Answered step by step

Verified Expert Solution

Question

1 Approved Answer

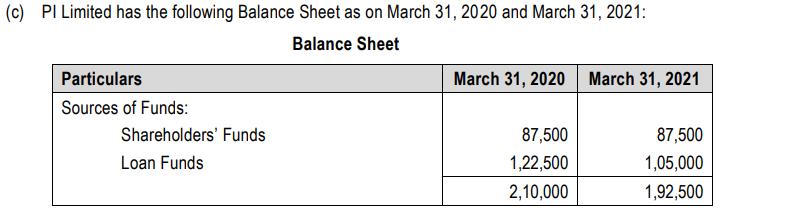

(c) PI Limited has the following Balance Sheet as on March 31, 2020 and March 31, 2021: Balance Sheet Particulars Sources of Funds: Shareholders'

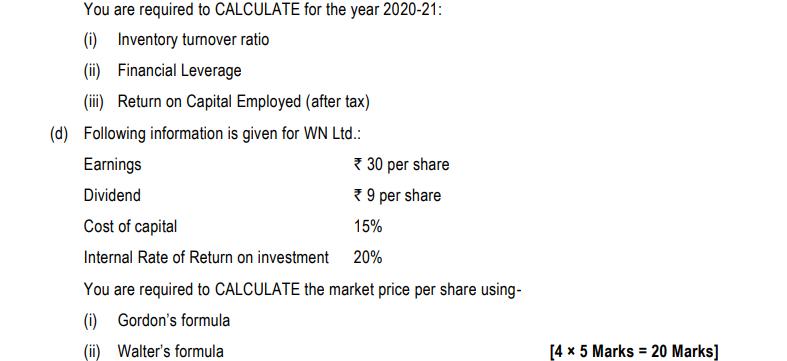

(c) PI Limited has the following Balance Sheet as on March 31, 2020 and March 31, 2021: Balance Sheet Particulars Sources of Funds: Shareholders' Funds Loan Funds March 31, 2020 March 31, 2021 87,500 1,22,500 2,10,000 87,500 1,05,000 1,92,500 Applications of Funds: Fixed Assets Cash and bank Receivables Inventories Other Current Assets Less: Current Liabilities 87,500 15,750 49,000 87,500 35,000 (64,750) 2,10,000 The Income Statement of the PI Ltd. for the year ended is as follows: Particulars Sales Less: Cost of Goods sold Gross Profit Less: Selling, General and Administrative expenses Earnings before Interest and Tax (EBIT) Less: Interest Expense Earnings before Tax (EBT) Less: Tax Profits after Tax (PAT) 1,05,000 14,000 38,500 70,000 35,000 (70,000) 1,92,500 March 31, 2020 March 31, 2021 7,87,500 8,33,000 (7,30,100) (7,38,500) 57,400 94,500 (38,500) (61,250) 18,900 33,250 (12,250) 6,650 (1,995) 4,655 (10,500) 22,750 (6,825) 15,925 You are required to CALCULATE for the year 2020-21: (i) Inventory turnover ratio (ii) Financial Leverage (iii) Return on Capital Employed (after tax) (d) Following information is given for WN Ltd.: Earnings Dividend * 30 per share *9 per share 15% Cost of capital Internal Rate of Return on investment 20% You are required to CALCULATE the market price per share using- (i) Gordon's formula (ii) Walter's formula [4 x 5 Marks = 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We calculate the financial ratios for PI Limited for the year 20202021 i Inventory Turnover Ratio It ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started