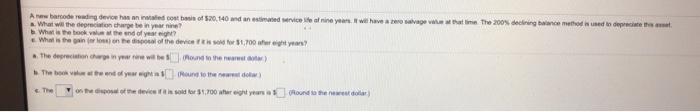

Question: A new barcode reading device has an installed cost basis of $20,140 and an estimated service life of nine years. It will have a zero

A new barcode reading Vieh waled cost of 20.146 and an ested ivice feat nine years we have a savage What time. The 200 decirang bac ho uned to depreciate that What will the depreciation charge ten year nie? What is the book the end of yearsight? What is the one of the device is $1,700 right? The depreciation charge are will be Rothen The both of In other The on the othecis so 1.700 hehty found to the newest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts