Question: A n i n v e s t o r i n v e s t e d A U D $ 2 5 ,

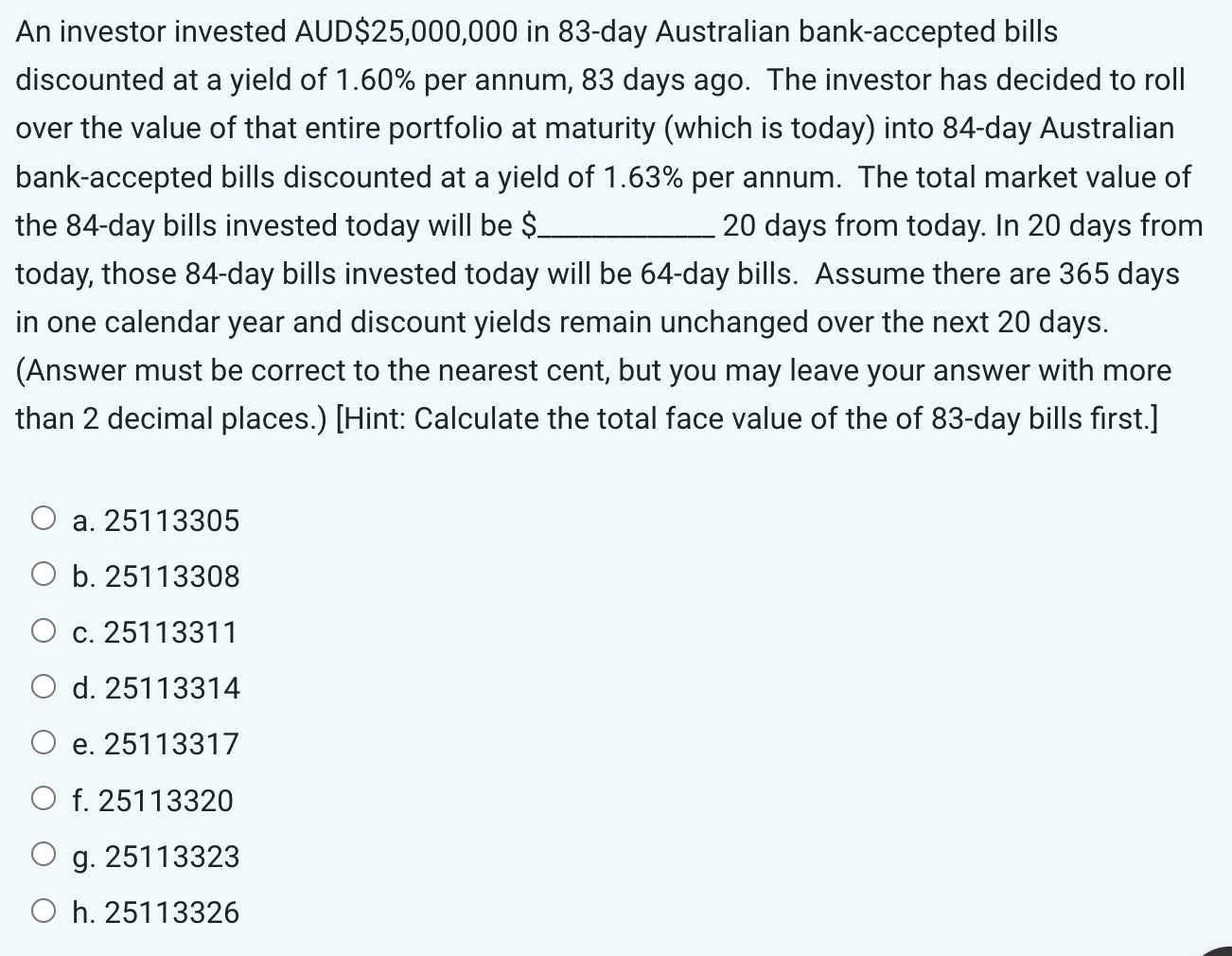

An investor invested AUD$ in day Australian bankaccepted bills discounted at a yield of per annum, days ago. The investor has decided to roll over the value of that entire portfolio at maturity which is today into day Australian bankaccepted bills discounted at a yield of per annum. The total market value of the day bills invested today will be $? _ _ _ _ _ _ _ _ 2 0 d a y s f r o m t o d a y . 2 0 d a y s f r o m t o d a y , t h o s e 8 4 - d a y b i l l s i n v e s t e d t o d a y w i l l 6 4 - d a y b i l l s . A s s u m e t h e r e a r e 3 6 5 d a y s o n e c a l e n d a r y e a r a n d d i s c o u n t y i e l d s r e m a i n u n c h a n g e d o v e r t h e n e x t 2 0 d a y s . ( Answerm u s t c o r r e c t t h e n e a r e s t c e n t , b u t y o u m a y l e a v e y o u r a n s w e r w i t h m o r e t h a n 2 d e c i m a l p l a c e s . ) [ Hint: C a l c u l a t e t h e t o t a l f a c e v a l u e t h e 8 3 - d a y b i l l s f i r s t . ]

a. 2 5 1 1 3 3 0 5

b. 2 5 1 1 3 3 0 8

C. 2 5 1 1 3 3 1 1

d. 2 5 1 1 3 3 1 4

e. 2 5 1 1 3 3 1 7

f. 2 5 1 1 3 3 2 0

g. 2 5 1 1 3 3 2 3

h. 2 5 1 1 3 3 2 6

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock