Question: A Moving to the next question prevents changes to this answer. Question 1 On 1/1 a business purchased land to build a new factory. The

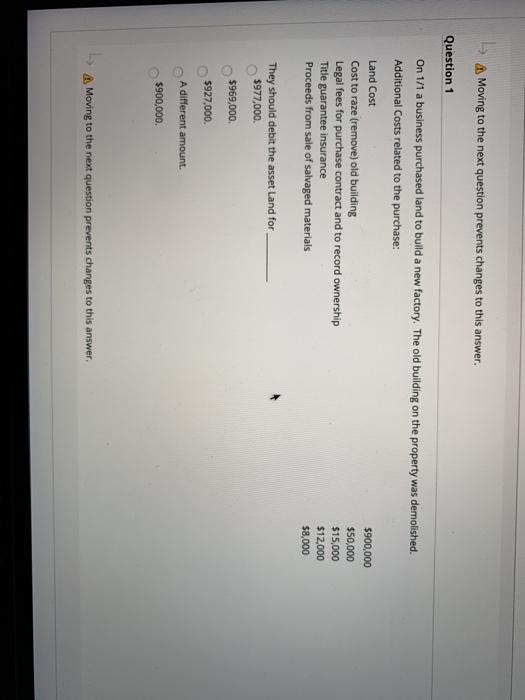

A Moving to the next question prevents changes to this answer. Question 1 On 1/1 a business purchased land to build a new factory. The old building on the property was demolished. Additional Costs related to the purchase: Land Cost $900,000 Cost to raze (remove) old building $50,000 Legal fees for purchase contract and to record ownership $15,000 Title guarantee insurance Proceeds from sale of salvaged materials $8,000 $12,000 They should debit the asset Land for $977,000. $969,000 5927,000 A different amount. $900,000 A Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock