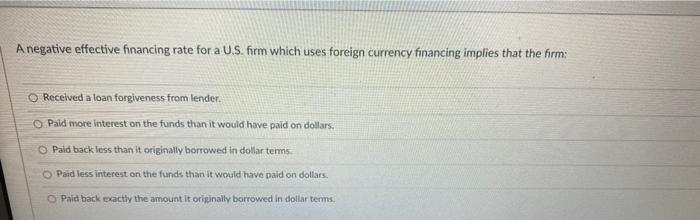

Question: A negative effective financing rate for a U.S. firm which uses foreign currency financing implies that the firm: Received a loan forgiveness from lender. Paid

A negative effective financing rate for a U.S. firm which uses foreign currency financing implies that the firm: Received a loan forgiveness from lender. Paid more interest on the funds than it would have paid on dollars. Paid backless than it originally borrowed in dollar terms Paid less interest on the funds than it would have paid on dollars. Paid back exactly the amount it originally borrowed in dollar terms. A negative effective financing rate for a U.S. firm which uses foreign currency financing implies that the firm: Received a loan forgiveness from lender. Paid more interest on the funds than it would have paid on dollars. Paid backless than it originally borrowed in dollar terms Paid less interest on the funds than it would have paid on dollars. Paid back exactly the amount it originally borrowed in dollar terms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts