Question: A- Multiple choices 5 points each: 1) Assume US is the home country and Turkey is the foreign country. Turkey inflation exceeds the current US

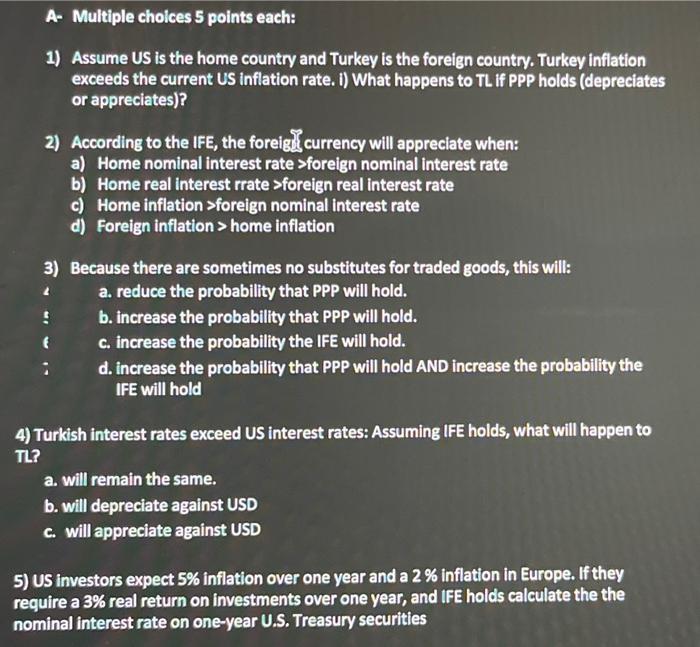

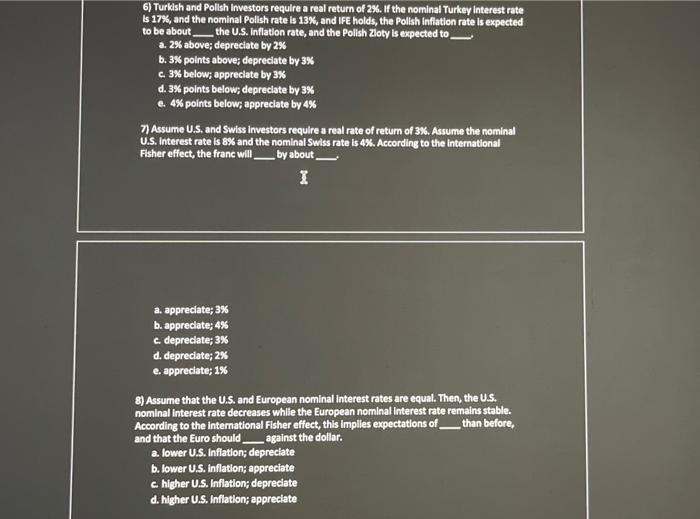

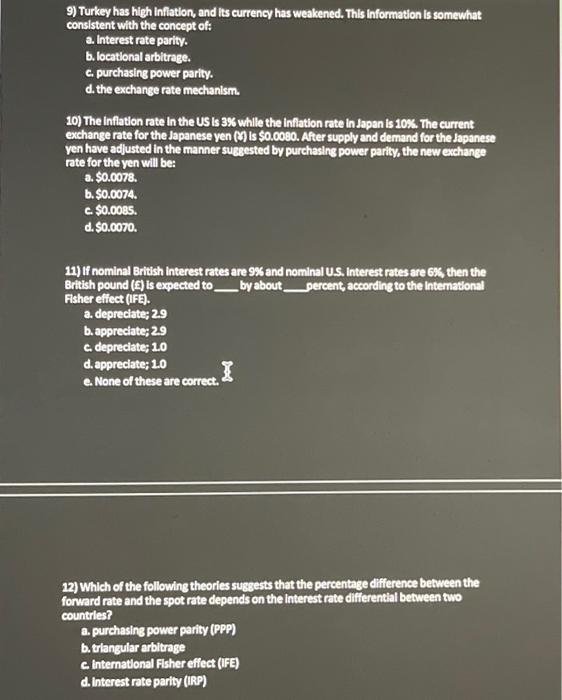

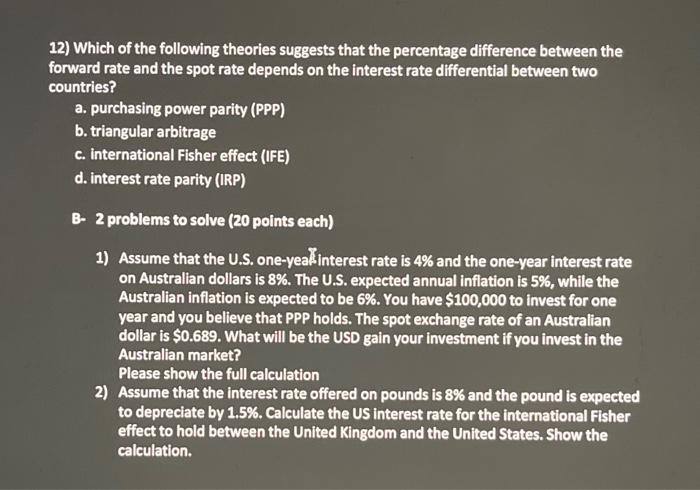

A- Multiple choices 5 points each: 1) Assume US is the home country and Turkey is the foreign country. Turkey inflation exceeds the current US Inflation rate. I) What happens to TL If PPP holds (depreciates or appreciates)? 2) According to the IFE, the foreigh currency will appreciate when: a) Home nominal interest rate >foreign nominal interest rate b) Home real interest rate >foreign real interest rate c) Home inflation >foreign nominal interest rate d) Foreign inflation > home inflation 3) Because there are sometimes no substitutes for traded goods, this will: a. reduce the probability that PPP will hold. ! b. increase the probability that PPP will hold. c. increase the probability the IFE will hold. d. increase the probability that PPP will hold AND increase the probability the IFE will hold 4) Turkish interest rates exceed US interest rates: Assuming IFE holds, what will happen to TL? a. will remain the same. b. will depreciate against USD c. will appreciate against USD 5) US investors expect 5% inflation over one year and a 2 % inflation in Europe. If they require a 3% real return on investments over one year, and IFE holds calculate the the nominal interest rate on one-year U.S. Treasury securities 6) Turkish and Polish Investors require a real return of 2%. If the nominal Turkey Interest rate is 17%, and the nominal Polish rate is 13%, and IFE holds, the Polish Inflation rate is expected to be about the U.S. Inflation rate, and the Polish Zloty is expected to a. 2% above; depreciate by 2% b. 3% points above; deprecate by 3% c. 3% below; appreciate by 3% d. 3% points below; depreciate by 3% e. 4% points below, appreciate by 4% 7) Assume U.S. and Swiss Investors require a real rate of return of 3%. Assume the nominal U.S. Interest rate is 8% and the nominal swiss rate is 4%. According to the International Fisher effect, the franc will by about I a. appreciate; 3% b. appreciate; 4% c. deprecate; 3% d. deprecate; 2% e. appreciate; 1% 8) Assume that the U.S. and European nominal Interest rates are equal. Then, the U.S. nominal Interest rate decreases while the European nominal Interest rate remains stable. According to the International Fisher effect, this implies expectations of_than before, and that the Euro should against the dollar. a. lower U.S. Inflation; depreciate b. lower U.S. Inflation; appreciate c. higher U.S. Inflation; depreciate d. higher U.S. Inflation; appreciate 9) Turkey has high Inflation, and its currency has weakened. This Information is somewhat consistent with the concept of: a. Interest rate parity. b. locational arbitrage. c. purchasing power parity. d. the exchange rate mechanism. 10) The Inflation rate in the US IS 3% while the Inflation rate In Japan Is 10%. The current exchange rate for the Japanese yen (M) is $0.0080. After supply and demand for the Japanese yen have adjusted in the manner suggested by purchasing power parity, the new exchange rate for the yen will be: a. $0.0078. b. $0.0074. c. $0.0085. d. $0.0070. 11) If nominal British Interest rates are 9% and nominal U.S. Interest rates are 6%, then the British pound () is expected to by about_percent, according to the International Fisher effect (IFE). a. depreciate; 2.9 b. appreciate; 2.9 c. depreciate; 1.0 d. appreciate; 10 e. None of these are correct. 12) Which of the following theories suggests that the percentage difference between the forward rate and the spot rate depends on the Interest rate differential between two countries? a. purchasing power parity (PPP) b. triangular arbitrage c International Fisher effect (IFE) d. Interest rate parity (IRP) 12) Which of the following theories suggests that the percentage difference between the forward rate and the spot rate depends on the interest rate differential between two countries? a. purchasing power parity (PPP) b. triangular arbitrage c. international Fisher effect (IFE) d. interest rate parity (IRP) B- 2 problems to solve (20 points each) 1) Assume that the U.S. one-yea interest rate is 4% and the one-year interest rate on Australian dollars is 8%. The U.S. expected annual inflation is 5%, while the Australian inflation is expected to be 6%. You have $100,000 to invest for one year and you believe that PPP holds. The spot exchange rate of an Australian dollar is $0.689. What will be the USD gain your investment if you invest in the Australian market? Please show the full calculation 2) Assume that the interest rate offered on pounds is 8% and the pound is expected to depreciate by 1.5%. Calculate the US interest rate for the international Fisher effect to hold between the United Kingdom and the United States. Show the calculation. A- Multiple choices 5 points each: 1) Assume US is the home country and Turkey is the foreign country. Turkey inflation exceeds the current US Inflation rate. I) What happens to TL If PPP holds (depreciates or appreciates)? 2) According to the IFE, the foreigh currency will appreciate when: a) Home nominal interest rate >foreign nominal interest rate b) Home real interest rate >foreign real interest rate c) Home inflation >foreign nominal interest rate d) Foreign inflation > home inflation 3) Because there are sometimes no substitutes for traded goods, this will: a. reduce the probability that PPP will hold. ! b. increase the probability that PPP will hold. c. increase the probability the IFE will hold. d. increase the probability that PPP will hold AND increase the probability the IFE will hold 4) Turkish interest rates exceed US interest rates: Assuming IFE holds, what will happen to TL? a. will remain the same. b. will depreciate against USD c. will appreciate against USD 5) US investors expect 5% inflation over one year and a 2 % inflation in Europe. If they require a 3% real return on investments over one year, and IFE holds calculate the the nominal interest rate on one-year U.S. Treasury securities 6) Turkish and Polish Investors require a real return of 2%. If the nominal Turkey Interest rate is 17%, and the nominal Polish rate is 13%, and IFE holds, the Polish Inflation rate is expected to be about the U.S. Inflation rate, and the Polish Zloty is expected to a. 2% above; depreciate by 2% b. 3% points above; deprecate by 3% c. 3% below; appreciate by 3% d. 3% points below; depreciate by 3% e. 4% points below, appreciate by 4% 7) Assume U.S. and Swiss Investors require a real rate of return of 3%. Assume the nominal U.S. Interest rate is 8% and the nominal swiss rate is 4%. According to the International Fisher effect, the franc will by about I a. appreciate; 3% b. appreciate; 4% c. deprecate; 3% d. deprecate; 2% e. appreciate; 1% 8) Assume that the U.S. and European nominal Interest rates are equal. Then, the U.S. nominal Interest rate decreases while the European nominal Interest rate remains stable. According to the International Fisher effect, this implies expectations of_than before, and that the Euro should against the dollar. a. lower U.S. Inflation; depreciate b. lower U.S. Inflation; appreciate c. higher U.S. Inflation; depreciate d. higher U.S. Inflation; appreciate 9) Turkey has high Inflation, and its currency has weakened. This Information is somewhat consistent with the concept of: a. Interest rate parity. b. locational arbitrage. c. purchasing power parity. d. the exchange rate mechanism. 10) The Inflation rate in the US IS 3% while the Inflation rate In Japan Is 10%. The current exchange rate for the Japanese yen (M) is $0.0080. After supply and demand for the Japanese yen have adjusted in the manner suggested by purchasing power parity, the new exchange rate for the yen will be: a. $0.0078. b. $0.0074. c. $0.0085. d. $0.0070. 11) If nominal British Interest rates are 9% and nominal U.S. Interest rates are 6%, then the British pound () is expected to by about_percent, according to the International Fisher effect (IFE). a. depreciate; 2.9 b. appreciate; 2.9 c. depreciate; 1.0 d. appreciate; 10 e. None of these are correct. 12) Which of the following theories suggests that the percentage difference between the forward rate and the spot rate depends on the Interest rate differential between two countries? a. purchasing power parity (PPP) b. triangular arbitrage c International Fisher effect (IFE) d. Interest rate parity (IRP) 12) Which of the following theories suggests that the percentage difference between the forward rate and the spot rate depends on the interest rate differential between two countries? a. purchasing power parity (PPP) b. triangular arbitrage c. international Fisher effect (IFE) d. interest rate parity (IRP) B- 2 problems to solve (20 points each) 1) Assume that the U.S. one-yea interest rate is 4% and the one-year interest rate on Australian dollars is 8%. The U.S. expected annual inflation is 5%, while the Australian inflation is expected to be 6%. You have $100,000 to invest for one year and you believe that PPP holds. The spot exchange rate of an Australian dollar is $0.689. What will be the USD gain your investment if you invest in the Australian market? Please show the full calculation 2) Assume that the interest rate offered on pounds is 8% and the pound is expected to depreciate by 1.5%. Calculate the US interest rate for the international Fisher effect to hold between the United Kingdom and the United States. Show the calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts