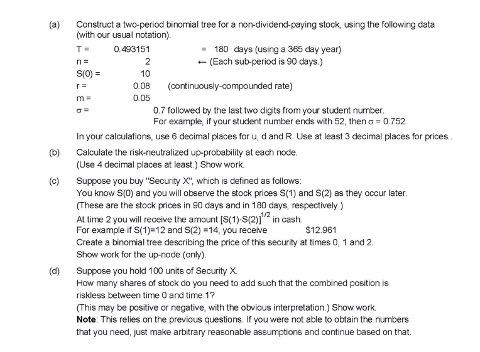

Question: (a) n= r= m D) (c) Construct a two-period tinertial tree for a non-dividence-exaying stock, using the following cata (with our usual notation) T- 0.493151

(a) n= r= m D) (c) Construct a two-period tinertial tree for a non-dividence-exaying stock, using the following cata (with our usual notation) T- 0.493151 180 days (using a 365 day year) 2 -- (Each sub-period is 90 days.) S(O) 10 0.DB (continuously-compounded rate) 0.05 0.7 followed by the last two digits from your student number For example, if your student number ends with 52, thens = 0.752 In you calculations use 6 decimal places for ud and R Use at least 3 decimal places for prices Calculate the risk-neutralized up probability at each node (Use 4 decimal places at least.) Show work Suppose you buy "Security X", which is defined as follows: You know S(0) and you will observe the stock prices S(1) and S(2) as they occur later (These are the stock prices in 90 days and in 180 days respectively) At time 2 you will receive the amount [S(1) S2);"2 in cash For example if S(1)-12 and S(2) -14 you receive $12.961 Create a binomial tree describing the price of this security at times 0 1 and 2 Show work for the up-node (only) Suppose you hold 100 units of Security X How many shares of stock do you need to add such that the combined position is riskless between time and time 17 (This may be positive or negative with the obvious interpretation) Show work Note This relies on the previous questions. If you were not able to obtain the numbers that you need, just make arbitrary reasonable assumptions and continue based on that. d) (a) n= r= m D) (c) Construct a two-period tinertial tree for a non-dividence-exaying stock, using the following cata (with our usual notation) T- 0.493151 180 days (using a 365 day year) 2 -- (Each sub-period is 90 days.) S(O) 10 0.DB (continuously-compounded rate) 0.05 0.7 followed by the last two digits from your student number For example, if your student number ends with 52, thens = 0.752 In you calculations use 6 decimal places for ud and R Use at least 3 decimal places for prices Calculate the risk-neutralized up probability at each node (Use 4 decimal places at least.) Show work Suppose you buy "Security X", which is defined as follows: You know S(0) and you will observe the stock prices S(1) and S(2) as they occur later (These are the stock prices in 90 days and in 180 days respectively) At time 2 you will receive the amount [S(1) S2);"2 in cash For example if S(1)-12 and S(2) -14 you receive $12.961 Create a binomial tree describing the price of this security at times 0 1 and 2 Show work for the up-node (only) Suppose you hold 100 units of Security X How many shares of stock do you need to add such that the combined position is riskless between time and time 17 (This may be positive or negative with the obvious interpretation) Show work Note This relies on the previous questions. If you were not able to obtain the numbers that you need, just make arbitrary reasonable assumptions and continue based on that. d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts