Question: List two MoviePass competitive advantages and two competitive risks, and explain why MoviePass-Are Subscribers Loving It to Death? Gretchen Johnson The University of Alabama Lou

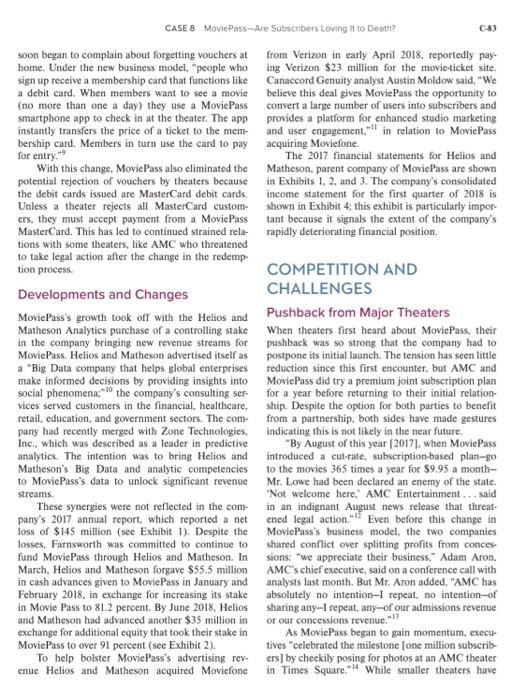

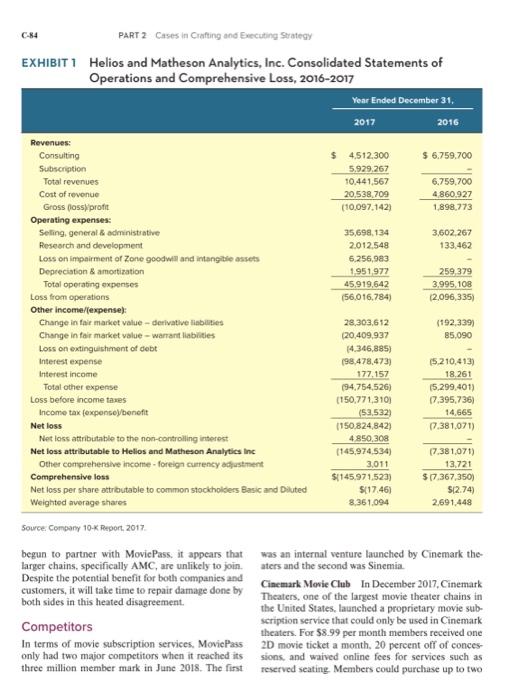

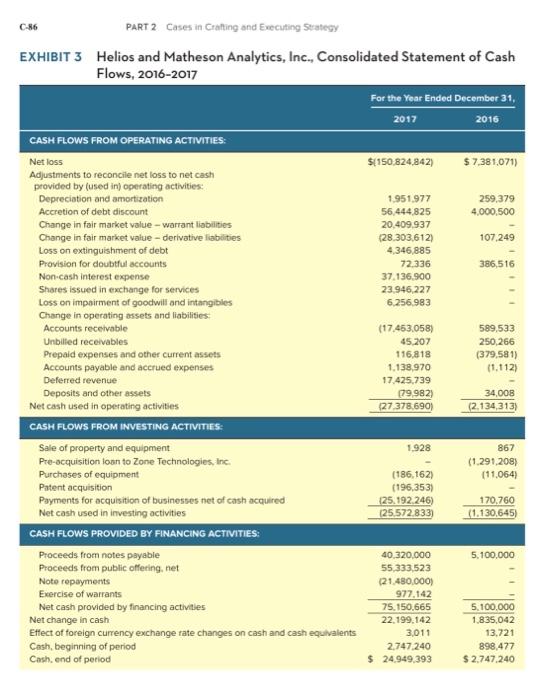

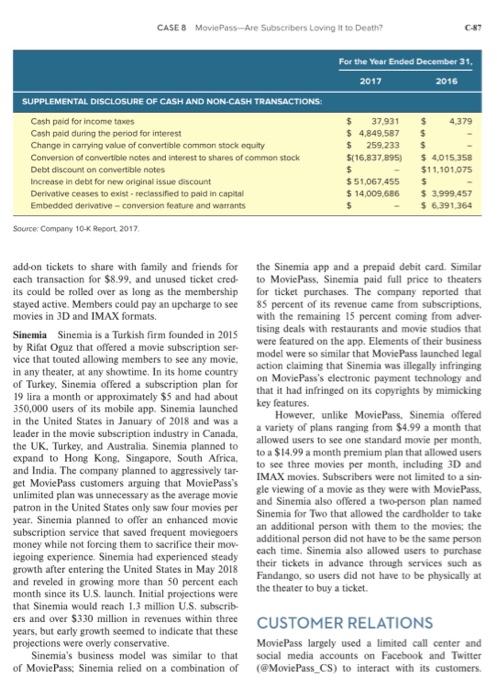

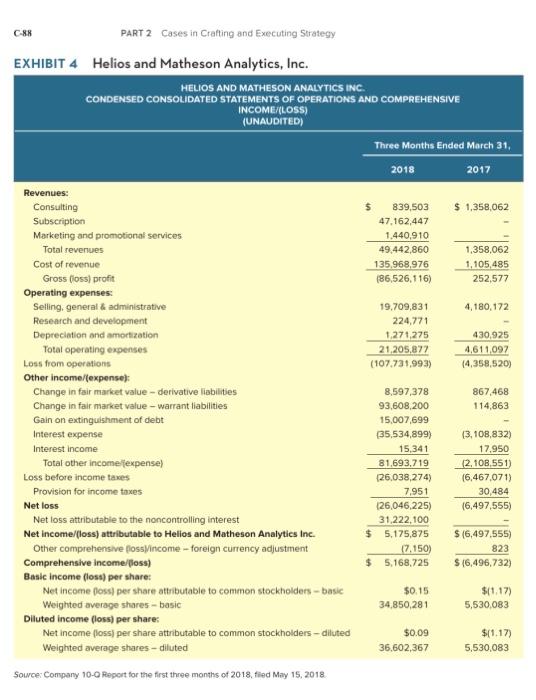

MoviePass-Are Subscribers Loving It to Death? Gretchen Johnson The University of Alabama Lou Marino The University of Alabama n 2011. Stacy Spikes and Hamet Watt launched MoviePass to combat the steady decline in ticket sales experienced by movie theaters in the United States as ticket sales fell from a high of 1.58 billion tickets in 2002 to 1.28 billion in 2011. The pair noticed that Americans were willing to pay for subscriptions for home mowie rentals through Netflix and for entertainment through cable TV, and they believed they could drive patrons to theaters through a subscription-based movie ticket service. The traditional movie ticket model was based on a transaction between theaters and customers. Each time a customer wanted to see a movic, they purchased a ticket for a specific time and location they wanted to attend. However, Spikes and Watt introduced a service that allowed customers to pay a flat monthly fee, originally set at $30 per month and fallen to as low as $7.95 per month by 2018 , that allows customers to see one 2D movie a day (no 3D or IMAX movies are allowed), and to choose between a variety of theaters. Even in the early days the company met with skepticism and resistance from investors and established theater industry players. Many questioned how the company could make money when, in many markets, ticket prices were already over $10. While Spikes and Watt positioned themselves as an ally for movie theaters that made a much higher percentage of their revenue from sales of soft drinks, popeorn. candy, and other food at their concession stands. some major theater chains saw the company as a rival trying to capture a portion of the industry's already McKenna Marino The University of Alabama declining revenues. Despite the fact that MovicPass estimated that subscribers went to the movies more often and increased their concession purchases by 120 percent, several theater chains refused to work with the company. In 2016 Mitch Lowe, an executive with previous experience at Redbox and Netflix, joined the company and began to experiment with the company's offerings. Under Lowe, the company experimented with pricing and offering various levels of service ranging from $15 a month plan for two movies a month in small markets to an unlimited plan for 550. In early August 2017 the company had approximately 20,000 subscribers. On August 15, 2017, the company announced it was going to an abgressive $9.95 subscription price and that an agreement had been made for Helios and Matheson Analyties, Ine.. to acquire 53.71 percent of MoviePass for \$28.5 million. The plan was for Helios and Matheson to monetize the data generated by MoviePass's subscriber platform. By October 24, when the deal with Helios and Matheson Analytics, Inc. closed. MoviePass's subscriber base had grown to over 600,000 . By June 1. 2018, MoviePass had grown to over three million subscribers with projections of five million by the end of the year. The company under Helios and Matheson became the fastest growing subscription company in the history of the internet. reaching one million subscribers in only four months, CASE 8 MoviePass - Are Subscribets Loving It to Death? beating Spotify (which took five months) and Netflix (which took 39 months) to reach one million subscribers. The company's subscription numbers were bolstered by aggressive marketing and a very strong 96 percent customer retention rate. Despite this growth in subscribers, the company had not yet achieved profitability leading to questions about their future viability. MoviePass and their parent company Helios and Matheson were actively building additional revenue streams to support operations including negotiations with smaller theaters to split profits on ticket and concession sales, the acquisition of Moviefone by Helios and Matheson to generate advertising revenue, and the launch of a movic distribution company-MoviePass Ventures-that would allow them to distribute independently. The question remaining was whether of not they would be able to achieve profitability before cash runs out. One analyst conjectured that perhaps MoviePass fans loved the service too much. It was estimated that while the average American saw approximately 4.5 movies a year, the average MoviePass subscriber doubled this. Some of the earliest MoviePass subseribers tended to be among the 11 percent of the U.S. population who were categorized as heavy moviegoers seeing more than 18 movies a year and accounting for approximately 50 percent of the movie tickets sold in a given year. Indeed, some MoviePass power users saw as many as 24 movies a month (prior to restrictions being put into place limiting users to being able to sec a movic only once) with one subscriber boasting he saw a movie 40 days in a row to celebrate his 40 th birthday. As of June 2018, it was clear that MoviePass subscribers loved paying a $9.95 monthly fee to attend an unlimited number of movies at most any theater. or for a \$7.95 monthly fee to attend up to three movies a month, but were they loving the company's subscription service to death? During the first five months of 2018, with MoviePass subscribers using their pass to attend as many as double the anticipated number of movies, the agreed-upon fees MoviePass had to pay theaters for each movie a MoviePass subscriber attended greatly exceeded its income from monthly subscriptions. Confronted with estimated monthly cash flow deficits approaching \$22 million and having rapidly burned through the cash raised from earlier rounds of financing, MoviePass's parent, Helios and Matheson, was scrambling to raise additional longterm capital-chiefly by issuing additional shares of stock. These new stock issues, however, had greatly diluted the price per share and triggered widespread concern whether the company could survive. The closing price of Helios and Matheson's common stock on June 22, 2018, was 50.32 per share, down from $20.40 in October 2017. From the outset, Lowe and the MoviePass management team had counted on being able to attract a much bieger percentage of casual moviegoers who would tikely attend only one to two movies per month and thus override the money-losing effects of early subseribers whose frequent movie attendance generated ticket fee payments to theaters that greatly surpassed their monthly subscription fees. MoviePass's parent company, Helios and Matheson. had also concluded that efforts to sustain the company's business model needed to include the devel. opment of new revenue streams that would have synergy with the company's growing subscriber base. One such possibility included internally producing its own movies and inducing subscribers to attend these movies-its first movic, Americun Animals, was scheduled to begin running in theaters in June 2018. The benefits of subscribers attending movies that were wholly or partially funded and produced by MoviePass included paying signifieantly lower ticket fees to theaters showing these movies and also receiving a share of the ticket price (typically, movie producers received a 60 percent share of the ticket price). There was no question that MoviePass's innovative business model had the potential to disrupt the movie theater industry, but a number of analysts believed that unless MoviePass could rather quickly transform its business model into something that was more sustainable, it could not survive long enough to profit from its game-changing innowation. COMPANY BACKGROUND Launch of the MoviePass Concept, 2011 to 2012 MowiePass "was originally conceived as being cxclusively for avid movie fans who attend the cinema multiple times a month and used a voucher system that allowed subseribers to print tiekets at home and redeem them at the theater for movie tickets. With their idea, Spikes and Watt planned to launch a beta in June 2011: however, they did not secure agreements with their key partners, the theaters, on their initial list in the San Francisco area prior to C.82 PART 2 Cases in Crafting and Executing Strategy launching the beta. Once theaters heard about the scheduled launch. they indicated that they did not wish to participate. One of these theaters. AMC. would go on to become one of MoviePass's largest critics. Resistance from the theaters caused the company to shut down the night before the launch and go on a "temporary hiatus". until August 2011 when they partnered with Hollywood Movie Money to leverage its existing theater network and woucher system. During this soft launch with Movie Moncy. MoviePass offered its services to a select few on an invitation-only member list with thousands waiting for a public launch. With this small list of subscribers, MoviePass found that " 64 percent started going to the movies more often, and not having to pay for a ticket (in the traditional sense) meant they were dropping about 123 percent more on concessions. 4 This suceess encouraged the entreprencurs, and MoviePass was launched nationwide in Oetober 2012 with reduced membership fees and an app instead of a printed voucher system. Initial Struggles "MoviePass ... strupgled to gain traction in its early years because of pricing [\$50 a month] and pushback from exhibitors, who worried that a subscription service would undermine per-ticket pricing. 5 Despite changes made after the "temporary hiatus," the company continued to face challenges because of their small number of subscribers. On top of this. a subscriber's location determined how much their monthly fee would be leading customers in larger cities to complain because of their higher fee. During this time, the conflict between MoviePass and AMC began to develop beyond comments prior to the first scheduled launch. Once available nationwide, AMC issued a statement that they had "no affil. iation with MovicPass and had no discussions with the company about participation in the service. 6 In 2016, Mitch Lowe, a former executive at Netflix and Redbox, became CEO and began to experiment with different subscription levels. Even with his ideas and new pricing, MoviePass was facing struggles from potential partners and customers, and the outlook for the company looked bleak until August of 2017. Success and Growth Helios and Matheson purchased a majority stake in MoviePass in October 2017 with a plan to collect data on subscribers and monetize this data through the use of analytics-based marketing. With the announcement of the investment in August 2017, MoviePass dropped its subseription fee to $9.95 and the number of subscribers skyrocketed. Helios and Matheson's stock price soared to $32.90, a 52 -week high. As a response to the growing popularity of MoviePass, large theater chains, namely AMC, took notice and began issuing statements about their relationship, or lack thereof, with MoviePass. Resistance from AMC was significant as they controlled approximately 29.4 percent of the industry market share in the United States in 2016 in terms of revenues, followed by Regal with 18.5 percent, and Cinemark with 13.6 percent. In terms of number of screens in 2016 in the United States, AMC controlled 28 percent (11, 247 sereens), Regal controlled 18.2 percent (7.315). and Cinemark. 14.8 percent (5.957). However, smaller independent movie theater chains, which tended to have 5 to 20 theaters per chain, began to consider partnering with MoviePass to drive up concession sales. One such theater chain, Studio Movie Grill, credits their investment with MoviePass for increased attendance, especially on week nights. "I know it's getting a bad rap in some circles, but we love MoviePass," said Brian Schultz, Studio Movie Grill's chief executive. "Some people aren't sure they want to pay $10 to $12 to see a movie like 'Lady Bird,' MoviePass takes out that hurdle." With locations in nine states, this chain offers a potentially large subscription base. Another small chain that MoviePass partnered with is Flix Brewhouse: "On April 6th [2018]. MoviePass announced a partnership with Flix Brewhouse, the nation's only cinema circuit that pairs full service in-theater dining with an award-winning craft brewery at every location. 5 With this type of venue, both MoviePass and Flix Brewhouse have the potential to make large profits off concession sales when customers use the ticket subscription. BUSINESS OPERATIONS "Purchasing" a Ticket The initial business model for MoviePass had subscribers print out ticket vouchers at home and bring them to theaters to redeem them for a printed theater ticket. This process worked for the initial launch in 2011 and nationwide launch in 2012, but customers CASE 8 MoviePass-Are Subscribers Loving it to Death? C.8.3 soon began to complain about forgetting vouchers at home. Under the new business model, "people who sign up receive a membership card that functions like a debit card. When members want to see a movie (no more than one a day) they use a MoviePass smartphone app to check in at the theater. The app instantly transfers the price of a ticket to the membership card. Members in turn use the card to pay for entry." 9 With this change, MoviePass also eliminated the potential rejection of vouchers by theaters because the debit cards issued are MasterCard debit cards. Unless a theater rejects all MasterCard customers, they must accept payment from a MovicPass MasterCard. This has led to continued strained relations with some theaters, like AMC who threatened to take legal action after the change in the redemption process. Developments and Changes MoviePuss's growth took off with the Helios and Matheson Analyties purchase of a controlling stake in the company bringing new revenue streams for MoviePass. Helios and Matheson advertised itself as a "Big Data company that helps global enterprises make informed decisions by providing insights into social phenomena:-10 the company's consulting services served customers in the financial, healthcare, retail, education, and government sectors. The company had recently merged with Zone Technologies, Inc., which was described as a leader in predictive analytics. The intention was to bring Helios and Matheson's Big Data and analytic competencies to MoviePass's data to unlock significant revenue streams. These synergies were not reflected in the company's 2017 annual report, which reported a net loss of $145 million (see Exhibit 1). Despite the losses. Farnsworth was committed to continte to fund MoviePass through Helios and Matheson. In March, Helios and Matheson forgave \$55.5 million in cash advances given to MoviePass in January and February 2018, in exchange for increasing its stake in Movie Pass to 81.2 percent. By June 2018, Helios and Matheson had advanced another $35 million in exchange for additional equity that took their stake in MoviePass to over 91 percent (see Exhibit 2). To help bolster MoviePass's advertising revenue Helios and Matheson acquired Moviefone from Verizon in early April 2018, reportedly paying Verizon \$23. million for the movio-ticket site. Canaceord Genuity analyst Austin Moldow said, "We believe this deal gives MoviePass the opportunity to convert a large number of users into subscribers and provides a platform for enhanced studio marketing and user engagement," 11 in relation to MoviePass acquiring Moviefone. The 2017 financial statements for Helios and Matheson, parent company of MoviePass are shown in Exhibits 1, 2, and 3. The company's consolidated income statement for the first quarter of 2018 is shown in Exhibit 4; this exhibit is particularly important because it signals the extent of the company's rapidly deteriorating financial position. COMPETITION AND CHALLENGES Pushback from Major Theaters When theaters first heard about MovicPass, their pushback was so strong that the company had to postpone its initial launch. The tension has seen little reduction since this first encounter, but AMC and MoviePass did try a premium joint subscription plan for a year before returning to their initial relationship. Despite the option for both parties to benefit from a partnership, both sides have made gestures indicating this is not likely in the near future. "By August of this year [2017], when MoviePass introduced a cut-rate, subscription-based plan-go to the movies 365 times a year for $9.95 a monthMr. Lowe had been declared an enemy of the state. "Not welcome here,' AMC Entertainment... said in an indignant August news release that threatened legal action." 12 Even before this change in MoviePass's business model, the two companies shared conflict over splitting profits from conces sions: "we appreciate their business." Adam Aron. AMC's chicf executive, said on a conference call with analysts last month. But Mr. Aron added, "AMC has absolutely no intention-I repeat, no intention-of sharing any-1 repeat, any-of our admissions revenue or our concessions revenue, 13 As MoviePass began to gain momentum, execttives "celebrated the milestone [one million subscribers] by checkily posing for photos at an AMC theater in Times Square, 14 While smaller theaters have C. -84 PART 2 Cases in Crafting and Exccuting Syategy EXHIBIT 1 Helios and Matheson Analutics. Ine. Consolidated Statements of Source: Company 10-K Report. 2017. begun to partner with MovicPass, it appears that larger chains, specifically AMC, are unlikely to join. Despite the potential benefit for both companies and customers, it will take time to repair damage done by both sides in this heated disagreement. Competitors In terms of movie subscription services, MoviePass only had two major competitors when it reached its three million member mark in Jane 2018. The first was an internal venture launched by Cinemark theaters and the second was Sinemia. Cinemark Movie Club In December 2017, Cinemark Theaters, one of the largest movie theatet chains in the United States, launched a proprietary movie subscription service that could only be used in Cinemark theaters. For 58.99 per month members received one 20 movic ticket a month. 20 pereent off of concessions, and waived online fees for services such as reserved seating. Members could purchase up to two C86 PART 2 Cases in Crahting and Executing Strategy EXHIBIT 3 Helios and Matheson Analytics, Inc., Consolidated Statement of Cash Flows, 2016-2017 CASH FLOWS FROM INVESTING ACTIVITES: Sale of property and equipment Pre-ocquisition laon to Zone Technologies, Inc. Purchases of equipment Patent acquisition Payments for acquisition of businesses net of cash acquired Net cash used in investing activities $(150,824,842) $7,381,0711 \begin{tabular}{rr} 1,951,977 & 259,379 \\ 56,444,825 & 4,000,500 \\ 20,409,937 & - \\ (28,303,612) & 107,249 \\ 4,346,885 & - \\ 72,336 & 386,516 \\ 37,136,900 & - \\ 23,946,227 & - \\ 6,256,983 & - \\ 17,453,058) & 589,533 \\ 45,207 & 250,266 \\ 116,818 & (379,581) \\ 1,138,970 & (1,1112) \\ 17,425,739 & 34,008 \\ (79,982) & (2,134,313) \\ \hline(27,378,690) & \\ \hline \end{tabular} CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: Proceeds from notes payable Proceeds from public offering, net Note repayments Exercise of warrants Net cash provided by financing activites Net change in cash Effect of foreign currency exchange rate changes on cash and cash equivalents Cash, beginning of period Cosh, end of period 1.928 (186,162) (196,353) (25.192.246)(25.572.833) 867 (1.291,208) (11,064) (1.130,645)170,760 C86 PART 2 Cases in Crahting and Executing Strategy EXHIBIT 3 Helios and Matheson Analytics, Inc., Consolidated Statement of Cash Flows, 2016-2017 CASH FLOWS FROM INVESTING ACTIVITES: Sale of property and equipment Pre-ocquisition laon to Zone Technologies, Inc. Purchases of equipment Patent acquisition Payments for acquisition of businesses net of cash acquired Net cash used in investing activities $(150,824,842) $7,381,0711 \begin{tabular}{rr} 1,951,977 & 259,379 \\ 56,444,825 & 4,000,500 \\ 20,409,937 & - \\ (28,303,612) & 107,249 \\ 4,346,885 & - \\ 72,336 & 386,516 \\ 37,136,900 & - \\ 23,946,227 & - \\ 6,256,983 & - \\ 17,453,058) & 589,533 \\ 45,207 & 250,266 \\ 116,818 & (379,581) \\ 1,138,970 & (1,1112) \\ 17,425,739 & 34,008 \\ (79,982) & (2,134,313) \\ \hline(27,378,690) & \\ \hline \end{tabular} CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: Proceeds from notes payable Proceeds from public offering, net Note repayments Exercise of warrants Net cash provided by financing activites Net change in cash Effect of foreign currency exchange rate changes on cash and cash equivalents Cash, beginning of period Cosh, end of period 1.928 (186,162) (196,353) (25.192.246)(25.572.833) 867 (1.291,208) (11,064) (1.130,645)170,760 CASE 8 MoviePass-Are Subscribers Loving it to Death? C.87 Soure: Company 10-K Report 2017. add-on tickets to share with family and friends for each transaction for $8.99, and unused ticket credits could be rolied over as long as the membership stayed active. Members could pay an upcharge to see movies in 3D and IMAX formats. Sinemia Sinemia is a Turkish firm founded in 2015 by Rifat Oguz that offered a movie subscription service that touted allowing members to see any movie, in any theater, at any showtime. In its home country of Turkey. Sinemia offered a subscription plan for 19 lira a month or approximately $5 and had about 350,000 users of its mobile app. Sinemia launched in the United States in January of 2018 and was a leader in the movie subscription industry in Canada, the UK. Turkey, and Australia. Sinemia planned to expand to Hong Kong. Singapore, South Africa, and India. The company planned to aggressively target MoviePass customers arguing that MoviePass's unlimited plan was unnecessary as the average movie patron in the United States only saw four movies per year. Sinemia planned to offer an enhanced movic subscription service that saved frequent moviegoers money while not forcing them to sacrifice their moviegoing experience. Sinemia had experienced steady growth after entering the United States in May 2018 and reveled in growing more than 50 percent each month since its U,S. launch. Initial projections were that Sinemia would reach 1.3 million U.S, subscribers and over $330 million in revenues within three years, but early growth seemed to indicate that these projections were overly conservative. Sinemia's business model was similar to that of MoviePass: Sinemia relied on a combination of the Sinemia app and a prepaid debit card. Similat to MoviePass, Sinemia paid full price to theaters for ticket purchases. The company reported that 85 percent of its revenue came from subscriptions, with the remaining 15 percent coming from advertising deals with restaurants and movie studios that were fearured on the app. Elements of their business model were so similar that MoviePass launched legal action claiming that Sinemia was illegally infrimeing on MoviePass's electronic payment technology and that it had infringed on its copyrights by mimicking key features. However, unlike MoviePass, Sinemia offered a variety of plans ranging from $4.99 a month that allowed users to see one standard movie per month. to a $14.99 a month premium plan that allowed users to see three movies per month, including 3D and IMAX movies. Subscribers were not limited to a sin. gle viewing of a movie as they were with MoviePass, and Sinemia also offered a two-person plan named Sinemia for Two that allowed the cardholder to take an additional person with them to the movies; the additional person did not have to be the same person each time. Sinemia also allowed users to purchase their tickets in advance through services such as Fandango, so users did not have to be physically at the theater to buy a ticket. CUSTOMER RELATIONS MoviePass largely used a limited call center and social media accounts on Facebook and Twitter (@MoviePass_CS) to interact with its customers. C88 PART 2 Cases in Crafting and Executing Strategy EXHIBIT 4 Helios and Matheson Analytics, Inc. HELIOS AND MATHESON ANALYTICS INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOMEN(LOSS) (UNAUDITED) \begin{tabular}{|ccc} \hline \multicolumn{3}{c}{ Three Months Ended March 31, } \\ \cline { 2 - 4 } & 2018 & 2017 \\ \hline \end{tabular} Revenues: Consulting Subscription Marketing and promotional services Total revenues Cost of revenue Gross (ioss) profit Operating expenses: Selling, general \& administrative Research and development Depreciation and amortzation Total operating expenses Loss from operations Other income/(expense): Change in fair market value - derivative liabilities Change in fair market value - warrant liabilities Gain on extinguishment of debt Interest expense Interest income Total other incomelexpense) Loss before income taves Provision for income toxes Net loss Net loss attributable to the noncontrolling interest Net income/(loss) attributable to Helios and Matheson Analytics Inc. Other comprehensive fossyincome - foreign currency adjustment Comprehensive income/(loss) Basic income (loss) per share: Net income (oss) per share attributable to common stockholders - basic Weighted average shares - basic Diluted income (loss) per share: Net income (loss) per share attnbutable to common stockholders - diluted Weighted average shares - diluted 5 839,503 S 1,358,062 47,162,447 49.442,8601.440,910 (86,526,116)135,968,976 19,709,831224,7711,271,27521,205,877(107,731,993) 8,597,378 93,608,200 15,007,699 [35,534,899) 15,341 81,693,719 (26.038,274) (26,046,225)7,951 55,175,87531,222,100 (7,150) \( 5 \longdiv { 5 , 1 6 8 , 7 2 5 } \) 50.15 34,850,281 $0.09 36,602,367 $(1,17) 5,530,083 $(1.17) 5,530,083 Source: Company 10-0 Report for the frst three months of 2018, filed Mny 15, 2018 CAst o MoviePass-Are Sutarchleds Loving it to Death? C34 This strategy proved an effective way to communicate with customers during normal operations, especially when the company was in its early growth stages. For example, in 2015. MoviePass subscribers Irina Gonzalez. Gene Deems, and Dauren had praised the company's customer service. As MoviePass has zrown, handling all its customers and their concerns has proved problematic for the company. Many of these customers have taken to social media to state their concerns leaving a lasting scar for the company: these customers often feel that their complaints disappear into a black hole. never to be dealt with. MoviePass was quick to respond to the public complaints about its customer service and implemented a number of changes. For example, when it lowered its subscription price in Augast 2017. the company's nine employees were quickly overwhelmed, and the company was slow to send out cards. Lowe admitted to underestimating demand, and the company quickly expanded its staffing to 35 employees. Following challenges faced in spring 2018, MoviePass hired a new head of customer experience, and, subsequently, some of the problems seemed to be slowly diminishing. 1 Even with these changes, other developments in subscriptions had pushed some customers away. For example, in the spring of 2018. MoviePass believed it was facing significant fraudulent activity on some accounts. This activity included individuals sharing a card, despite the rules clearly stating each person was required to have their own membership. subscribers reserving one movie on the app and buying another ticket at the box office (only one screening of a movie was allowed), users checking in for a 2D movie ticket but then paying an upcharge for a 3D. IMAX or Real D ticket, using MoviePass to purchase gift cards from theaters, and using the card to buy concession. In response to this, MoviePass terminated a small percentage of users' accounts. This served to give the company the reputation for heavy-handed administration of its rules and caused customers to fear getting banned. Additionally, some of the banned customers protested their innocence and blamed inadequate documentation of the rules and poor operating procedures on the part of MoviePass. In some cases. the customers' accounts were reactivated. Another challenge reported on the Facebook page and Twitter feed were regular problems with the software. Customers reported that the app would have inaccurate showtimes or would list a 2D movie as a 3D movie, thus not allowing the movie to be seen. Other customers reported challenges with using the photo verification system that MoviePass began to require in spring 2018 to fight ticket fraud. To prove customers had purchased the tickets that matched the ones they reserved on the app, some customers had to upload a photo of their tickets before they could reserve another movie; sometimes the app generated errors that prevented customers from doing so. Customers would also face significant frustration when the app would crash, and they were not able to reserve movies. Stated company policy aas that customers could get preapproval to see a movie if the app was down by direct messaging the company via Twitter. However, when the app crashed as it did on June 14, 2018, the number of messages quickly overwhelmed MovicPass's response capabilities and a number of subscribers used Twitter to express their frustrations. Other subscribers reported problems with getting a refund from MoviePass for movies that had been seen when the app was unavallable. Finally, customers expressed frustration with what was perceived as MoviePass's regular experimentation with pricing strategies and inaccurate order processing. Throughout its history, MoviePass had experimented with a number of pricing plans including a $50 a month unlimited plan to as low as $6.95 a month for its one movie a day plan. At times the company also offered various plans with costs that varied depending on how many moves the subscriber wanted to see. For example, in 2016 customers could choose between one, two, three, or unlimiled movies per month, and the prices for the two-movie plan varied depending on whether the customer lived in a small market with comparatively low ticket prices (subseription price of $15 per month) or a larget market where ticket prices were higher (subscription price of $21 per month). While the company offered their unlimited plan for prices ranging from $6.95a month to $9.95a month depending on whether the company was offering a special promotion, through the fall of 2017 and spring of 2018 they experimented with prices again in April 2018. In April 2018, the company discontinued the one movie a day plan and offered a joint promotion with iHeartRadio that featured four 2D movies a month for three months and three months of iHeartRadio's All Access on-demand music. Customer reaction was swift and overwhelmingly C90 PART 2 Cases in Crafung and Execuning Serntery negative forcing the company to go back to its one movie a day plan. However, analysts predicted that MoviePass would continue to experiment with pricing and value-added bundling with other partners to find a way to drive subseription prices up. In June 2018. MoviePass was running a special promotion plan of $7.95 per month for up to three movies per month. The Future Path to Profitability In June 2018, even as MoviePass exceeded three million subscribers, Helios and Matheson's stock price fell to record lows of less than 40 cents a share. Investor confidence was decply shaken as the company's cash flow deficits ballooned past $20 million per month. Even an assurance by the company's CEO that it had secured a $300 million line of credit to sustain operations did little to calm the concerns of some analysts and investors. In an interview with Yahoo Finance published in April 2018, Mitch Lowe, MoviePass CEO, laid out MoviePass's plan to reach profitability by both driving down costs and increasing revenues. The longterm goal was to reach a breakeven point on the MoviePass subseriptions and to realize profit through revenues related to marketing and data. is Lowe expected four key factors to evolve that would help drive down subscription related costs: 1. MoviePass subscribers would eventually start seeing fewer movies. Lowe predicted that while MoviePass subscribers were very enthusiastic and saw a number of movies each month, by the fourth or fifth month the novelty wore off, and MoviePass subscribers would see fewer movies cach, thus reducing cost. 2. While initial MoviePass subscribers tended to be heavy users, more occasional moviegoers, who don't go to the moves often, would join MoviePass. This would significantly reduce the average number of movies seen by MoviePass members. 3. MowiePass planned to market to users who were in locations where movie tickets cost less, perhaps $7 or $8 in Omaha or Kansas versus $15 in New York or Los Angeles. When MoviePass first started, 55 percent of subseribers were from large cities where tickets tend to be more expensive. By April 2018, only 30 percent of subseribers were from those areas, a trend Lowe predicted would continue. 4. The company planned to leverage its market strength to negotiate discounts with theater chains of up to 20 percent per ticket. According to Helios and Matheson's CEO. Ted Farnsworth, MoviePass controls on average across all movies, approximately 6.1 percent of the U.S. box office, and as much as 10 to 25 percent of bex office sales for movies promoted through the app." Given this power, Lowe believes it is reasonable for the company to receive discounts similar to Costco, where customers can purchase tickets to AMC. Regal, and Cinemark Theaters for 20 to 25 percent off of retail price. The company also planned to increase revenues by marketing fllms for studios, selling advertising on its app for movies and restaurants near movie theaters, and taking a percentage of the concession sales in a theater. In over 1.000 independent theaters, MoviePass has been able to leverage its considerable power to negotiate a $3 commission on each ticket sale, 25 percent commission on concession sales. or sometimes both. II In total, Lowe believed the company could earn as much as $6 per subscriber through these initiatives. In addition to the original plan, MoviePass has begun to branch out into other parts of the movie industry. In April 2018. MoviePass, through a new subsidiary named MoviePass Ventures, invested in two movies-dmerican Animals and Gotti-with mixed success, American Animals received positive reviews but only opened in a limited number of theaters earning just over $500,000 in two weeks. Gorti, on the other hand, was called "a dismal mess" by the New York Times and "the worst mob movie of all time" by the New York Post. It was unclear if MoviePass had the competencies to make this type of investment consistently pay ofr. Headod into summer 2018, analysts were generally pessimistic on the future of MoviePass and its parent Helios and Matheson. Many argued that the numbers simply didn't add up and that the company would burn through its reserves before it could achieve profitability. Further. AMC, the largest theater chain in the United States, announced it would lauach its own subscription plan in summer 2018 called AMC Stubs A-List. This plan would cost \$20 and would allow subscribers to see three movies a weck, including Real 3D and IMAX movies. Perhaps the most concerning factor for investors occurred in April 2018, when the company acknowledged in its prospectus that it did not have sufficient accounting resources to ensure adequate internal control over financial reporting mechanisms due to signiffcant and complex transactions such as MoviePass's acquisition. 19 Despite these challenges Lowe believe the company would not only break even and achieve five million subscribers by the end of 2018, but that the company would eventually become a major competitor with Netflix, Hulu, and Amazon over a fight for leisure time. Lowe predicted that his company could disrupt the "Netrlix and chill" trend toward cocooning and encourage customers to reengage with the moviegoing experience. To further extend the reach of the company, MoviePass planned to roll out family plans during the summer of 2018, and it was planning to offer a new bring-a-friend option that allowed users to purchase a ticket for a friend at a little below retail price, and it would allow subscribers to pay an additional fee to see 3D and IMAX movies. However, MoviePass also planned to introduce surge pricing for subscribers who were on the monthly plan, which would force them to pay a \$2 surcharge to see popular movies and movies on opening weekends or at high demand times such as nights and weekends. Subscribers who had annual plans would not be forced to pay the surge pricing. There was no question that MoviePass had the support of some customers who loved the service and were willing to voluntarily limit the number of mov. ies they saw to help the struggling company. When these same customers discovered that MoviePass had invested in Gofti, they encouraged members of the MovicPass Fans Facebook page to see the movic despite its unfavorable reviews to support the company. With this ardent customer support, the debate raged on as to whether MoviePass was doomed to failure with a fatally flawed business model, or, as Lowe argued, it was an industry disruptor, and rumors of the company's death had been greatly ecazgerated. ENDNOTES 'OFait. Chns,' MovePess Boonc 500,000 New Subscribers join in less then 30 Days." millien-aubecrihers-1201915495\%. "Lang. Brevt, "The Great Oisruptor, MovePass Upends the Movie Gukiness, but Can it ame-1202754112? 3 Long, Christian, "A Eliet History of MovicPass sntertainmend/maviepaus-ame tiatary/ January 30.201d. 4 Itid. "Barnes, Hrooks. "MoviePass Adds a Milion Subsoribers, Even if Theatres Aren' Sald on it" December 27, 2017, hatpi:ferw wotimas. theatars-tickets hatmL. " Lomg. Christier, "A Brier History ef Movie?ass. and is Feud wh AME." Jaruary 30, 2018, httyufikprokx.cem/eotertainment meriegass-ase-histarn? 'Barees, Blools, "Moviopass Adds a Mellen Subserbers, Even if Theatres Aven't Sold on ic." December 27, 2017, hrtas:lfurw notimes. tem/2017/12/27/hesines dimedia/meviepas: theataraticketa himL. "Schnoider, George, "Mssed A Hot IPD" Subticriptons Soar Towards 5 Mibon At This Startup, Agri 14, 2018. mttpsed. subingelphe cem/article/a1 12327 mined- "Barnes, Brocks. MaviePass Adds a Mallon Subscribers, Eve if Theabes Arent Sold on com/2017/12/27/busineve/media/herispiastheaters-tickets kiml. "Helios and Masteson, Wha We Are, 2018 . "'Schreider, Geogge. "Mused A Hot iPO? 5ubscriptions 5oer Toweios 5 Malon At This 5uatup". Apri 14, 2018, hrtps:ll startupPift, email, reckiales. 12 Barnes, Grooka. "MoviePass Adtit a Mtion Subscribers, Even if Theates Avent Seia on theaters tickets.hol. "1ibid. in ibid MoviePass Upends the Movle Gusiness; Aul Can it Survive?" Mtap//Turiety cem/201N/ atudiesame-1202754312f 4 pogue, David. "MoviePass CEO on How the Comoary Wit Finally Dreak Event" Yahoe TGuerrasie, 1 and McAlone. M. Thene Ave Red Flags Al Over MoviePoss Fnancial Staterente That Shovid Scare hvesten:" anemarifinaterial-4 leswesters-2018-4. "Dupter, F., VGrowing Fains? Or Dow MoviePhis Have o Seribus Problem" The Morey Fool Marct 14, 2018, Mitpadivos Saleam/inesting/2018/03/14/prewing Baimet atent. "Guerresio, 1 and Me None, M. Thece are red fags al over Movic Pass' Inonclal ntubements thet should scare investinn. Alsinestlesder. Apri. 20, 2018, httpd/ew bealnesilmalder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts