Question: A Moving to the next question prevents changes to this answer. uestion 21 A subsidiary of Reynolds Inc., a U.S. company, was located in a

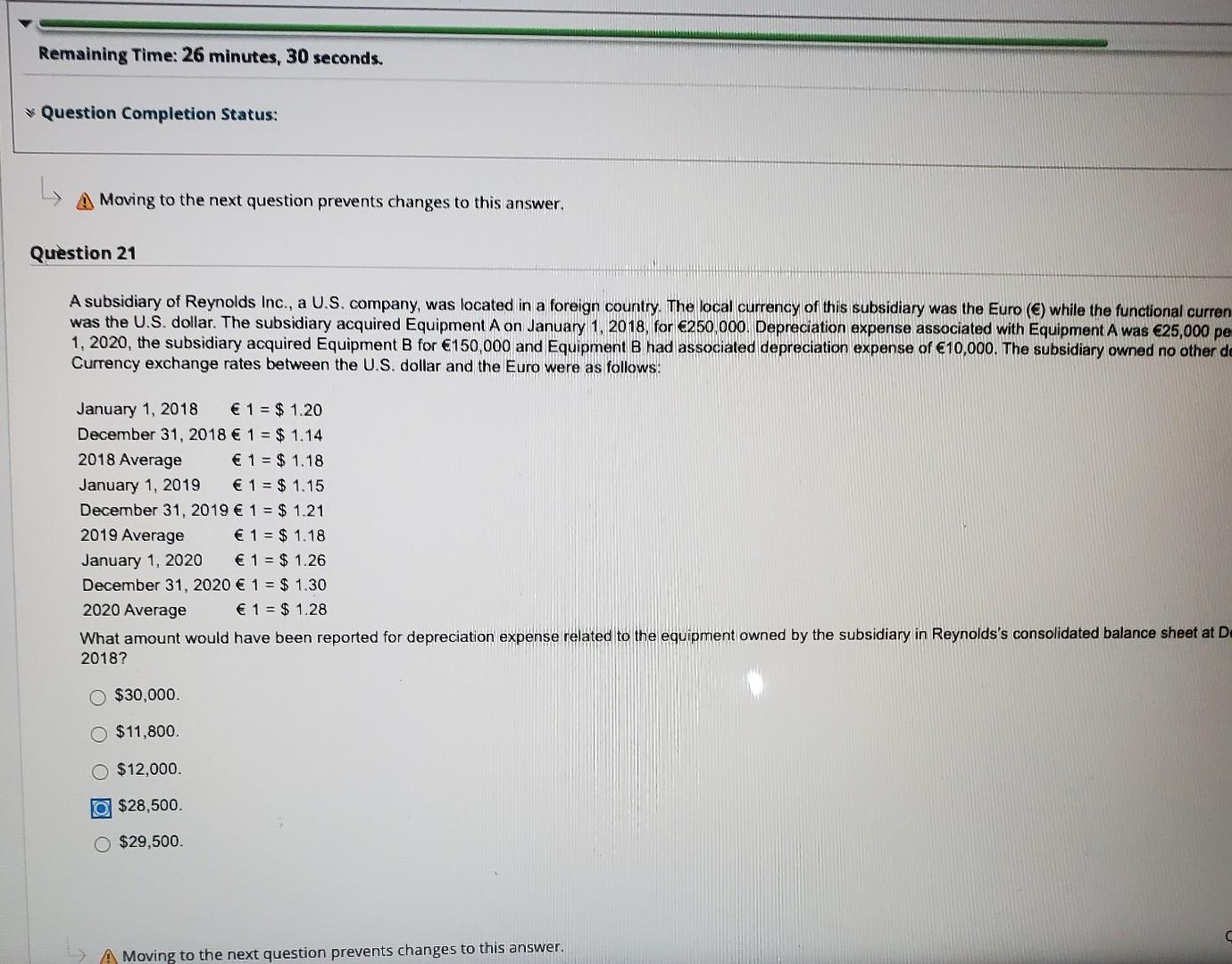

A Moving to the next question prevents changes to this answer. uestion 21 A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro () while the functional curren was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for 250,000. Depreciation expense associated with Equipment A was 25,000 pe 1, 2020, the subsidiary acquired Equipment B for 150,000 and Equipment B had associated depreciation expense of 10,000. The subsidiary owned no other dt Currency exchange rates between the U.S. dollar and the Euro were as follows: What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at D, 2018? $30,000. $11,800 $12,000. $28,500. $29,500. A Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts