Question: Y5 A new barcode reading device has an Installed cost basis of 320,610 and an estimated service life of eight years It will have a

Y5

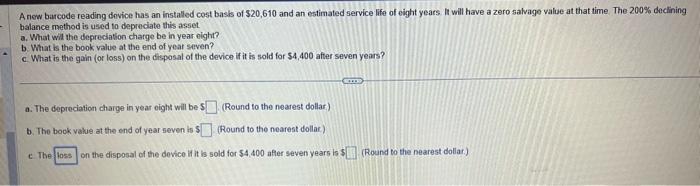

A new barcode reading device has an Installed cost basis of 320,610 and an estimated service life of eight years It will have a zero salvage value at that time The 200% declining balance method is used to depreciate this asset a. What wil the depreciation charge be in year night? b. What is the book value at the end of year seven? c What is the gain (or loss) on the disposal of the device if it is sold for $4,400 after seven years? n. The depreciation charge in year eight will be $(Round to the nearest dollar) b The book value at the end of year seven is $ (Round to the nearest dollar) c The loss on the disposal of the device if it is sold for $4:400 after seven years is $ $ (Round to the nearest dollar)A new barcode reading device has an Installed cost basis of 320,610 and an estimated service life of eight years It will have a zero salvage value at that time The 200% declining balance method is used to depreciate this asset a. What wil the depreciation charge be in year night? b. What is the book value at the end of year seven? c What is the gain (or loss) on the disposal of the device if it is sold for $4,400 after seven years? n. The depreciation charge in year eight will be $(Round to the nearest dollar) b The book value at the end of year seven is $ (Round to the nearest dollar) c The loss on the disposal of the device if it is sold for $4:400 after seven years is $ $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts