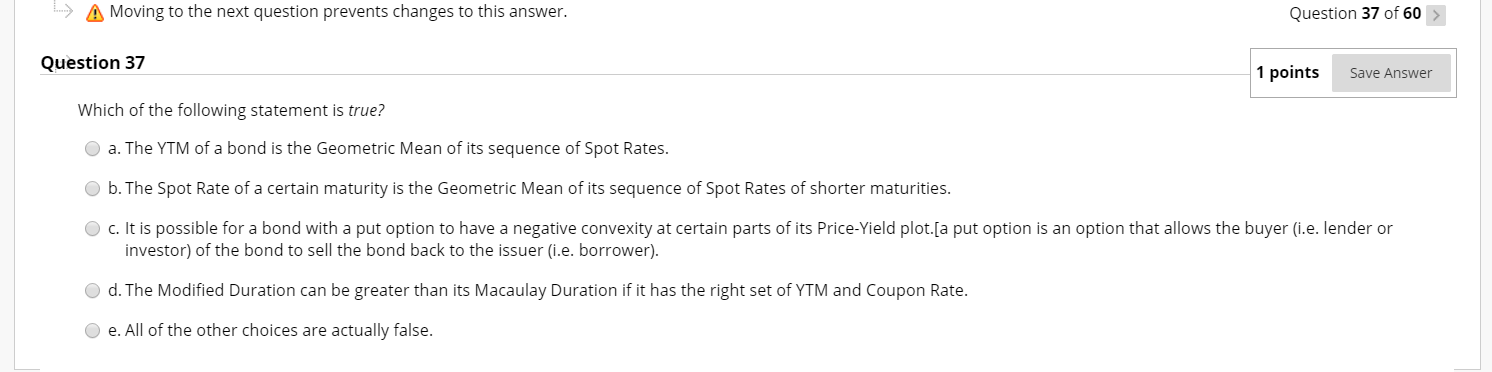

Question: > A Moving to the next question prevents changes to this answer. Question 37 of 60 Question 37 1 points Save Answer Which of the

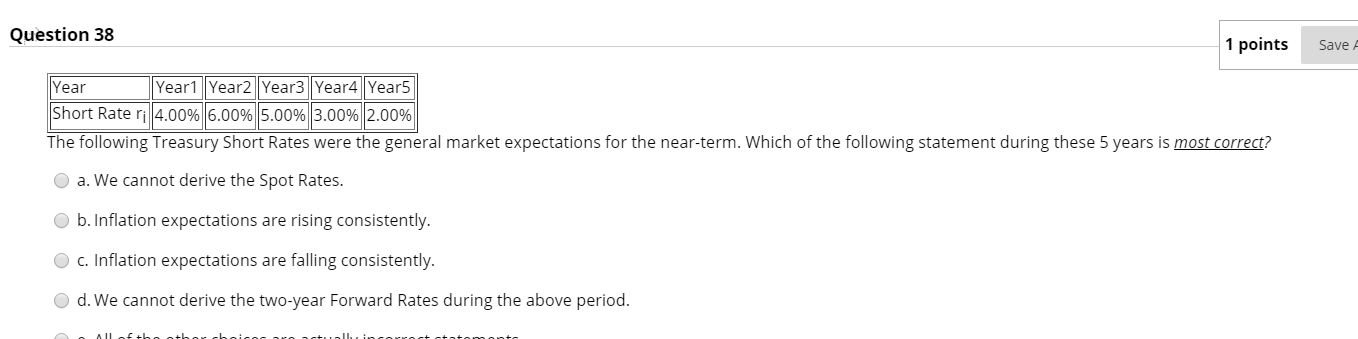

> A Moving to the next question prevents changes to this answer. Question 37 of 60 Question 37 1 points Save Answer Which of the following statement is true? a. The YTM of a bond is the Geometric Mean of its sequence of Spot Rates. b. The Spot Rate of a certain maturity is the Geometric Mean of its sequence of Spot Rates of shorter maturities. c. It is possible for a bond with a put option to have a negative convexity at certain parts of its Price-Yield plot.[a put option is an option that allows the buyer (i.e. lender or investor) of the bond to sell the bond back to the issuer (i.e. borrower). d. The Modified Duration can be greater than its Macaulay Duration if it has the right set of YTM and Coupon Rate. e. All of the other choices are actually false. Question 38 1 points Save A Year Year1 Year2Year3 Year 4 Year5 Short Rate ri 4.00% 6.00% 5.00% |3.00% 2.00% The following Treasury Short Rates were the general market expectations for the near-term. Which of the following statement during these 5 years is most correct? a. We cannot derive the Spot Rates. b. Inflation expectations are rising consistently. c. Inflation expectations are falling consistently. d. We cannot derive the two-year Forward Rates during the above period. > A Moving to the next question prevents changes to this answer. Question 37 of 60 Question 37 1 points Save Answer Which of the following statement is true? a. The YTM of a bond is the Geometric Mean of its sequence of Spot Rates. b. The Spot Rate of a certain maturity is the Geometric Mean of its sequence of Spot Rates of shorter maturities. c. It is possible for a bond with a put option to have a negative convexity at certain parts of its Price-Yield plot.[a put option is an option that allows the buyer (i.e. lender or investor) of the bond to sell the bond back to the issuer (i.e. borrower). d. The Modified Duration can be greater than its Macaulay Duration if it has the right set of YTM and Coupon Rate. e. All of the other choices are actually false. Question 38 1 points Save A Year Year1 Year2Year3 Year 4 Year5 Short Rate ri 4.00% 6.00% 5.00% |3.00% 2.00% The following Treasury Short Rates were the general market expectations for the near-term. Which of the following statement during these 5 years is most correct? a. We cannot derive the Spot Rates. b. Inflation expectations are rising consistently. c. Inflation expectations are falling consistently. d. We cannot derive the two-year Forward Rates during the above period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts