Question: A new antitheft system incorporating MEMS technology is being separately evaluated economically by three engineers at Dragon Technologies. The first cost of the equipment will

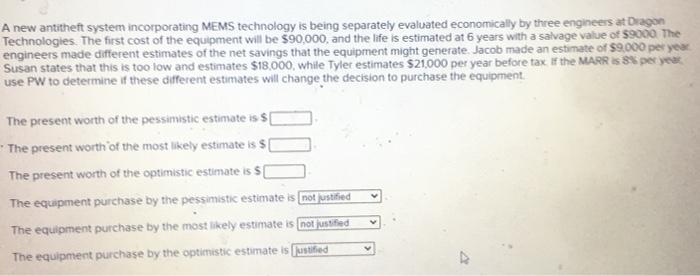

A new antitheft system incorporating MEMS technology is being separately evaluated economically by three engineers at Dragon Technologies. The first cost of the equipment will be $90,000, and the life is estimated at 6 years with a salvage value of $9000 The engineers made different estimates of the net savings that the equipment might generate. Jacob made an estimate of $9,000 per year Susan states that this is too low and estimates $18,000, while Tyler estimates $21.000 per year before tax If the MARRIS X per year use PW to determine if these different estimates will change the decision to purchase the equipment, The present worth of the pessimistic estimate is $ * The present worth of the most likely estimate is $ The present worth of the optimistic estimate is $[ The equipment purchase by the pessimistic estimate is not justified The equipment purchase by the most likely estimate is not justified The equipment purchase by the optimistic estimate is justified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts